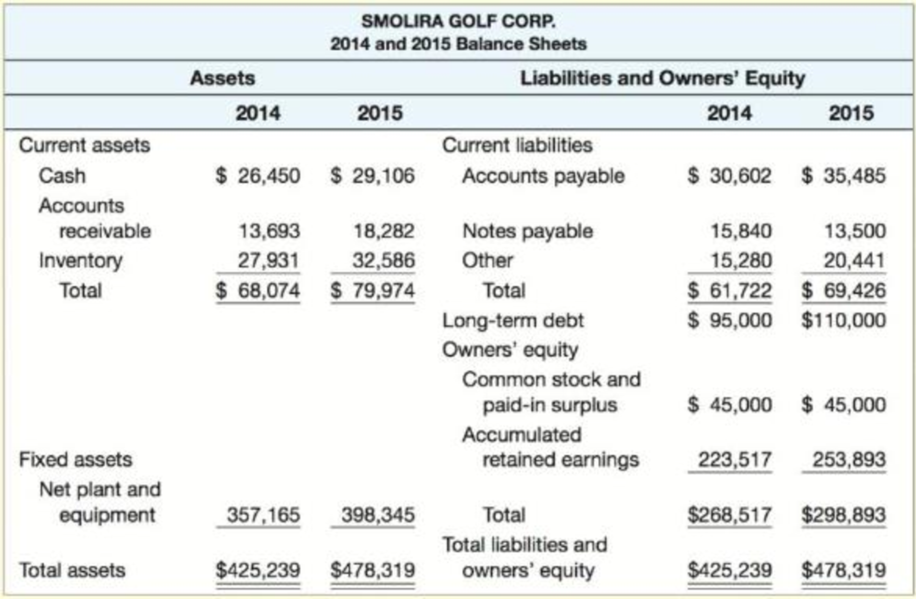

Some recent financial statements for Smolira Golf Corp. follow. Use this information to work Problems 26 through 30.

| SMOLIRA GOLF CORP. 2015 Income Statement | ||

| Sales | $422,045 | |

| Cost of goods sold | 291,090 | |

| 37,053 | ||

| Earnings before interest and taxes | $ 93,902 | |

| Interest paid | 16,400 | |

| Taxable income | $ 77,502 | |

| Taxes (35%) | 27,126 | |

| Net income | $ 50,376 | |

| Dividends | $20,000 | |

| |

30,376 | |

26. Calculating Financial Ratios [LO2] Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate):

Short-term solvency ratios:

| a. Current ratio | ____________________ |

| b. Quick ratio | ____________________ |

| c. Cash ratio | ____________________ |

Asset utilization ratios:

| d. Total asset turnover | ____________________ |

| e. Inventory turnover | ____________________ |

| f. Receivables turnover | ____________________ |

Long-term solvency ratios:

| g. Total debt ratio | ____________________ |

| h. Debt–equity ratio | ____________________ |

| i. Equity multiplier | ____________________ |

| j. Times interest earned ratio | ____________________ |

| k. Cash coverage ratio | ____________________ |

Profitability ratios:

| l. Profit margin | ____________________ |

| m. |

____________________ |

| n. |

____________________ |

a)

To find: The financial current ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The current ratio for 2014 and 2015 is 1.10 times and 1.15 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Short-term solvency ratios:

Formula to calculate the current ratio:

Compute the current ratio:

Hence, the current ratio for 2014 is 1.10 times

Hence, the current ratio for 2015 is 1.15 times

b)

To find: The financial quick ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The quick ratio for 2014 and 2015 is 0.65 and 0.68 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate Quick ratio:

Compute the quick ratio:

Hence, the quick ratio for 2014 is 0.65 times

Hence, the quick ratio for 2015 is 0.68 times.

c)

To find: The financial cash ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The cash ratio for 2014 and 2015 is 0.43 times and 0.42 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the cash ratio:

Compute the cash ratio:

Hence, the cash ratio for 2014 is 0.43 times

Hence, the cash ratio for 2015 is 0.42 times

d)

To find: The financial total asset turnover ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The total asset turnover ratio is 0.88 times.

Explanation of Solution

Asset utilization ratios:

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the total asset turnover ratio:

Compute the total asset turnover ratio:

Hence, the total asset turnover ratio is 0.88 times.

e)

To find: The inventory turnover ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The inventory turnover ratio is 8.93 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the inventory turnover ratio:

Compute the inventory turnover ratio:

Hence, the inventory turnover ratio is 8.93 times.

f)

To find: The receivables turnover ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The receivables turnover ratio is 23.09 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the receivables turnover ratio:

Compute the receivables turnover ratio:

Hence, the receivables turnover ratio is 23.09 times.

g)

To find: The total debt ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The total debt ratio for 2014 is 0.37 timesand for 2015 is 0.38 times.

Explanation of Solution

Long-term solvency ratios:

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the total debt ratio:

Compute the total debt ratio:

Hence, the total debt ratio for 2014 is 0.37 times.

Hence, the total debt ratio for 2015 is 0.38 times.

h)

To find: The debt equity ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The debt-equity ratio for the year 2014 is 0.58 timesand the debt-equity ratio for the year 2015 is 0.60 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the debt-equity ratio:

Compute the debt-equity:

Hence, the debt-equity ratio for the year 2014 is 0.58 times.

Hence, the debt-equity ratio for the year 2015 is 0.60 times.

Note: The total debt is calculated by adding the total-long term debt and total current liabilities.

i)

To find: The equity multiplier ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The equity multiplier ratio for the year 2014 is 1.58 timesand the equity multiplier ratio for the year 2015 is 1.60 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the equity multiplier:

Compute the equity multiplier ratio for the year 2015:

Hence, the equity multiplier ratio for the year 2014 is 1.58 times.

Hence, the equity multiplier ratio for the year 2015 is 1.60 times.

j)

To find: The times interest earned of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The times interest earned is 5.73 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the times interest earned ratio:

Compute the times interest earned ratio:

Hence, the times interest earned is 5.73 times.

k)

To find: The cash coverage ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The cash coverage ratio is 7.99 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the cash coverage ratio:

Compute the cash coverage ratio:

Hence, the cash coverage ratio is 7.99 times.

l)

To find: The profit margin of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The profit margin is 11.94%.

Explanation of Solution

Profitability ratios:

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the profit margin ratio:

Compute the profit margin:

Hence, the profit margin is 11.94%.

m)

To find: The return on assets of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The return on assets is 0.1194.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the Return on assets (ROA):

Compute the Return on assets (ROA):

Hence, the return on assets is 0.1194 or 11.94%.

n)

To find: The return on equity of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The return on equity is 0.1685.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the Return on equity (ROE):

Compute the Return on equity (ROE):

Hence, the return on equity is 0.1685 or 16.85%.

Want to see more full solutions like this?

Chapter 3 Solutions

Connect 1 Semester Access Card for Fundamentals of Corporate Finance

- I need help with this situation and financial accounting questionarrow_forwardRemaining Time: 50 minutes, 26 seconds. * Question Completion Status: A Moving to the next question prevents changes to this answer. Question 9 Question 9 of 20 5 points Save Answer A currency speculator wants to speculate on the future movements of the €. The speculator expects the € to appreciate in the near future and decides to concentrate on the nearby contract. The broker requires a 2% Initial Margin (IM) and the Maintenance Margin (MM) is 75% of IM. Following € Futures quotes are currently available from the Chicago Mercantile Exchange (CME). Euro (CME)- €125,000; $/€ Open High Low Settle Change Open Interest June 1.2216 1.2276 1.2175 1.2259 -0.0018 Sept 1.2229 1.2288 1.2189 1.2269 0.0018 255,420 19,335 In addition to the information provided above, consider the following CME quotes that are available at the end of day one's trading: Euro (CME) - €125,000; $/€ Open High Low June 1.2216 Sept 1.2229 1.2276 1.2288 Settle Change Open Interest 1.2175 1.2176 -0.0083 255,420 1.2189…arrow_forwardI need help with this problem and financial accounting questionarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning