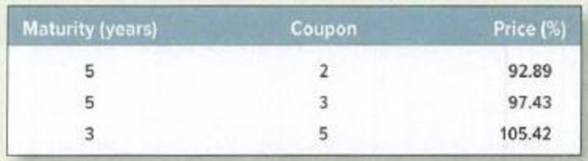

Prices and spot interest rates What spot interest rates are implied by the following Treasury bonds? Assume for simplicity that the bonds pay annual coupons. The price of a one-year strip is 97.56%, and the price of a four-year strip is 87.48%.

To determine: The spot interest rates implied by treasury bonds.

Explanation of Solution

Determine

Hence,

Determine

Hence,

Determine

Determine

Solve equation 1 and 2

Determine

Hence, the spot rates are 2.50%, 3.22%, 3.09%, 3.40% and 3.60 for years 1 to 5.

Want to see more full solutions like this?

Chapter 3 Solutions

PRIN.OF CORPORATE FINANCE

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College