Horngren's Financial & Managerial Accounting, Student Value Edition (5th Edition)

5th Edition

ISBN: 9780133851267

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.40BP

Journalizing

Henderson Fishing Charters has collected the following data for the December 31 adjusting entries:

- a. The company received its electric bill on December 20 for $ 150 but will not pay it until January 5. (Use the Utilities Payable account.)

- b. Henderson purchased a nine-month boat insurance policy on November 1 for $8,100. Henderson recorded a debit to Prepaid Insurance.

- c. As of December 31, Henderson had earned $4,000 of charter revenue that has not been recorded or received.

- d. Henderson’s fishing boat was purchased on January 1 at a cost of $80,500. Henderson expects to use the boat for five years and that it will have a residual value of $5,500. Determine annual

depreciation assuming thestraight-line depreciation method is used. - e. On October 1, Henderson received $5,000 prepayment for a deep-sea fishing charter to take place in December. As of December 31, Henderson has completed the charter.

Requirements

- 1. Journalize the adjusting entries needed on December 31 for Henderson Fishing Charters. Assume Henderson records adjusting entries only at the end of the year.

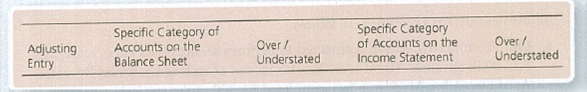

- 2. If Henderson had not recorded the adjusting entries, indicate which specific category of accounts on the financial statements would be misstated and if the misstatement is overstated or understated. Use the following table as a guide:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide problem with accounting answer

Need help

What is the value stockholders's equity after the investment

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting, Student Value Edition (5th Edition)

Ch. 3 - Which of the following is true of accrual basis...Ch. 3 - Get Fit Now gains a client who prepays 540 for a...Ch. 3 - The revenue recognition principle requires a. time...Ch. 3 - Adjusting the accounts is the process of a....Ch. 3 - Which of the following is an example of a deferral...Ch. 3 - Assume that the weekly payroll of In the Woods...Ch. 3 - The adjusted trial balance shows a. amounts that...Ch. 3 - A D Window Cleaning performed 450 of services but...Ch. 3 - A worksheet a. is a journal used to record...Ch. 3 - On February 1, Clovis Wilson Law Firm contracted...

Ch. 3 - What is the difference between cash basis...Ch. 3 - Which method of accounting (cash or accrual basis)...Ch. 3 - Which accounting concept or principle requires...Ch. 3 - What is a fiscal year? Why might companies choose...Ch. 3 - Under the revenue recognition principle, when is...Ch. 3 - Prob. 6RQCh. 3 - When are adjusting entries completed, and what is...Ch. 3 - Prob. 8RQCh. 3 - Prob. 9RQCh. 3 - Prob. 10RQCh. 3 - Prob. 11RQCh. 3 - Prob. 12RQCh. 3 - Prob. 13RQCh. 3 - Prob. 14RQCh. 3 - Prob. 15RQCh. 3 - What is an accrued expense? Provide an example.Ch. 3 - What is an accrued revenue? Provide an example.Ch. 3 - Prob. 18RQCh. 3 - When is an adjusted trial balance prepared, and...Ch. 3 - If an accrued expense is not recorded at the end...Ch. 3 - What is a worksheet, and how is it used to help...Ch. 3 - If a payment of a deferred expense was recorded...Ch. 3 - If a payment of a deferred expense was recorded...Ch. 3 - Comparing cash and accrual basis accounting for...Ch. 3 - Comparing cash and accrual basis accounting for...Ch. 3 - Applying the revenue recognition principle South...Ch. 3 - Applying the matching principle Suppose on January...Ch. 3 - Identifying types of adjusting entries A select...Ch. 3 - Journalizing and posting adjusting entries for...Ch. 3 - Journalizing and posting an adjusting entry for...Ch. 3 - Journalizing and posting an adjusting entry for...Ch. 3 - Prob. 3.9SECh. 3 - Prob. 3.10SECh. 3 - Prob. 3.11SECh. 3 - Journalizing an adjusting entry for accrued...Ch. 3 - Prob. 3.13SECh. 3 - Determining the effects on financial statements In...Ch. 3 - Prob. 3.15SECh. 3 - Prob. 3.16SECh. 3 - Prob. 3.17SECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19ECh. 3 - Prob. 3.20ECh. 3 - Prob. 3.21ECh. 3 - Prob. 3.22ECh. 3 - Prob. 3.23ECh. 3 - Prob. 3.24ECh. 3 - Prob. 3.25ECh. 3 - Prob. 3.26ECh. 3 - Identifying the impact of adjusting entries on the...Ch. 3 - Journalizing adjusting entries and analyzing their...Ch. 3 - Prob. 3.29ECh. 3 - Prob. 3.30ECh. 3 - Understanding the alternative treatment of prepaid...Ch. 3 - Understanding the alternative treatment of...Ch. 3 - Journalizing adjusting entries and subsequent...Ch. 3 - Journalizing adjusting entries and identifying the...Ch. 3 - Journalizing and posting adjustments to the...Ch. 3 - Journalizing and posting adjustments to the...Ch. 3 - A Using the worksheet to record the adjusting...Ch. 3 - Understanding the alternative treatment of prepaid...Ch. 3 - Journalizing adjusting entries and subsequent...Ch. 3 - Journalizing adjusting entries and identifying the...Ch. 3 - Journalizing and posting adjustments to the...Ch. 3 - Journalizing and posting adjustments to the...Ch. 3 - Prob. 3.43BPCh. 3 - Understanding the alternative treatment of prepaid...Ch. 3 - Prob. 3.45CPCh. 3 - Prob. 3.46PSCh. 3 - One year ago, Tyler Stasney founded Swift...Ch. 3 - Prob. 3.1CTEICh. 3 - XM, Ltd. was a small engineering firm that built...Ch. 3 - Prob. 3.1CTFSCCh. 3 - In 75 words or fewer, explain adjusting journal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For the Crestview Manufacturing Company, the average age of accounts receivable is 50 days, the average age of accounts payable is 40 days, and the average age of inventory is 68 days. Assuming a 365-day year, what is the length of the firm's cash conversion cycle?arrow_forwardFinancial accountingarrow_forwardI need help with this solution and accounting questionarrow_forward

- A California-based company had a raw materials inventory of $130,000 as of December 31, 2021, and $110,000 as of December 31, 2022. During 2022, the company purchased $175,000 of raw materials, incurred direct labor costs of $230,000, and incurred manufacturing overhead totaling $350,000. How much is the total manufacturing cost incurred by the company?arrow_forwardHello tutor solve this question accountingarrow_forwardA company uses the weighted-average method for inventory costing. At the end of the period, 19,500 units were in the ending Work in Process inventory and are 100% complete for materials and 72% complete for conversion. The equivalent costs per unit are; materials, $2.75, and conversion $2.40. Compute the cost that would be assigned to the ending Work in Process inventory for the period.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY