Concept explainers

Consolidated Worksheet at End of the First Year of Ownership (Equity Method)

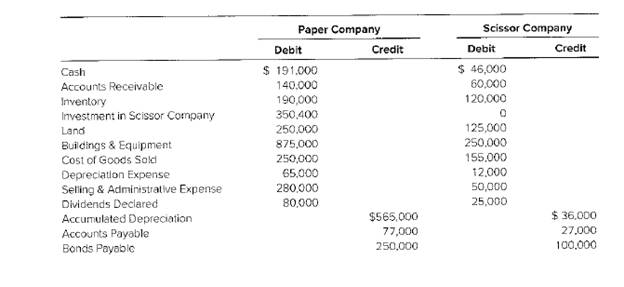

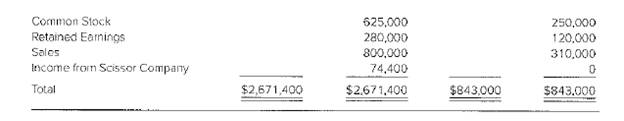

Paper Company acquired 80 percent of Scissor Company’s outstanding common stock for$296,000 on January 1, 20X8, when the book value of Scissor’s net assets was equal to $370,000.Paper uses the equity method to account for investments.

Required

a. Prepare any equity-method entry(ies) related to the investment in Scissor Company during20X8.

b. Prepare a consolidation worksheet for 20X8 in good form.

a.

Introduction:

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare: A journal entry by equity method for the investment in S company in the year

Explanation of Solution

| Equity method entry onP company books | Amount ($) | Amount ($) |

| Investment in S co. Dr. | ||

| Cash Cr. | ||

| (To recordthe initial investment in S co.) | ||

| Investment in S co. Dr. | ||

| Income from S co. Cr. | ||

| (To record share of P co in S co.) | ||

| Cash Dr. | ||

| Investment in S company. Cr. | ||

| (To record P co.’s share in S Co.’s dividend) |

b.

Introduction:

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare:The consolidated worksheet for the final values.

Explanation of Solution

| Book value calculation | |||||||

| NCI | + | P co | = | Common stock | + | Retained earnings | |

| Book value | |||||||

| Net income | |||||||

| Dividend | |||||||

| Ending book value |

| Income statement | P co | S co | Eliminated Dr. | Eliminated Cr. | Consolidated |

| Cash | |||||

| Accounts received | |||||

| Inventory | |||||

| Investment in scissor co | |||||

| Land | |||||

| Building and equipment | |||||

| Less accumulated depreciation | |||||

| Total assets | |||||

| Accountspayable | |||||

| Bonds | |||||

| Common stocks | |||||

| Retained earnings | |||||

| NCI in NA of Snoopy Co. | |||||

| Total liabilities |

Want to see more full solutions like this?

Chapter 3 Solutions

ADV.FIN.ACCT. CONNECT+PROCTORIO PLUS

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardOn January 1, 2018, Sycamore International reports net assets of $1,245,000, although machinery (with an eight-year life) having a book value of $720,000 is worth $840,000 and an unrecorded trademark is valued at $75,600. Teton Group pays $1,140,000 on that date for a 90 percent ownership in Sycamore. If the trademark is to be written off over a 15-year period, at what amount should it be reported on the consolidated statements on December 31, 2020?arrow_forward