MANAGERIAL ACCOUNTING F/MGRS.

6th Edition

ISBN: 9781264100590

Author: Noreen

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3.24P

Plantwide versus Multiple Predetermined

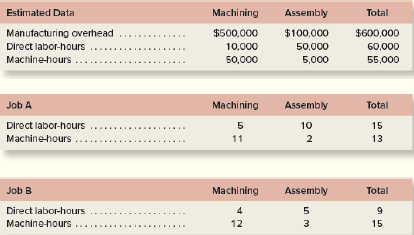

Mason Company has two manufacturing departments—Machining and Assembly. The company considers all of itsmanufacturing overhead costs to be fixed costs. It provided the following estimates at the beginning of the year as well as thefollowing information with respect to Jobs A and B:

Required:

- If Mason Company uses a plantwide predetermined overhead rate with direct labor-hours as the allocation base, how much

manufacturing overhead cost would be applied to Job A? Job B? - Assume Mason Company uses departmental predetermined overhead rates. The Machining Department is allocated based on machine-hours and the Assembly Department is allocated based on direct labor-hours. How much manufacturing overhead cost would be applied to Job A? Job B?

- If Mason multiplies its

job costs by a markup percentage to establish selling prices, how might plantwide overhead allocation adversely affect the company’s pricing decisions?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyneed help

Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyno ai

Can you solve this general accounting problem using appropriate accounting principles?

Chapter 3 Solutions

MANAGERIAL ACCOUNTING F/MGRS.

Ch. 3 - Prob. 3.1QCh. 3 - Prob. 3.2QCh. 3 - Prob. 3.3QCh. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Prob. 3.6QCh. 3 - Prob. 3.7QCh. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Prob. 3.10Q

Ch. 3 - Prob. 3.11QCh. 3 - Prob. 3.12QCh. 3 - Prob. 3.13QCh. 3 - Prob. 1AECh. 3 - Prob. 1TF15Ch. 3 - Prob. 3.1ECh. 3 - Prob. 3.2ECh. 3 - Prob. 3.3ECh. 3 - Prob. 3.4ECh. 3 - Prob. 3.5ECh. 3 - Prob. 3.6ECh. 3 - Prob. 3.7ECh. 3 - Prob. 3.8ECh. 3 - Prob. 3.9ECh. 3 - Prob. 3.10ECh. 3 - Prob. 3.11ECh. 3 - Prob. 3.12ECh. 3 - Prob. 3.13ECh. 3 - Prob. 3.14ECh. 3 - Prob. 3.15ECh. 3 - Prob. 3.16PCh. 3 - Prob. 3.17PCh. 3 - Prob. 3.18PCh. 3 - Prob. 3.19PCh. 3 - Prob. 3.20PCh. 3 - Prob. 3.21PCh. 3 - Prob. 3.22PCh. 3 - Prob. 3.23PCh. 3 - Plantwide versus Multiple Predetermined Overhead...Ch. 3 - Prob. 3.25PCh. 3 - Prob. 3.26C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiency no aiarrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forward

- 20 Nelson and Murdock, a law firm, sells $8,000,000 of four-year, 8% bonds priced to yield 6.6%. The bonds are dated January 1, 2026, but due to some regulatory hurdles are not issued until March 1, 2026. Interest is payable on January 1 and July 1 each year. The bonds sell for $8,388,175 plus accrued interest. In mid-June, Nelson and Murdock earns an unusually large fee of $11,000,000 for one of its cases. They use part of the proceeds to buy back the bonds in the open market on July 1, 2026 after the interest payment has been made. Nelson and Murdock pays a total of $8,456,234 to reacquire the bonds and retires them. Required1. The issuance of the bonds—assume that Nelson and Murdock has adopted a policy of crediting interest expense for the accrued interest on the date of sale.2. Payment of interest and related amortization on July 1, 2026.3. Reacquisition and retirement of the bonds.arrow_forward13 Which of the following is correct about the difference between basic earnings per share (EPS) and diluted earnings per share? Question 13 options: Basic EPS uses comprehensive income in its calculation, whereas diluted EPS does not. Basic EPS is not a required disclosure, whereas diluted EPS is required disclosure. Basic EPS uses total common shares outstanding, whereas diluted EPS uses the weighted-average number of common shares. Basic EPS is not adjusted for the potential dilutive effects of complex financial structures, whereas diluted EPS is adjusted.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forward

- I need guidance with this financial accounting problem using the right financial principles.arrow_forwardGeneral Accounting Question Solutionarrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

alue Chain Analysis EXPLAINED | B2U | Business To You; Author: Business To You;https://www.youtube.com/watch?v=SI5lYaZaUlg;License: Standard Youtube License