Concept explainers

(a)

T- Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

To Enter: The beginning balancesin the general ledger as of April 30, 2017.

(a)

Explanation of Solution

The beginning balancesare entered in the general ledger using T- Accounts as on April 30, 2017 as follows:

| Cash | |||

| Apr. 30 | $5,000 | ||

| Bal. | $ 5,000 | ||

Table (1)

| Supplies | |||

| Apr. 30 | $ 500 | ||

| Bal. | $ 500 | ||

Table (2)

| Equipment | |||

| Apr. 30 | $ 24,000 | ||

| Bal. | $ 24,000 | ||

Table (3)

| Accounts Payable | |||

| Apr. 30 | $2,100 | ||

| Bal. | $ 2,100 | ||

Table (4)

| Notes Payable | |||

| Apr. 30 | $10,000 | ||

| Bal. | $10,000 | ||

Table (5)

| Unearned Service Revenue | |||

| Apr. 30 | $ 1,000 | ||

| Bal. | $ 1,000 | ||

Table (6)

| Common Stock | |||

| Apr. 30 | $ 5,000 | ||

| Bal. | $ 5,000 | ||

Table (7)

|

| |||

| Apr. 30 | $11,400 | ||

| Bal. | $11,400 | ||

Table (8)

(b)

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

To journalize: The business transactions as given for Incorporation P.

(b)

Explanation of Solution

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| May 1 | Rent Expenses | 1,000 | |

| Cash | 1,000 | ||

| (To record the payment of rent) | |||

| May 4 | Accounts Payable | 1,100 | |

| Cash | 1,100 | ||

| (To record the payment of account payable at April 30) | |||

| May 7 | Cash | 1,500 | |

| Unearned Service revenue | 1,500 | ||

| (To record the cash received in advance for the services yet to be provided) | |||

| May 8 | Cash | 1,200 | |

| Service Revenue | 1,200 | ||

| (To record the cash received for the services performed) | |||

| May 14 | Salaries Expenses | 1,200 | |

| Cash | 1,200 | ||

| (To record the payment of salaries to employees) | |||

| May 15 | Cash | 800 | |

| Service Revenue | 800 | ||

| (To record the collection of cash for the services performed) | |||

| May 15 | Unearned Service revenue | 700 | |

| Service Revenue | 700 | ||

| (To record the recognition of service revenue from the unearned service revenue account) | |||

| May 21 | Accounts Payable | 1,000 | |

| Cash | 1,000 | ||

| (To record the payment of cash on account from the remaining balance due on April 30) | |||

| May 22 | Cash | 1,000 | |

| Service Revenue | 1,000 | ||

| (To record the cash received for the services performed) | |||

| May 22 | Supplies | 700 | |

| Accounts Payable | 700 | ||

| (To record the purchase of supplies on account) | |||

| May 25 | Advertising Expenses | 500 | |

| Accounts Payable | 500 | ||

| (To record the advertising expenses, due to be paid on June 13) | |||

| May 25 | Utilities Expenses | 400 | |

| Cash | 400 | ||

| (To record the payment of utilities expenses) | |||

| May 29 | Cash | 1,700 | |

| Service Revenue | 1,700 | ||

| (To record the cash received for the services performed) | |||

| May 29 | Unearned Service revenue | 600 | |

| Service Revenue | 600 | ||

| ( To record the recognition of service revenue from the unearned service revenue account) | |||

| May 31 | Interest Expenses | 50 | |

| Cash | 50 | ||

| (To record the payment of interest on notes payable) | |||

| May 31 | Salaries Expenses | 1,200 | |

| Cash | 1,200 | ||

| (To record the salaries paid to the employees) | |||

| May 31 | Income Tax Expenses | 150 | |

| Cash | 150 | ||

| (To record the payment of income tax) |

Table(1)

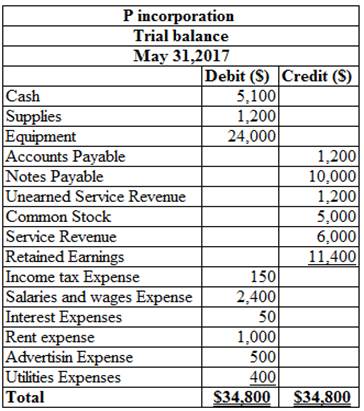

(c)

A trial balance is the summary of all the ledger accounts. The trial balance is prepared to check the total balance of the debit with the total of the balance of the credit column, which must be equal. The trial balance is usually prepared to check accuracy of ledger balances. In trial balance the debit balances are listed in the left column, and credit balances are listed in the right column.

To

(c)

Explanation of Solution

| Cash | |||

| Apr. 30 | $ 5,000 | May. 1 | $1,000 |

| May. 7 | $ 1,500 | 4 | $1,100 |

| 8 | $ 1,200 | 14 | $1,200 |

| 15 | $ 800 | 21 | $1,000 |

| 22 | $ 1,000 | 25 | $ 400 |

| 29 | $ 1,700 | 31 | $ 50 |

| 31 | $1,200 | ||

| 31 | $ 150 | ||

| Total | 11,200 | Total | 6,100 |

| Bal. | $ 5,100 | ||

Table (1)

| Supplies | |||

| Apr. 30 | $ 500 | ||

| Bal. | $ 500 | ||

Table (2)

| Equipment | |||

| Apr. 30 | $24,000 | ||

| Bal. | $24,000 | ||

Table (3)

| Accounts Payable | |||

| Apr. 30 | $2,100 | ||

| May 4 | $1,100 | May 22 | $ 700 |

| May 21 | $1,000 | 25 | $ 500 |

| Total | $2,100 | Total | $3,300 |

| Bal. | $1,200 | ||

Table (4)

| Notes Payable | |||

| Apr. 30 | $10,000 | ||

| Bal. | $10,000 | ||

Table (5)

| Unearned Service Revenue | |||

| Apr. 30 | $ 1,000 | ||

| May 15 | $ 700 | May 7 | $ 1,500 |

| May 29 | $ 600 | ||

| Total | $ 1,300 | Total | $2,500 |

| Bal. | $1,200 | ||

Table (6)

| Common Stock | |||

| Apr. 30 | $ 5,000 | ||

| Bal. | $ 5,000 | ||

Table (7)

| Retained earnings | |||

| Apr. 30 | $11,400 | ||

| Bal. | $11,400 | ||

Table (8)

| Service Revenue | |||

| May. 8 | $1,200 | ||

| 15 | $ 800 | ||

| 15 | $ 700 | ||

| 22 | $1,000 | ||

| 29 | $1,700 | ||

| 29 | $ 600 | ||

| Bal. | $6,000 | ||

Table (9)

| Salaries and wages expenses | |||

| May 14 | $ 1,200 | ||

| May 31 | $ 1,200 | ||

| Bal. | $ 2,400 | ||

Table (10)

| Rent Expense | |||

| May. 1 | $1,000 | ||

| Bal. | $1,000 | ||

Table (11)

| Supplies Expense | |||

| May. 22 | $ 700 | ||

| Bal. | $ 700 | ||

Table (12)

| Advertising Expense | |||

| May. 25 | $ 500 | ||

| Bal. | $ 500 | ||

Table (13)

| Utilities Expense | |||

| May. 25 | $ 400 | ||

| Bal. | $ 400 | ||

Table (14)

| Interest Expense | |||

| May. 31 | $ 50 | ||

| Bal. | $ 50 | ||

Table (15)

| Income tax Expense | |||

| May. 31 | $ 150 | ||

| Bal. | $ 150 | ||

Table (16)

(d)

To Prepare: The trial balance of Incorporation P as on May 31, 2017.

(d)

Explanation of Solution

Table-1

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCOUNTING>IC<

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning