a)

To determine: Average tax rate and marginal tax rate of a single tax payer.

a)

Explanation of Solution

Given information:

The income of the single tax payer is $20,000.

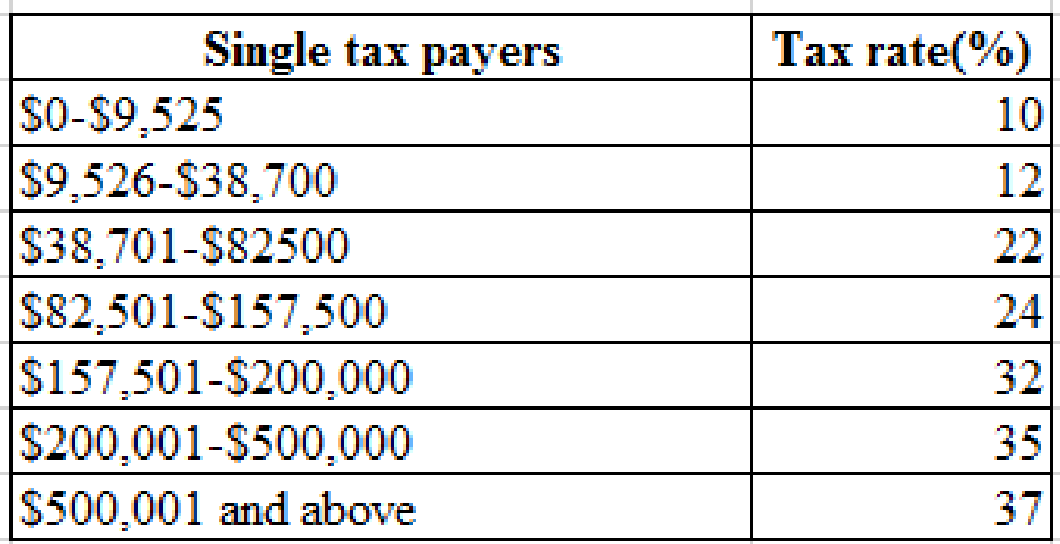

The slab rates of single tax payers are as follows, they are

If the taxable income is $20,000 then up to $9,525 the tax rate is 10% and after that remaining balance is charged under 12% tax rate.

Calculation of taxes:

Hence, taxes are $2,209.50

Calculation of Average tax rate:

Hence, average tax rate is 11.05%

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 12% incurred on each additional dollar of his income.

b)

To determine: Average tax rate and marginal tax rate of a single tax payer.

b)

Explanation of Solution

Given information:

The income of the single tax payer is $50,000.

If the taxable income is $50,000 then up to $9,525 the tax rate is 10%, after that tax rate is 12% up to $38,700 then, after remaining balance is charged under 22% tax rate.

Calculation of taxes:

Hence, taxes are $6,939.50

Calculation of Average tax rate:

Hence, average tax rate is 13.88%

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 22% incurred on each additional dollar of his income.

c)

To determine: Average tax rate and marginal tax rate of a single tax payer.

c)

Explanation of Solution

Given information:

The income of the single tax payer is $300,000.

If the taxable income is $300,000 then up to $9,525 the tax rate is 10%, after that tax rate is 12% up to $38,700, up to $82,500 the tax rate is 22% and up to $157,500 the tax rate is 24% and up to $200,000 the tax rate is 32%, then the remaining balance is charged under 35% tax rate.

Calculation of taxes:

Hence, taxes are $78,445.50

Calculation of Average tax rate:

Hence, average tax rate is 26.14%

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 35% incurred on each additional dollar of his income.

d)

To determine: Average tax rate and marginal tax rate of a single tax payer.

d)

Explanation of Solution

Given information:

The income of the single tax payer is $3,000,000.

If the taxable income is $3,000,000 then up to $9,525 the tax rate is 10%, after that tax rate is 12% up to $38,700, up to $82,500 the tax rate is 22% and up to $157,500 the tax rate is 24% and up to $200,000 the tax rate is 32%, and up to $500,000 the tax rate is 35% then the remaining balance is charged under 37% tax rate.

Calculation of taxes:

Hence, taxes are $1,075,689.50

Calculation of Average tax rate:

Hence, average tax rate is 35.86%

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 37% incurred on each additional dollar of his income.

Want to see more full solutions like this?

Chapter 3 Solutions

FUNDAMENTALS OF CORPORATE FINANCE

- Forest Enterprises, Incorporated, has been considering the purchase of a new manufacturing facility for $290,000. The facility is to be fully depreciated on a straight-line basis over seven years. It is expected to have no resale value after the seven years. Operating revenues from the facility are expected to be $125,000, in nominal terms, at the end of the first year. The revenues are expected to increase at the inflation rate of 2 percent. Production costs at the end of the first year will be $50,000, in nominal terms, and they are expected to increase at 3 percent per year. The real discount rate is 5 percent. The corporate tax rate is 25 percent. Calculate the NPV of the project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPVarrow_forwardHelp with questionsarrow_forwardPlease help with questionsarrow_forward

- Create financial forecasting years 2022, 2023, and 2024 using this balance sheet.arrow_forwardBeta Company Ltd issued 10% perpetual debt of Rs. 1,00,000. The company's tax rate is 50%. Determine the cost of capital (before tax as well as after tax) assuming the debt is issued at 10 percent premium. helparrow_forwardFinance subject qn solve.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education