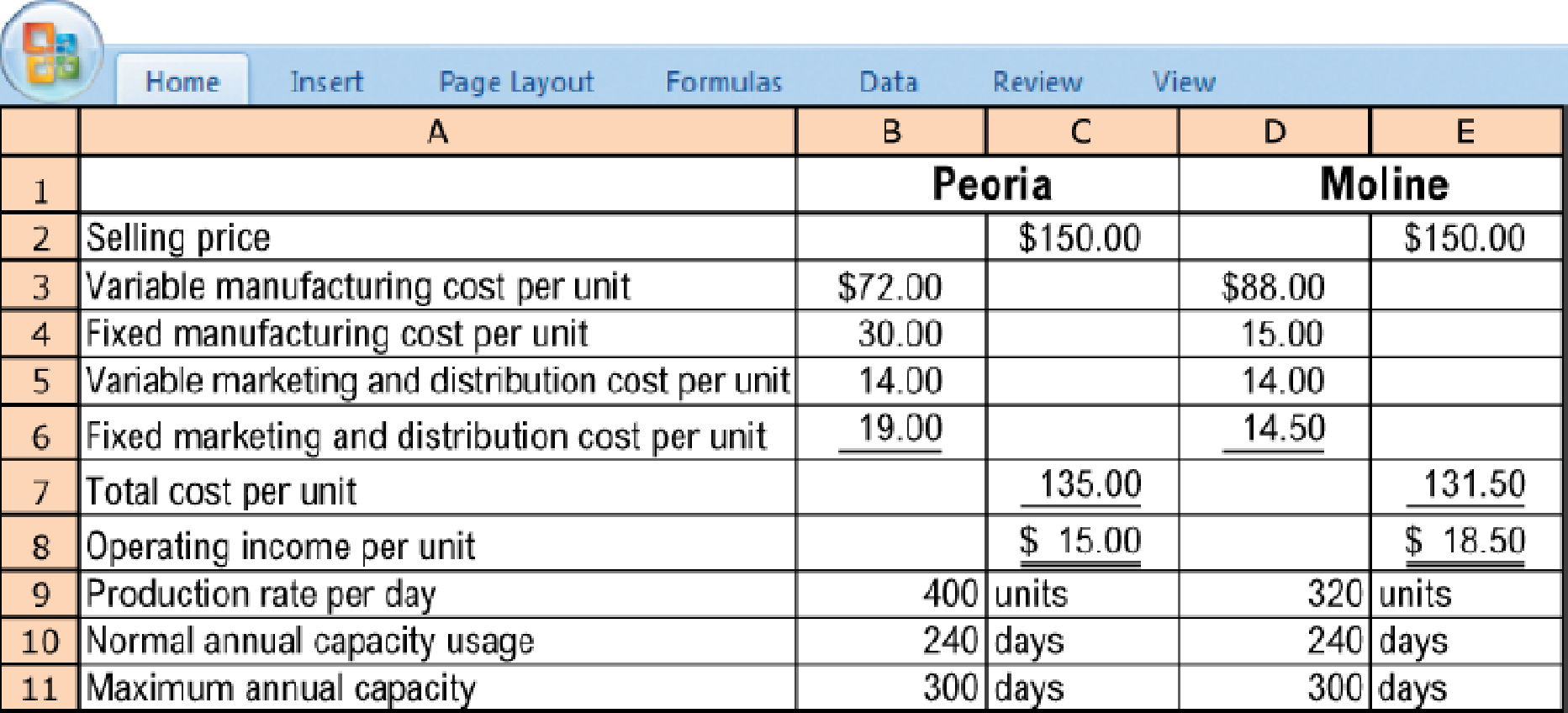

Deciding where to produce. (CMA, adapted) Portal Corporation produces the same power generator in two Illinois plants, a new plant in Peoria and an older plant in Moline. The following data are available for the two plants:

All fixed costs per unit are calculated based on a normal capacity usage consisting of 240 working days. When the number of working days exceeds 240, overtime charges raise the variable

Portal Corporation is expected to produce and sell 192,000 power generators during the coming year.

Wanting to take advantage of the higher operating income per unit at Moline, the company’s production manager has decided to manufacture 96,000 units at each plant, resulting in a plan in which Moline operates at maximum capacity (320 units per day × 300 days) and Peoria operates at its normal volume (400 units per day × 240 days).

- 1. Calculate the breakeven point in units for the Peoria plant and for the Moline plant. Required

- 2. Calculate the operating income that would result from the production manager’s plan to produce 96.000 units at each plant.

- 3. Determine how the production of 192,000 units should be allocated between the Peoria and Moline plants to maximize operating income for Portal Corporation. Show your calculations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Cost Accounting: A Managerial Emphasis, 15th Edition

- During FY 2024 Matrix Industries had total manufacturing costs of $563,000. Their cost of goods manufactured for the year was $598,000. The January 1, 2025 balance of the Work-in-Process Inventory is $57,000. Use this information to determine the dollar amount of the FY 2024 beginning Work-in-Process Inventory.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education