Huron Manufacturing Co. uses a

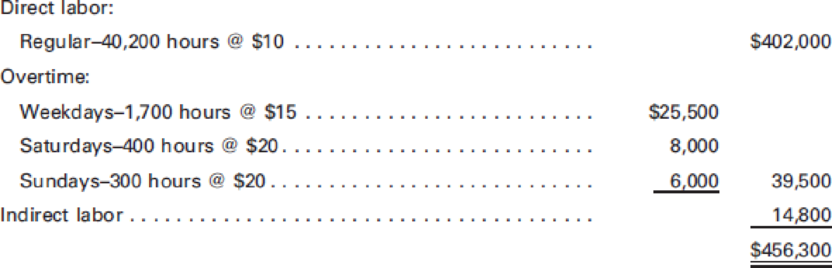

An examination of the first month’s payroll under the new union contract provisions shows the following:

Analysis of the supporting payroll documents revealed the following:

- a. More production was scheduled each day than could be handled in a regular workday, resulting in the need for overtime.

- b. The Saturday and Sunday hours resulted from rush orders with special contract arrangements with the customers.

The controller believes that the overtime premiums and the bonus should be charged to factory

The plant manager favors charging the overtime premiums directly to the jobs worked on during overtime hours and the bonus to administrative expense.

The sales manager states that the overtime premiums and bonus are not

Required:

- 1. Evaluate each position—the controller’s, the plant manager’s, and the sales manager’s. If you disagree with all of the positions taken, present your view of the appropriate allocation.

- 2. Prepare the

journal entries to illustrate the position you support, including the accrual for the bonus.

Trending nowThis is a popular solution!

Chapter 3 Solutions

PRINCIPLES OF COST ACCOUNTING

- I need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you provide the accurate answer to this financial accounting question using correct methods?arrow_forward

- Please show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Mona Equipment Inc. had $22.50 million in sales last year. The cost of goods sold was $12.40 million, depreciation expense was $3.60 million, interest payment on outstanding debt was $2.10 million, and the firm's tax rate was 25%. A. What was the firm's net income? B. What was the firm's cash flow?arrow_forwardThe direct manufacturing labor efficiency variance during July is:arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning