Principles of Corporate Finance

13th Edition

ISBN: 9781260465099

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1SQ

(PRICE) In February 2009, Treasury 8.5s of 2020 yielded 3.2976%. What was their price? If the yield rose to 4%, what would happen to the price?

Expert Solution

Summary Introduction

To determine: The price of bond at a yield of 3.2976%.

Answer to Problem 1SQ

The price of bond at a yield of 3.2976% is $147.67.

Explanation of Solution

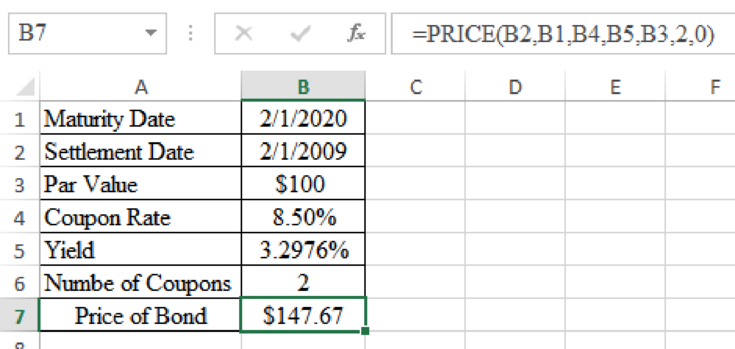

Determine the price of bond at a yield of 3.2976%

Excel Spreadsheet:

Therefore the price of bond at a yield of 3.2976% is $147.67.

Expert Solution

Summary Introduction

To determine: The price of bond at a yield of 4%.

Answer to Problem 1SQ

The price of bond at a yield of 4% is $139.73.

Explanation of Solution

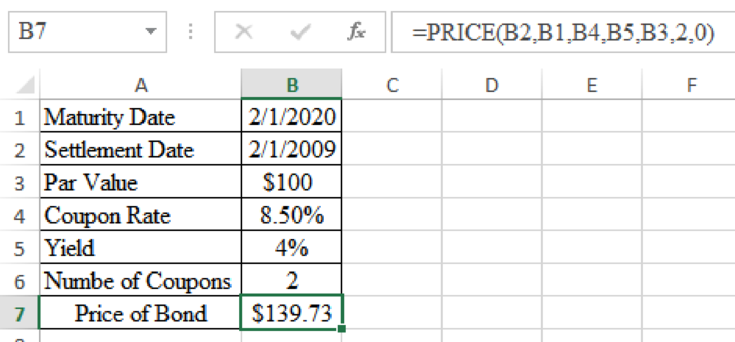

Determine the price of bond at a yield of 4%

Excel Spreadsheet:

Therefore the price of bond at a yield of 4% is $139.73.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

What is the difference between a contra asset account and a liability?i need help.

What is the significance of a company’s price-to-earnings (P/E) ratio? i need answer.

What is the significance of a company’s price-to-earnings (P/E) ratio?

Chapter 3 Solutions

Principles of Corporate Finance

Ch. 3 - (PRICE) In February 2009, Treasury 8.5s of 2020...Ch. 3 - (YLD) On the same day, Treasury 3.5s of 2018 were...Ch. 3 - (DURATION) What was the duration of the Treasury...Ch. 3 - (MDURATION) What was the modified duration of the...Ch. 3 - Bond prices and yields A 10-year bond is issued...Ch. 3 - Bond prices and yields The following statements...Ch. 3 - Bond prices and yields Construct some simple...Ch. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields A 10-year U.S. Treasury...

Ch. 3 - Bond returns If a bonds yield to maturity does not...Ch. 3 - Bond returns a. An 8%, five-year bond yields 6%....Ch. 3 - Prob. 10PSCh. 3 - Duration True or false? Explain. a....Ch. 3 - Duration Here are the prices of three bonds with...Ch. 3 - Duration Calculate the durations and volatilities...Ch. 3 - Prob. 14PSCh. 3 - Duration Find the spreadsheet for Table 3.4 in...Ch. 3 - Prob. 16PSCh. 3 - Spot interest rates and yields Which comes first...Ch. 3 - Prob. 18PSCh. 3 - Spot interest rates and yields Look again at Table...Ch. 3 - Prob. 20PSCh. 3 - Spot interest rates and yields Assume annual...Ch. 3 - Spot interest rates and yields A 6% six-year bond...Ch. 3 - Spot interest rates and yields Is the yield on...Ch. 3 - Prob. 24PSCh. 3 - Measuring term structure The following table shows...Ch. 3 - Term-structure theories The one-year spot interest...Ch. 3 - Term-structure theories Look again at the spot...Ch. 3 - Real interest rates The two-year interest rate is...Ch. 3 - Prob. 30PSCh. 3 - Bond ratings A bonds credit rating provides a...Ch. 3 - Prob. 32PSCh. 3 - Price and spot interest rates Find the arbitrage...Ch. 3 - Prob. 34PSCh. 3 - Prices and spot interest rates What spot interest...Ch. 3 - Prices and spot interest rates Look one more time...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License