Accounting, Chapters 1-13

27th Edition

ISBN: 9781337272100

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 3, Problem 3.27EX

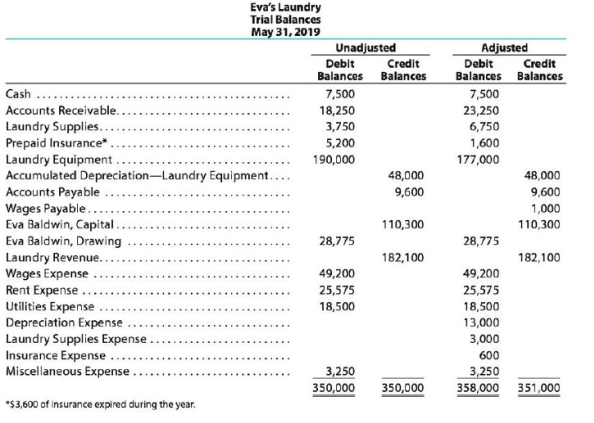

The accountant for Eva's Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please explain the solution to this general accounting problem with accurate principles.

Hii teacher please provide for general accounting question answer do fast

explain properly all the answer for General accounting question Please given fast

Chapter 3 Solutions

Accounting, Chapters 1-13

Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Is the matching concept related to (a) the cash...Ch. 3 - Why are adjusting entries needed at the end of an...Ch. 3 - What is the difference between adjusting entries...Ch. 3 - Identify the four different categories of...Ch. 3 - If the effect of the debit portion of an adjusting...Ch. 3 - If the effect of the credit portion of an...Ch. 3 - Does every adjusting entry affect net income for...Ch. 3 - Prob. 9DQCh. 3 - (a) Explain the purpose of the two accounts:...

Ch. 3 - Accounts requiring adjustment Indicate with a Yes...Ch. 3 - Accounts requiring adjustment Indicate with a Yes...Ch. 3 - Prob. 3.2APECh. 3 - Type of adjustment Classify the following items as...Ch. 3 - Adjustment for accrued revenues At the end of the...Ch. 3 - Adjustment for accrued expense Prospect Realty Co....Ch. 3 - Adjustment for accrued expense We-Sell Realty Co....Ch. 3 - Adjustment for unearned revenue On June 1, 2019,...Ch. 3 - Adjustment for unearned revenue The balance in the...Ch. 3 - Adjustment for prepaid expense The prepaid...Ch. 3 - Adjustment for prepaid expense The supplies...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Effect of omitting adjustments For the year ending...Ch. 3 - Effect of omitting adjustments For the year ending...Ch. 3 - Effect of errors on adjusted trial balance For...Ch. 3 - Effect of errors on adjusted trial balance For...Ch. 3 - Vertical analysis Two income statements for...Ch. 3 - Vertical analysis Two income statements for Cornea...Ch. 3 - Classifying types of adjustments Classify the...Ch. 3 - Classifying adjusting entries The following...Ch. 3 - Adjusting entry for accrued fees At the end of the...Ch. 3 - Effect of omitting adjusting entry The adjusting...Ch. 3 - Adjusting entries for accrued salaries Garcia...Ch. 3 - Determining wages paid The wages payable and wages...Ch. 3 - Effect of omitting adjusting entry Accrued...Ch. 3 - Effect of omitting adjusting entry When preparing...Ch. 3 - Adjusting entries for unearned fees The balance in...Ch. 3 - Effect of omitting adjusting entry At the end of...Ch. 3 - Adjusting entry for supplies The balance in the...Ch. 3 - Determining supplies purchased The supplies and...Ch. 3 - Effect of omitting adjusting entry At August 31,...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for unearned and accrued fees...Ch. 3 - Adjusting entries for prepaid and accrued taxes...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Determining fixed asset's book value The balance...Ch. 3 - Book value of fixed assets In a recent balance...Ch. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements The...Ch. 3 - Effects of errors on financial statements If the...Ch. 3 - Adjusting entries for depreciation; effect of...Ch. 3 - Adjusting entries from trial balances The...Ch. 3 - Adjusting entries from trial balances The...Ch. 3 - Prob. 3.28EXCh. 3 - Prob. 3.29EXCh. 3 - Prob. 3.30EXCh. 3 - Adjusting entries On December 31, the following...Ch. 3 - Prob. 3.2APRCh. 3 - Adjusting entries Milbank Repairs Service, an...Ch. 3 - Adjusting entries Good Note Company specializes in...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Adjusting entries and errors At the end of April,...Ch. 3 - Adjusting entries On May 31, the following data...Ch. 3 - Prob. 3.2BPRCh. 3 - Adjusting entries Crazy Mountain Outfitters Co.,...Ch. 3 - Adjusting entries The Signage Company specializes...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Prob. 3.6BPRCh. 3 - The unadjusted trial balance that you prepared for...Ch. 3 - Prob. 3.1CPCh. 3 - Ethics in Action Daryl Kirby opened Squid Realty...Ch. 3 - Prob. 3.4CPCh. 3 - Prob. 3.5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Herbert expects to increase sales in the coming year by 15% while keeping fixed operating costs constant at $15.6 million.arrow_forwardGeneral accountingarrow_forwardHillwood Textiles computes its plantwide predetermined overhead rate annually based on direct labor hours. At the beginning of the year, it was estimated that 42,000 direct labor hours would be required for the period's estimated level of production. The company also estimated $525,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor hour. Hillwood’s actual manufacturing overhead cost for the year was $670,000, and its actual total direct labor hours were 43,200. Compute the company’s plantwide predetermined overhead rate for the year.arrow_forward

- Accurate Answerarrow_forwardElizabeth Appliance Company had a net income of $68,400 and net sales of $480,000. Compute the relationship of net income to net sales.arrow_forwardUsing the weighted-average valuation method the equivalent units produced by the department were _________Units.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY