• LO3–2, LO3–3

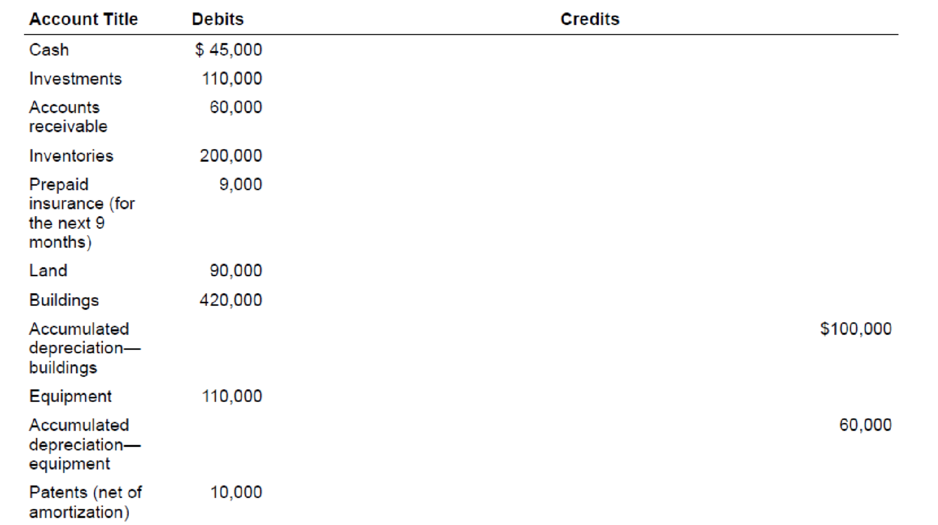

The following is a December 31, 2018, post-closing

Additional Information:

1. The investment account includes an investment in common stock of another corporation of $30,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year.

2. The land account includes land which cost $25,000 that the company has not used and is currently listed for sale.

3. The cash account includes $15,000 restricted in a fund to pay bonds payable that mature in 2021 and $23,000 restricted in a three-month Treasury bill.

4. The notes payable account consists of the following:

a. a $30,000 note due in six months

b. a $50,000 note due in six years

c. a $50,000 note due in five annual installments of $10,000 each, with the next installment due February 15, 2019

5. The $60,000 balance in

6. The common stock account represents 100,000 shares of no par value common stock issued and outstanding. The corporation has 500,000 shares authorized.

Required:

Prepare a classified balance sheet for the Almway Corporation at December 31, 2018.

Trending nowThis is a popular solution!

Chapter 3 Solutions

INTERMEDIATE ACCOUNTING (LL) W/CONNECT

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardI need assistance with this financial accounting question using appropriate principles.arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forward

- Could you explain the steps for solving this financial accounting question accurately?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning