Concept explainers

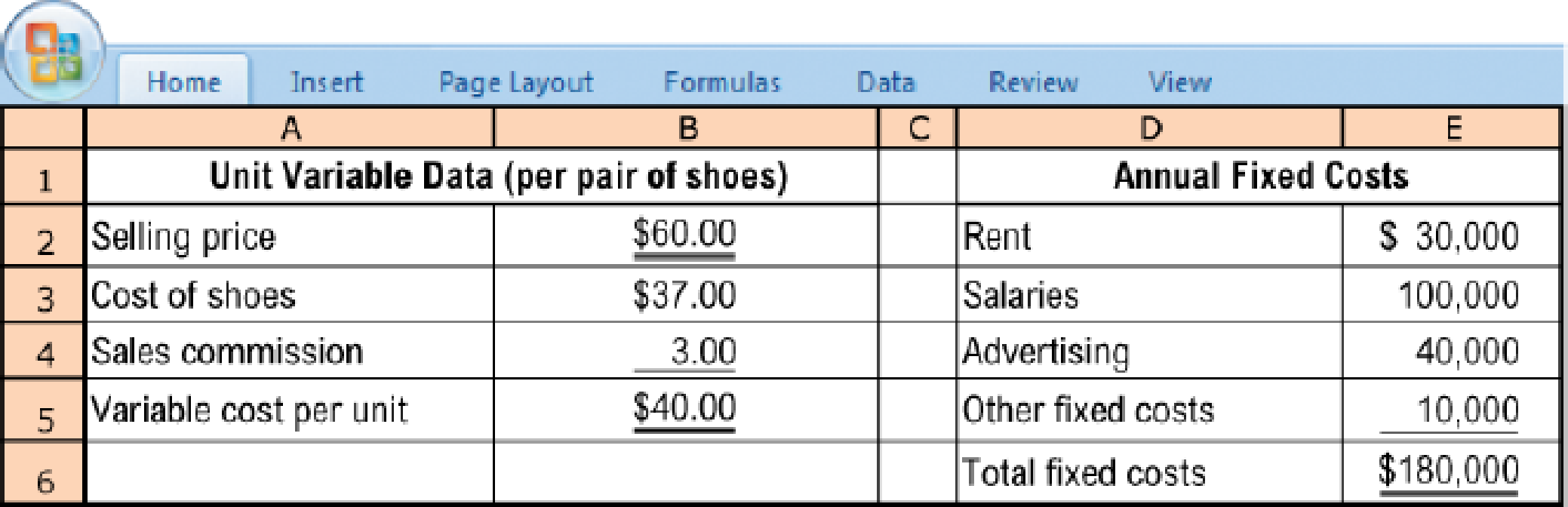

CVP analysis, shoe stores. The HighStep Shoe Company operates a chain of shoe stores that sell 10 different styles of inexpensive men’s shoes with identical unit costs and selling prices. A unit is defined as a pair of shoes. Each store has a store manager who is paid a fixed salary. Individual salespeople receive a fixed salary and a sales commission. HighStep is considering opening another store that is expected to have the revenue and cost relationships shown here.

Consider each question independently.

- 1. What is the annual breakeven point in (a) units sold and (b) revenues?

Required

- 2. If 8,000 units are sold, what will be the store’s operating income (loss)?

- 3. If sales commissions are discontinued and fixed salaries are raised by a total of $15,500, what would be the annual breakeven point in (a) units sold and (b) revenues?

- 4. Refer to the original data. If, in addition to his fixed salary, the store manager is paid a commission of $2.00 per unit sold, what would be the annual breakeven point in (a) units sold and (b) revenues?

- 5. Refer to the original data. If, in addition to his fixed salary, the store manager is paid a commission of $2.00 per unit in excess of the breakeven point, what would be the store’s operating income if 12,000 units were sold?

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 3 Solutions

Cost Accounting (15th Edition)

Additional Business Textbook Solutions

Business Essentials (12th Edition) (What's New in Intro to Business)

Engineering Economy (17th Edition)

Horngren's Accounting (12th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

- Expand upon it and add more infoarrow_forwardJH, Inc., is a calendar year, accrual basis corporation with Joe as its sole shareholder (basis in his stock is $90,000). On January 1 of the current year, JH Corporation has accumulated E & P of $200,000. Before considering the effect of the distribution described below, the corporation’s current E & P is $50,000. On November 1, JH distributes an office building to Joe. The office building has an adjusted basis of $80,000 (fair market value of $100,000) and is subject to a mortgage of $110,000. Assume that the building has been depreciated using the ADS method for both income tax and E & P purposes. What are the tax consequences of the distribution to JH and to Joe? (In your answer, be sure to describe the effects on taxable income for both JH and Joe, the impact of the distribution on JH’s E & P, and Joe’s basis in the building.)arrow_forwardJoe is the sole shareholder of JH Corporation. Joe sold his stock to Ethan on October 31 for $150,000. Joe’s basis in JH stock was $50,000 at the start of the year. JH distributed land to Joe immediately before the sale. JH’s basis in the land was $20,000 (fair market value of $25,000). On December 31, Ethan received a $75,000 cash distribution from JH. During the year, JH has $20,000 of current E & P and its accumulated E & P balance on January 1 is $10,000. Which of the following statements is true? a. Joe recognizes a $110,000 gain on the sale of his stock. b. Joe recognizes a $100,000 gain on the sale of his stock. c. Ethan receives $5,000 of dividend income.d. Joe receives $20,000 of dividend income. e. None of the above.arrow_forward

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,