a.

Calculate the contribution margin per unit.

a.

Explanation of Solution

The calculation of contribution margin per unit is as follows:

Hence, the contribution margin per unit is $40.

b.

Calculate the break-even points in dollars and units and prepare income statement using contribution margin format.

b.

Explanation of Solution

The calculation of break-even points in units is as follows:

Hence, the break-even units are 6,250 units.

The calculation of break-even point in dollars is as follows:

Hence, the break-even in dollars is $1,250,000.

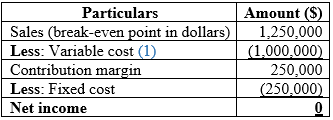

The calculation of income statement is as follows:

(Table 1)

Working note:

The calculation of variable cost is as follows:

Hence, the variable cost is $1,000,000.

…… (1)

c.

Calculate the sales volume in units and dollars that is required to earn profit and prepare income statement.

c.

Explanation of Solution

The calculation of sales volume in units is as follows:

Hence, the sales volume in units is 7,500 units.

The calculation of break even in dollars is as follows:

Hence, the sales volume in dollars is $1,500,000.

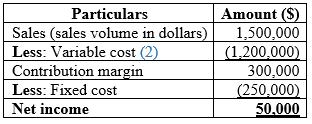

The calculation of income statement is as follows:

(Table 2)

Working note:

The calculation of variable cost is as follows:

Hence, the variable cost is $1,200,000.

…… (2)

d.

Calculate the level of sales that is necessary to earn profit in case of drop in sales price.

d.

Explanation of Solution

The calculation of sales volume in units is as follows:

Hence, the sales volume in units is 15,000 units.

The calculation of sales volume in dollars is as follows:

Hence, the sales volume in dollars is $2,700,000.

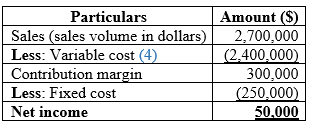

The calculation of income statement is as follows:

(Table 3)

Working note:

The calculation of contribution margin per unit is as follows:

Hence, the contribution margin per unit is $20.

…… (3)

The calculation of variable cost is as follows:

Hence, the variable cost is $2,400,000.

…… (4)

e.

Calculate the level of sales that is necessary to earn profit in case of drop in fixed cost.

e.

Explanation of Solution

The calculation of sales volume in units is as follows:

Hence, the sales volume in units is 12,500 units.

The calculation of sales volume in dollars is as follows:

Hence, the sales volume in dollars is $2,250,000.

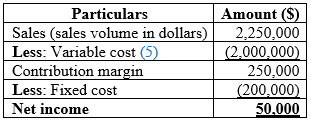

The calculation of income statement is as follows:

(Table 4)

Working note:

The calculation of variable cost is as follows:

Hence, the variable cost is $2,000,000.

…… (5)

f.

Calculate the level of sales that is necessary to earn profit in case of drop in variable cost.

f.

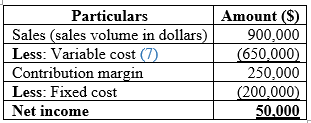

Explanation of Solution

The calculation of sales volume in units is as follows:

Hence, the sales volume in units is 5,000 units.

The calculation of sales volume in dollars is as follows:

Hence, the sales volume in dollars is $900,000.

The calculation of income statement is as follows:

(Table 5)

Working note:

The calculation of contribution margin per unit is as follows:

Hence, the contribution margin per unit is $50.

…… (6)

The calculation of variable cost is as follows:

Hence, the variable cost is $650,000.

…… (7)

g.

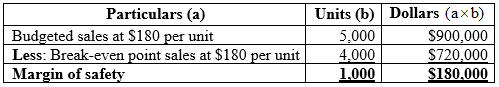

Calculate the margin of safety in dollars, units and as a percentage.

g.

Explanation of Solution

The calculation of break-even points in units is as follows:

Hence, the break-even units are 4,000 units.

The calculation of margin of safety in dollars and units is as follows:

(Table 6)

The calculation of margin of safety in percentage is as follows:

Hence, the margin of safety in percentage is 20%

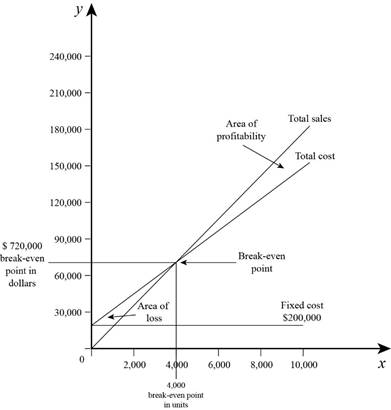

h.

Draw a break-even graph using the data in requirement (g).

h.

Explanation of Solution

The break-even graph is as follows:

s

s

(Figure 1)

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamental Managerial Accounting Concepts

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardI am looking for the most effective method for solving this financial accounting problem.arrow_forward

- Subject : Financial accountingarrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardCooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal? Helparrow_forward

- Cooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education