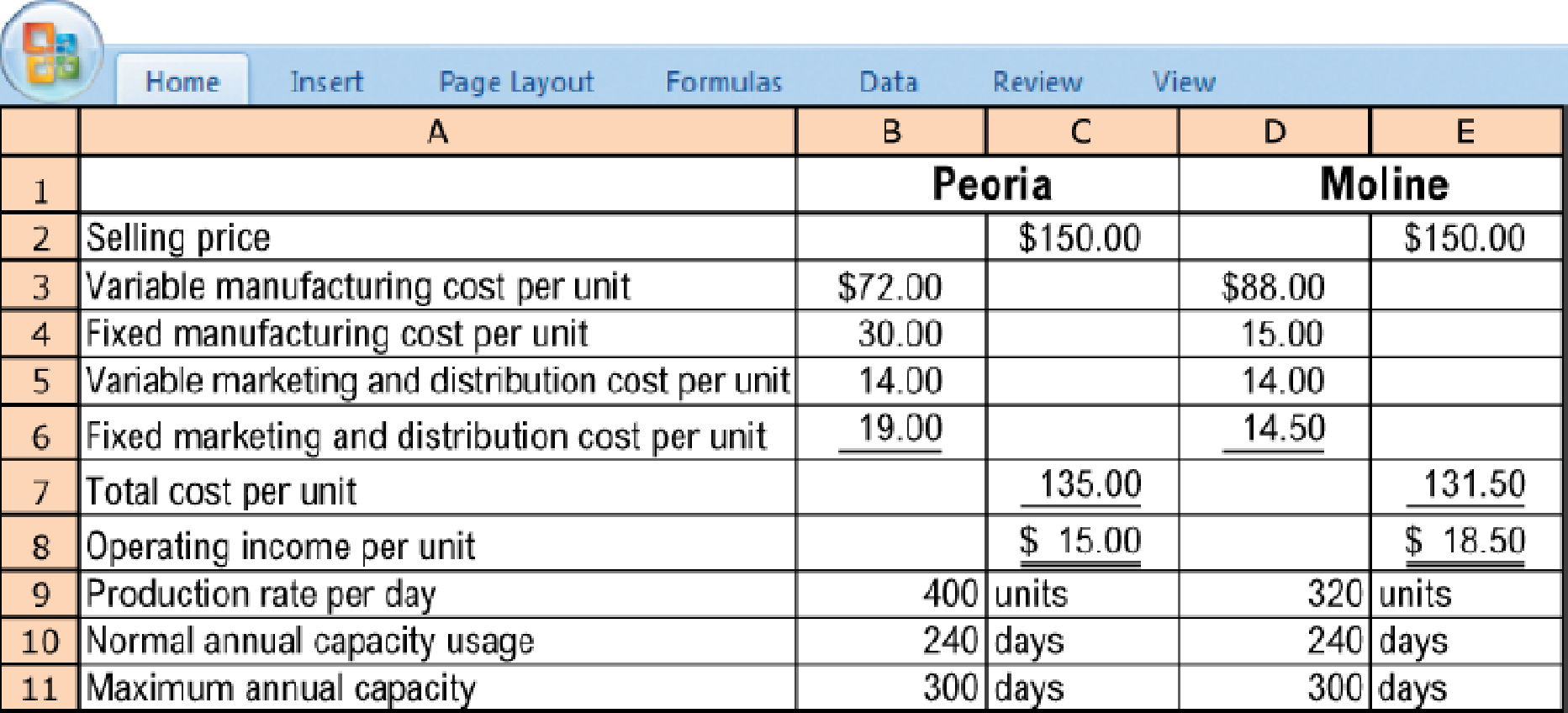

Deciding where to produce. (CMA, adapted) Portal Corporation produces the same power generator in two Illinois plants, a new plant in Peoria and an older plant in Moline. The following data are available for the two plants:

All fixed costs per unit are calculated based on a normal capacity usage consisting of 240 working days. When the number of working days exceeds 240, overtime charges raise the variable

Portal Corporation is expected to produce and sell 192,000 power generators during the coming year.

Wanting to take advantage of the higher operating income per unit at Moline, the company’s production manager has decided to manufacture 96,000 units at each plant, resulting in a plan in which Moline operates at maximum capacity (320 units per day × 300 days) and Peoria operates at its normal volume (400 units per day × 240 days).

- 1. Calculate the breakeven point in units for the Peoria plant and for the Moline plant. Required

- 2. Calculate the operating income that would result from the production manager’s plan to produce 96.000 units at each plant.

- 3. Determine how the production of 192,000 units should be allocated between the Peoria and Moline plants to maximize operating income for Portal Corporation. Show your calculations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

COST ACCT-W/ACCESS >C< NON-MAJORS

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning