Concept explainers

Preparing Financial Statements from a

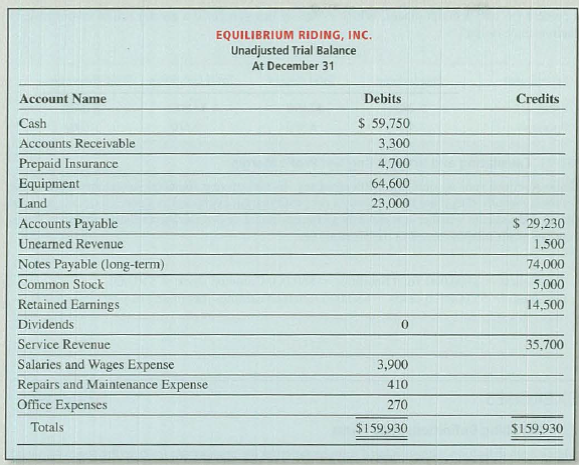

The following accounts are taken from Equilibrium Riding, Inc., a company that specializes in occupational therapy and horseback riding lessons, as of December 31.

Required:

Using the unadjusted trial balance provided, create a classified

TIP: Create the Income Statement first, followed by the Statement of Retained Earnings, and finally the classified Balance Sheet. Follow the formats presented in Exhibits 1.3, 1.4, and 2.13.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

FUND. OF FINANCIAL ACCT. (LL) W/CONNECT

Additional Business Textbook Solutions

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Foundations of Financial Management

Marketing: An Introduction (13th Edition)

Essentials of MIS (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- 19. Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyarrow_forward19. Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyhelparrow_forwardYou invest 60% of your money in Asset A (expected return = 8%, standard deviation = 12%) and 40% in Asset B (expected return = 5%, standard deviation = 8%). The correlation coefficient between the two assets is 0.3. What is the expected return and standard deviation of the portfolio?correct solutarrow_forward

- You invest 60% of your money in Asset A (expected return = 8%, standard deviation = 12%) and 40% in Asset B (expected return = 5%, standard deviation = 8%). The correlation coefficient between the two assets is 0.3. What is the expected return and standard deviation of the portfolio?need jelparrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.no aiarrow_forward1) Identify whethere the company is paying out dividends based on the attached statement. 2) Describe in detail how that the company’s dividend payouts have changed over the past five years. 3)Describe in detail the changes in “total equity” (representing the current “book value” of the company).arrow_forward

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College