Cost Accounting, Student Value Edition (15th Edition)

15th Edition

ISBN: 9780133428858

Author: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.27E

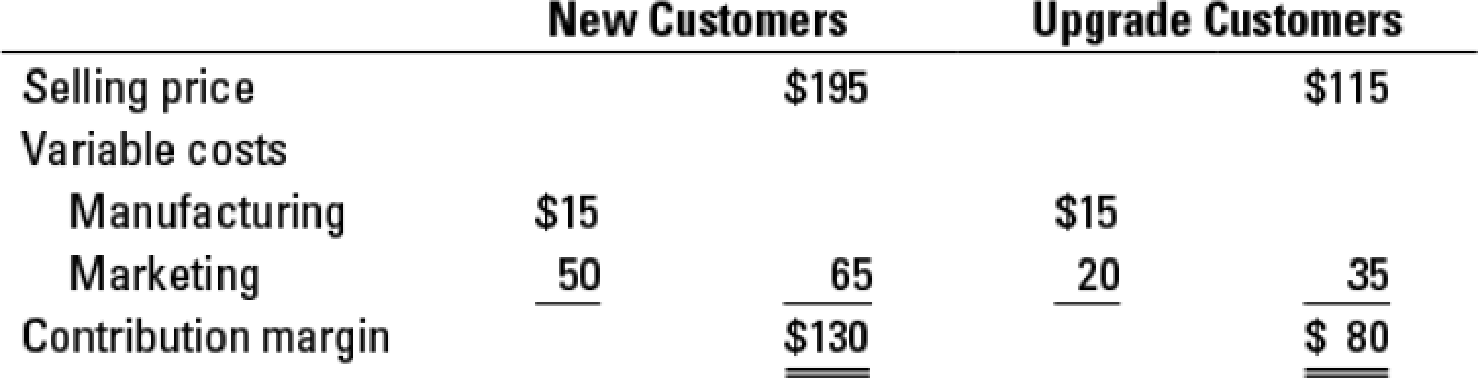

Sales mix, new and upgrade customers. Chartz 1-2-3 is a top-selling electronic spreadsheet product. Chartz is about to release version 5.0. It divides its customers into two groups: new customers and upgrade customers (those who previously purchased Chartz 1-2-3 4.0 or earlier versions). Although the same physical product is provided to each customer group, sizable differences exist in selling prices and variable marketing costs:

The fixed costs of Chartz 1-2-3 5.0 are $16,500,000. The planned sales mix in units is 60% new customers and 40% upgrade customers.

- 1. What is the Chartz 1-2-3 5.0 breakeven point in units, assuming that the planned 60%/40% sales mix is attained?

Required

- 2. If the sales mix is attained, what is the operating income when 170,000 total units are sold?

- 3. Show how the breakeven point in units changes with the following customer mixes:

- a. New 40% and upgrade 60%

- b. New 80% and upgrade 20%

- c. Comment on the results.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you solve this general accounting question with accurate accounting calculations?

Please explain the correct approach for solving this general accounting question.

Accounting Question

Chapter 3 Solutions

Cost Accounting, Student Value Edition (15th Edition)

Ch. 3 - Define costvolumeprofit analysis.Ch. 3 - Describe the assumptions underlying CVP analysis.Ch. 3 - Distinguish between operating income and net...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Why is it more accurate to describe the subject...Ch. 3 - CVP analysis is both simple and simplistic. If you...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Give an example of how a manager can decrease...

Ch. 3 - Give an example of how a manager can increase...Ch. 3 - What is operating leverage? How is knowing the...Ch. 3 - There is no such thing as a fixed cost. All costs...Ch. 3 - Prob. 3.14QCh. 3 - In CVP analysis, gross margin is a less-useful...Ch. 3 - Prob. 3.16ECh. 3 - Prob. 3.17ECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19ECh. 3 - CVP exercises. The Doral Company manufactures and...Ch. 3 - Prob. 3.21ECh. 3 - Prob. 3.22ECh. 3 - Prob. 3.23ECh. 3 - Prob. 3.24ECh. 3 - Prob. 3.25ECh. 3 - Prob. 3.26ECh. 3 - Sales mix, new and upgrade customers. Chartz 1-2-3...Ch. 3 - Prob. 3.28ECh. 3 - Prob. 3.29ECh. 3 - Prob. 3.30ECh. 3 - Prob. 3.31ECh. 3 - Prob. 3.32ECh. 3 - CVP analysis, service firm. Lifetime Escapes...Ch. 3 - Prob. 3.34PCh. 3 - Prob. 3.35PCh. 3 - Prob. 3.36PCh. 3 - Prob. 3.37PCh. 3 - CVP analysis, shoe stores. The HighStep Shoe...Ch. 3 - Prob. 3.39PCh. 3 - Prob. 3.40PCh. 3 - Prob. 3.41PCh. 3 - Prob. 3.42PCh. 3 - Prob. 3.43PCh. 3 - Prob. 3.44PCh. 3 - Prob. 3.45PCh. 3 - Sales mix, two products. The Stackpole Company...Ch. 3 - Prob. 3.47PCh. 3 - Prob. 3.48PCh. 3 - Deciding where to produce. (CMA, adapted) Portal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forward

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Determine the price of a $1.3 million bond issue under each of the following independent assumptions: Maturity 10 years, interest paid annually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%.arrow_forwardIf total assets increase while liabilities remain unchanged, equity must: A) IncreaseB) DecreaseC) Remain the sameD) Be negativearrow_forwardNo chatgpt!! Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forward

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivableno aiarrow_forwardWhich of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Pricing Decisions; Author: Rutgers Accounting Web;https://www.youtube.com/watch?v=rQHbIVEAOvM;License: Standard Youtube License