Advanced Financial Accounting

11th Edition

ISBN: 9780078025877

Author: Theodore E. Christensen, David M Cottrell, Cassy JH Budd Advanced Financial Accounting

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.24P

Parent Company and Consolidated Balances

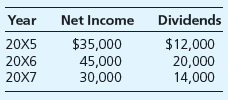

Exacto Company reported the following net income and dividends for the years indicated:

True Corporation acquired 75 percent of Exacto’s common stock on January 1, 20X5. On that date, the fair value of Exacto’s net assets was equal to the book value. True uses the equity method in accounting for its ownership in Exacto and reported a balance of $259,800 in its investment account on December 31, 20X7.

Required

- What amount did True pay when it purchased Exacto’s shares?

- What was the fair value of Exacto’s net assets on January 1, 20X5?

- What amount was assigned to the NCI shareholders on January 1, 20X5?

- What amount will be assigned to the NCI shareholders in the consolidated balance sheet prepared at December 31, 20X7?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The comparative balance sheets and an income statement for Raceway Corporation follow.

Balance Sheets

As of December 31

Year 2

Year 1

Assets

Cash

$ 6,300

$ 48,400

Accounts receivable

10,200

7,260

Inventory

45,200

56,000

Prepaid rent

700

2,140

Equipment

140,000

144,000

Accumulated depreciation

(73,400)

(118,000)

Land

116,000

50,000

Total assets

$ 245,000

$ 189,800

Liabilities

Accounts payable (inventory)

$ 37,200

$ 40,000

Salaries payable

12,200

10,600

Stockholders’ equity

Common stock, $50 par value

150,000

120,000

Retained earnings

45,600

19,200

Total liabilities and stockholders’ equity

$ 245,000

$ 189,800

Income Statement

For the Year Ended December 31, Year 2

Sales

$ 480,000

Cost of goods sold

(264,000)

Gross profit

216,000

Operating expenses

Depreciation expense

(11,400)

Rent expense

(7,000)

Salaries expense

(95,200)

Other operating expenses

(76,000)

Net income

$ 26,400

Other Information

Purchased…

Please help holy tamale I have been staring at this for hours.

Could you explain the steps for solving this financial accounting question accurately?

Chapter 3 Solutions

Advanced Financial Accounting

Ch. 3 - What is the basic idea underlying the preparation...Ch. 3 - How might consolidated statements help an investor...Ch. 3 - Prob. 3.3QCh. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Prob. 3.6QCh. 3 - Prob. 3.7QCh. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Prob. 3.10Q

Ch. 3 - Prob. 3.11QCh. 3 - Prob. 3.12QCh. 3 - What is meant by indirect control? Give an...Ch. 3 - Prob. 3.14QCh. 3 - Prob. 3.15QCh. 3 - Prob. 3.16QCh. 3 - Prob. 3.17QCh. 3 - Prob. 3.18QCh. 3 - Prob. 3.1CCh. 3 - Prob. 3.2CCh. 3 - Prob. 3.3CCh. 3 - Prob. 3.6CCh. 3 - Prob. 3.7CCh. 3 - Prob. 3.1.1ECh. 3 - Prob. 3.1.2ECh. 3 - Prob. 3.1.3ECh. 3 - Prob. 3.1.4ECh. 3 - Multiple-Choice Question on Variable Interest...Ch. 3 - Multiple-Choice Question on Variable Interest...Ch. 3 - Prob. 3.2.3ECh. 3 - Prob. 3.2.4ECh. 3 - Prob. 3.3.1ECh. 3 - Prob. 3.3.2ECh. 3 - Prob. 3.3.3ECh. 3 - Prob. 3.4.1ECh. 3 - Prob. 3.4.2ECh. 3 - Prob. 3.4.3ECh. 3 - Prob. 3.4.4ECh. 3 - Prob. 3.5ECh. 3 - Prob. 3.6ECh. 3 - Prob. 3.7ECh. 3 - Prob. 3.8ECh. 3 - Prob. 3.9ECh. 3 - Reporting for a Variable Interest Entity Gamble...Ch. 3 - Prob. 3.11ECh. 3 - Prob. 3.12ECh. 3 - Prob. 3.13ECh. 3 - Noncontrolling Interest Sanderson Corporation...Ch. 3 - Prob. 3.15ECh. 3 - Prob. 3.16ECh. 3 - Prob. 3.17ECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19.1PCh. 3 - Prob. 3.19.2PCh. 3 - Prob. 3.20PCh. 3 - Prob. 3.21PCh. 3 - Prob. 3.22PCh. 3 - Prob. 3.23PCh. 3 - Parent Company and Consolidated Balances Exacto...Ch. 3 - Prob. 3.25PCh. 3 - Prob. 3.26PCh. 3 - Prob. 3.27PCh. 3 - Prob. 3.28PCh. 3 - Prob. 3.29PCh. 3 - Consolidated Worksheet at End of the First Year of...Ch. 3 - Prob. 3.31P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License