1.

Analyze the effects of the January transaction on the

1.

Explanation of Solution

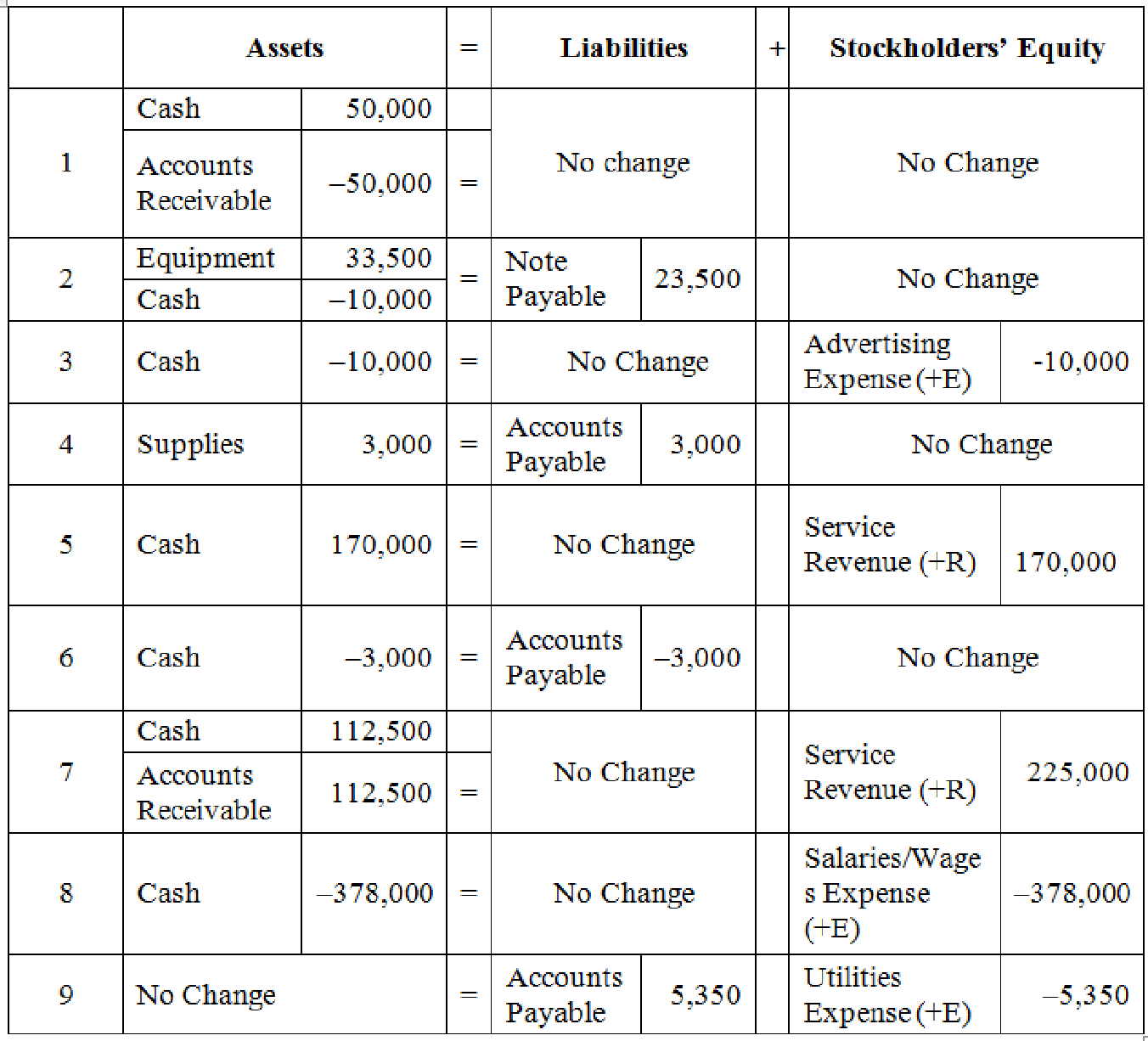

The effects of the accounting equation for the September events using a table are indicated as follows:

Table (1)

Note:

SE refers to Stockholder’s equity.

E refers to Expenses.

R refers to Revenues.

2.

Prepare

2.

Explanation of Solution

Journal: Journal is the book of original entry. Journal consists of the day today financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

Journal entries for September events are prepared as follows:

|

Date | Account Title and Explanation | Debit ($) | Credit ($) | |

| 1. | Cash (A+) | 50,000 | ||

| 50,000 | ||||

| (To record the cash receipt from customer for the service rendered already) | ||||

| 2. | Equipment (A+) | 33,500 | ||

| Cash (A–) | 10,000 | |||

| Notes Payable (L+) | 23,500 | |||

| (To record the purchase of equipment partly for cash and partly by signing a note) | ||||

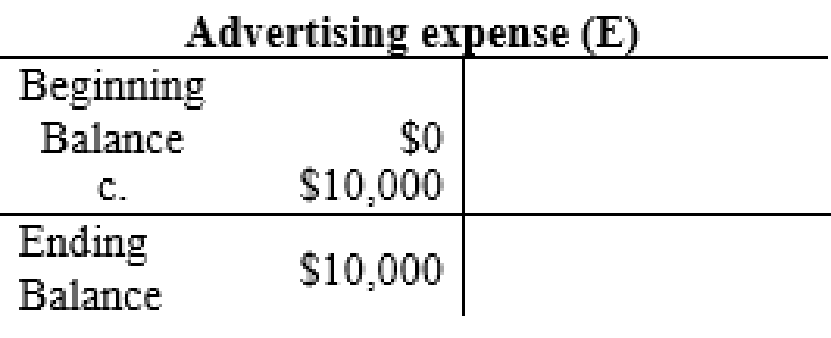

| 3. | Advertising Expense | 10,000 | ||

| Cash (A–) | 10,000 | |||

| (To record the payment made for advertising expenses) | ||||

| 4. | Supplies (A+) | 3,000 | ||

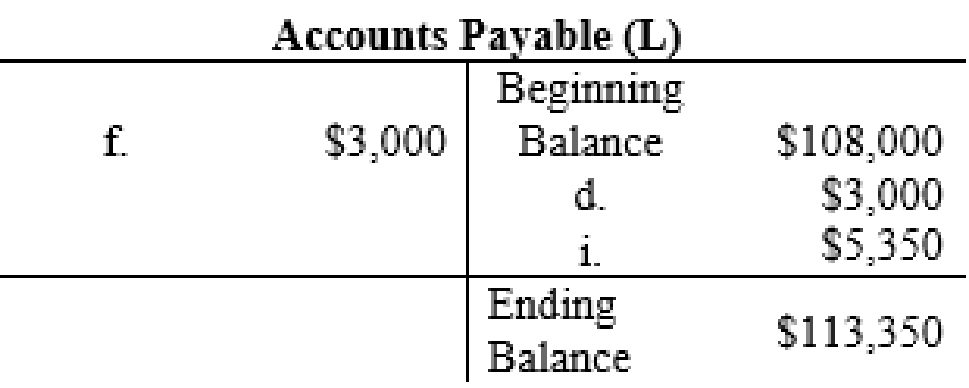

| Accounts Payable (L+) | 3,000 | |||

| (To record the supplies purchased on accounts) | ||||

| 5. | Cash (A+) | 170,000 | ||

| Service Revenue (R+, SE+) | 170,000 | |||

| (To record the cash receipt for the service provide) | ||||

| 6. | Accounts Payable (L–) | 3,000 | ||

| Cash (A–) | 3,000 | |||

| (To record the payment made for the supplies purchased on account) | ||||

| 7. | Cash (A+) | 112,500 | ||

| Accounts Receivable (A+) | 112,500 | |||

| Service Revenue (R+, SE+) | 225,000 | |||

| (To record the sales made partly for cash and partly on account ) | ||||

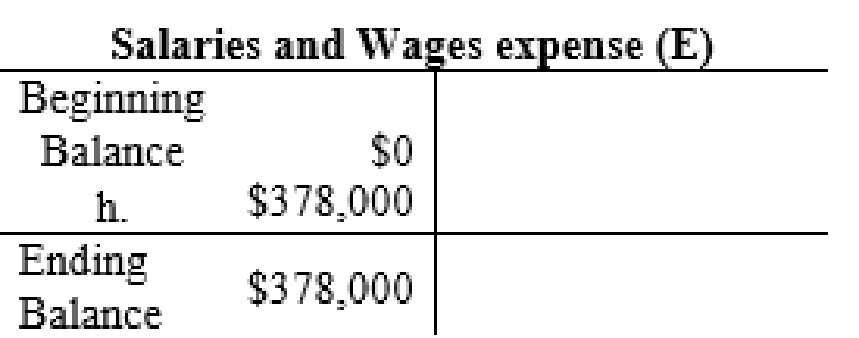

| 8. | Salaries and Wages Expense (E+, SE–) | 378,000 | ||

| Cash (A–) | 378,000 | |||

| (To record the payment of wages expenses to employees) | ||||

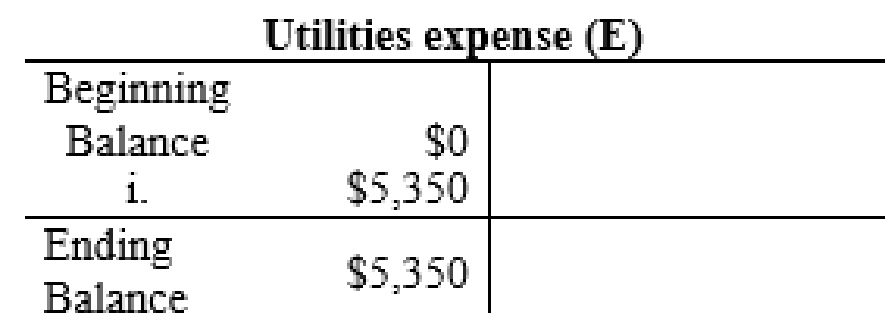

| 9. | Utilities Expense (E+, SE–) | 5.350 | ||

| Accounts Payable (L+) | 5.350 | |||

| (To record the utilities expenses incurred which are to be paid later) | ||||

Table (2)

3.

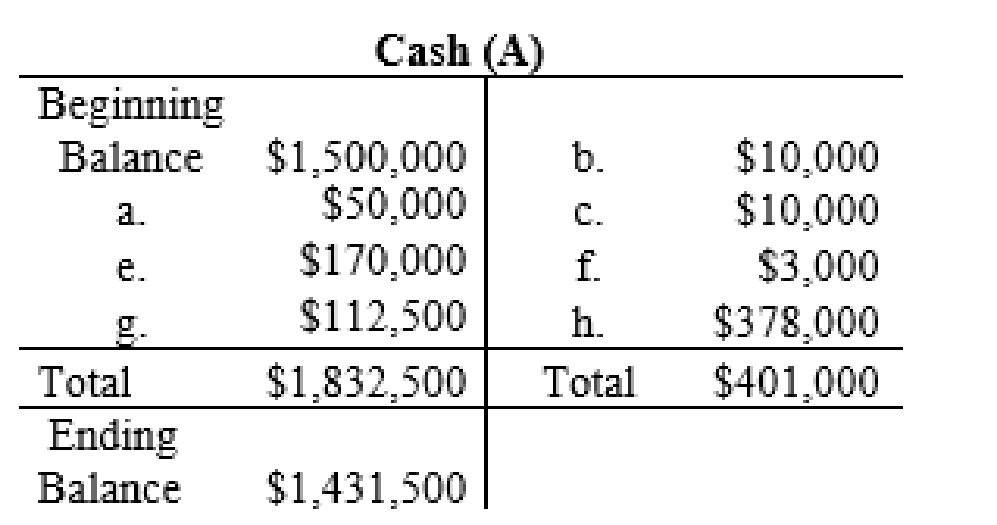

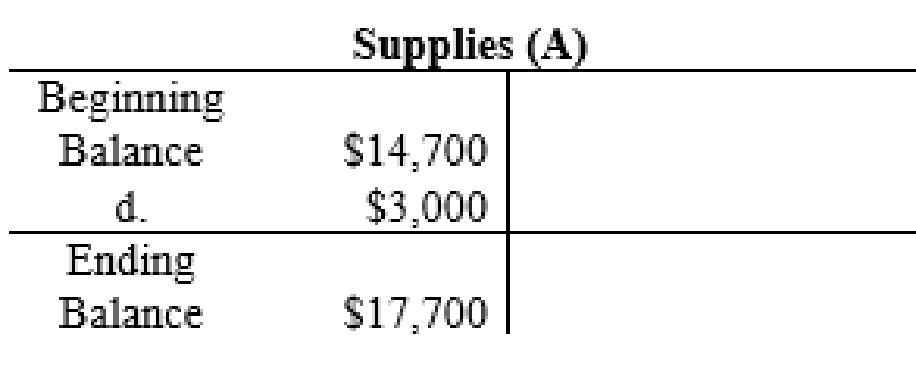

Create T accounts for the

3.

Explanation of Solution

T-account: An account is referred to as a T-account, because the alignment of the components of the account resembles the capital letter ‘T’. An account consists of the three main components which are as follows:

- The title of the account

- The left or debit side

- The right or credit side

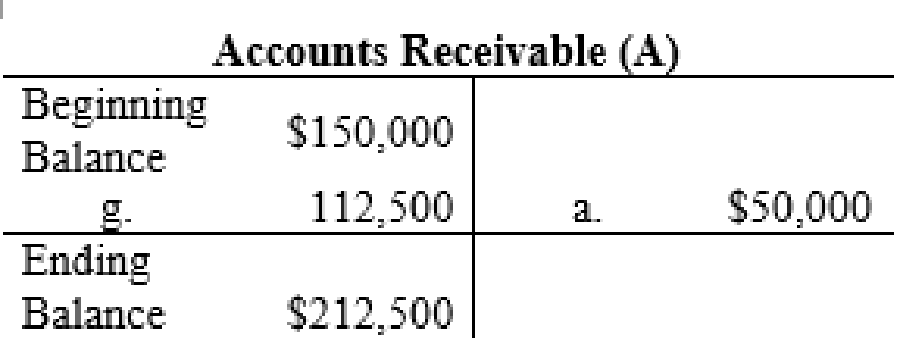

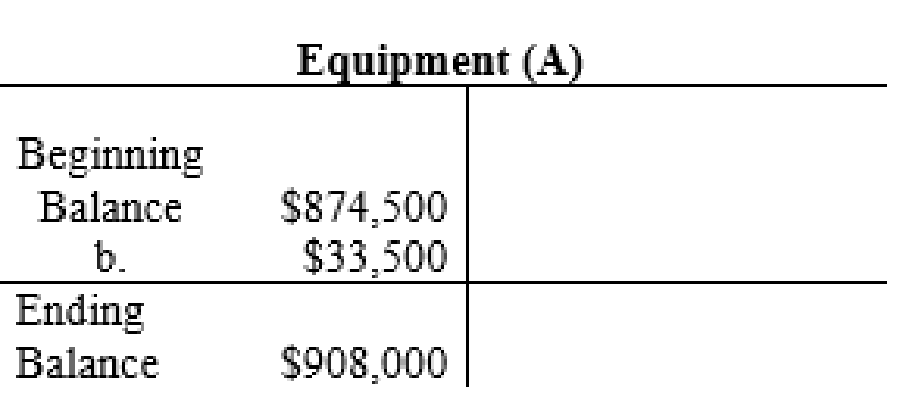

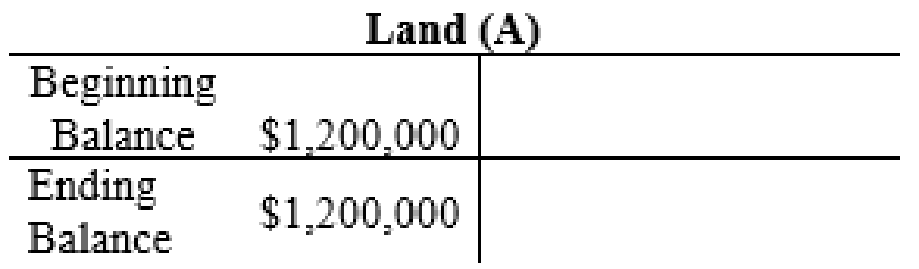

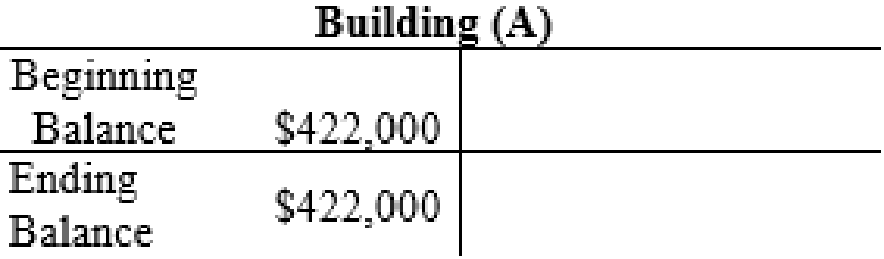

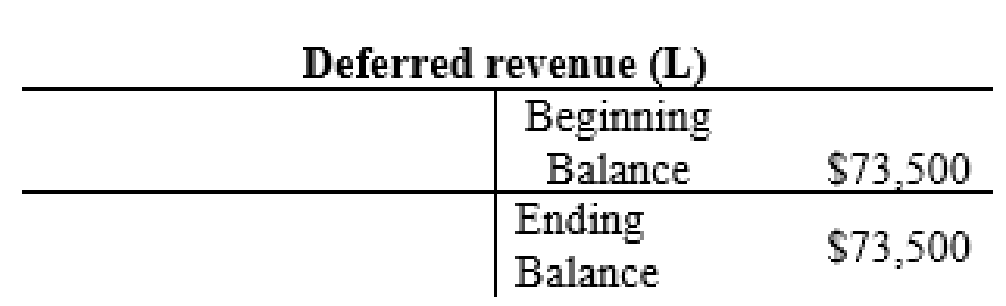

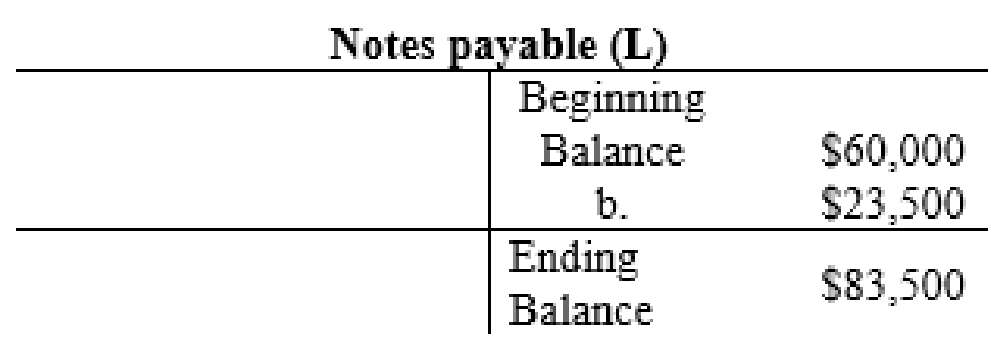

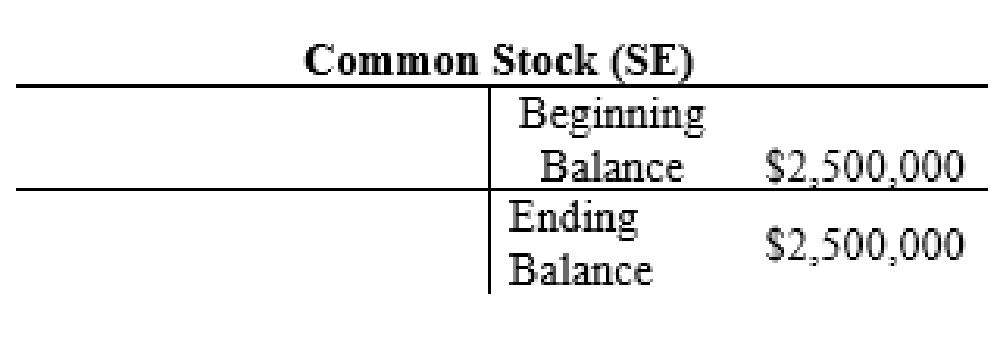

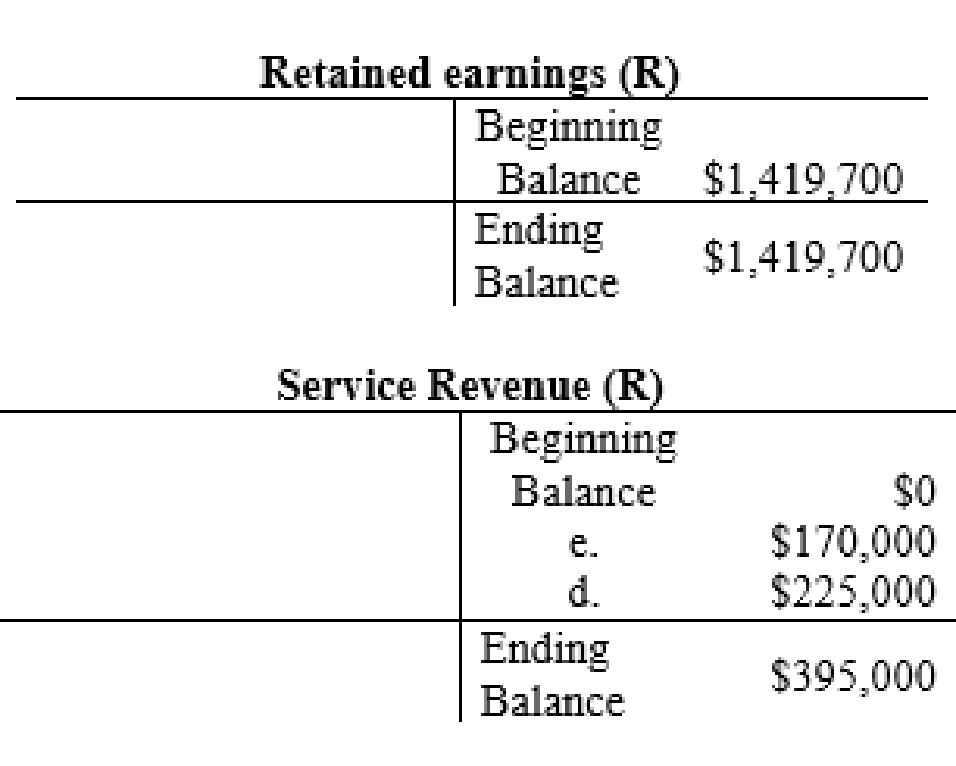

The posting of the journal entries to the T accounts are as follows:

4.

Prepare an unadjusted

4.

Explanation of Solution

Unadjusted trial balance: Unadjusted trial balance is that statement which contains complete list of accounts with their unadjusted balances. This statement is prepared at the end of every financial period.

An unadjusted trial balance of corporation V for the month ended January 31, 2018 is prepared as follows:

| Corporation V | ||

| Unadjusted Trial Balance | ||

| At January 31, 2018 | ||

| Particulars | Debit ($) | Credit ($) |

| Cash | $1,431,500 | |

| Accounts Receivable | 212,500 | |

| Supplies | 17,700 | |

| Equipment | 908,000 | |

| Building | 422,000 | |

| Land | 1,200,000 | |

| Accounts Payable | $113,350 | |

| Deferred Revenue | 73,500 | |

| Notes Payable | 83,500 | |

| Common Stock | 2,500,000 | |

| Retained Earnings | 1,419,700 | |

| Service Revenue | 395,000 | |

| Salaries and Wages Expense | 378,000 | |

| Advertising Expense | 10,000 | |

| Utilities Expense | 5,350 | |

| Total | $4,585,050 | $4,585,050 |

Table (3)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $4,585,050.

5.

Prepare an income statement of corporation V for the year ended January 31, 2018.

5.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

An income statement of corporation V for the year ended December 31is prepared as follows:

|

Corporation V Income Statement For the year Ended January 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Service Revenue | $395,000 | |

| Total Revenues | 395,000 | |

|

Less: Expenses: | ||

| Salaries and Wages Expense | 378,000 | |

| Advertising Expense | 10,000 | |

| Utilities Expense | 5,350 | |

| Total Expenses | 393,350 | |

| Net Income | $1,650 | |

Table (4)

6.

Prepare the statement of retained earnings of Corporation V for the year ended January 31, 2018.

6.

Explanation of Solution

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

The statement of retained earnings of Corporation V for the year ended January 31, 2018 is prepared as follows.

| Corporation V | |

| Statement of Retained Earnings | |

| For the Year Ended January 31, 2018 | |

| Particulars | $ |

| Retained Earnings, January 1, 2018 | 1,419,700 |

| Less: Net Loss | 1,650 |

| Dividends | 0 |

| Retained Earnings, December 31 | 1,421,350 |

Table (5)

7.

Prepare a classified balance sheet of Corporation V for the year ended January 31, 2018.

7.

Explanation of Solution

Classified balance sheet: This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

A classified balance sheet of Corporation V for the year ended January 31, 2018 is prepared as follows:

| Corporation V | ||

| Balance Sheet | ||

| At January 31, 2018 | ||

| Assets: | $ | $ |

| Current Assets | ||

| Cash | $1,431,500 | |

| Accounts Receivable | 212,500 | |

| Supplies | 17,700 | |

| Total Current Assets | 1,661,700 | |

| Equipment | 908,000 | |

| Building | 422,000 | |

| Land | 1,200,000 | |

| Total Assets | $4,191,700 | |

| Liabilities: | ||

| Current Liabilities | ||

| Accounts Payable | $113,350 | |

| Deferred Revenue | 73,500 | |

| Total Current Liabilities | 186,850 | |

| Notes Payable | 83,500 | |

| Total Liabilities | 270,350 | |

| Stockholders’ Equity | ||

| Common Stock | 2,500,000 | |

| Retained Earnings | 1,421,350 | |

| Total Stockholders’ Equity | 3,921,350 | |

| Total Liabilities and Stockholders’ Equity | $4,191,700 | |

Table (6)

8.

Calculate the net profit margin of the company.

8.

Explanation of Solution

Profit Margin Ratio: Profit margin provides an indication of the earnings per dollar of sales, and it represents the net profit as a percentage of the revenues. Use the following formula to calculate the profit margin ratio.

The net profit margin of the Company is determined as follows:

Want to see more full solutions like this?

Chapter 3 Solutions

Loose Leaf For Fundamentals Of Financial Accounting

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardHow does operational efficiency measurement differ from financial metrics? (a) Process effectiveness indicators complement cost measures (b) Financial data tells complete story (c) Efficiency remains constant (d) Standard metrics work everywhere need answerarrow_forwardGeneral accountingarrow_forward

- When should dynamic allocation models replace static methods? a. Changes create confusion b. Changing business conditions demand flexible distribution systems c. Fixed allocations work better d. Static models fit all casesarrow_forwardGenshin Company uses process costing. During March, the packaging department had 8,500 units in beginning work-in-process inventory that were 70% complete. During the month, 42,000 units were started and 37,500 units were completed. Ending work-in-process inventory was 40% complete. Using the weighted-average method, what are the equivalent units for the month?arrow_forwardI need guidance in solving this financial accounting problem using standard procedures.arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning