Concept explainers

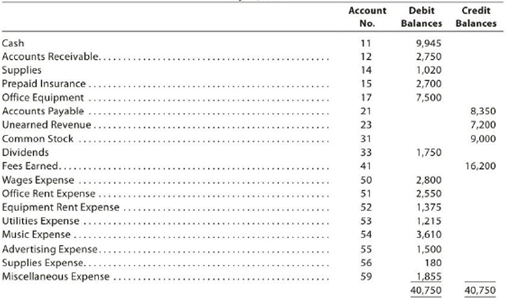

The unadjusted

PS Music

Unadjusted Trial Balance

July 31, 2018

The data needed to determine adjustments are as follows:

- During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2.

- Supplies on hand at July 31, $275.

- The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2.

Depreciation of the office equipment is $50.- The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2.

- Accrued wages as of July 31 were $140.

Instructions

- 1. Prepare adjusting

journal entries. You will need the following additional accounts:18

Accumulated Depreciation —Office Equipment22 Wages Payable

57 Insurance Expense

58 Depreciation Expense

- 2.

Post the adjusting entries , inserting balances in the accounts affected. - 3. Prepare an adjusted trial balance.

1.

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

To prepare: The adjusting entries in the books of Company PS at the end of the July 31, 2019.

Explanation of Solution

| Journal Page 18 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2019 | Accounts receivable | 12 | 1,400 | ||

| July | 31 | Fees earned (1) | 41 | 1,400 | |

| (To record the fees earned at the end of July) | |||||

| 31 | Supplies expense (2) | 56 | 745 | ||

| Supplies | 14 | 745 | |||

| (To record supplies expense incurred at the end of the July) | |||||

| 31 | Insurance expense (3) | 57 | 225 | ||

| Prepaid insurance | 15 | 225 | |||

| (To record insurance expense incurred at the end of the July) | |||||

| 31 | Depreciation expense | 58 | 50 | ||

| Accumulated depreciation-Office equipment | 18 | 50 | |||

| (To record depreciation expense incurred at the end of the July) | |||||

| 31 | Unearned revenue (4) | 23 | 3,600 | ||

| Fees earned | 41 | 3,600 | |||

| (To record the service performed to the customer at the end of the July) | |||||

| 31 | Wages expense | 50 | 140 | ||

| Wages payable | 22 | 140 | |||

| (To record wages expense incurred at the end of the July) | |||||

Table (1)

Working notes:

1. Calculated the value of accrued fees during the July

Hence, fees earned during the July are $1,400.

2. Calculate the value of supplies expense

Hence, supplies expense during the July is $745.

3. Calculate the value of insurance expense

Hence, insurance expense during the July is $745.

4. Calculate the value of unearned fees at the end of the July

Hence, unearned fees at the end of the July are $3,600.

2.

To post: The adjusting entries to the ledger in the books of Company PS.

Explanation of Solution

Post the adjusting entries to the ledger account as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 3,920 | |||

| 1 | 1 | 5,000 | 8,920 | ||||

| 1 | 1 | 1,750 | 7,170 | ||||

| 1 | 1 | 2,700 | 4,470 | ||||

| 2 | 1 | 1,000 | 5,470 | ||||

| 3 | 1 | 7,200 | 12,670 | ||||

| 3 | 1 | 250 | 12,420 | ||||

| 4 | 1 | 900 | 11,520 | ||||

| 8 | 1 | 200 | 11,320 | ||||

| 11 | 1 | 1,000 | 12,320 | ||||

| 13 | 1 | 700 | 11,620 | ||||

| 14 | 1 | 1,200 | 10,420 | ||||

| 16 | 2 | 2,000 | 12,420 | ||||

| 21 | 2 | 620 | 11,800 | ||||

| 22 | 2 | 800 | 11,000 | ||||

| 23 | 2 | 750 | 11,750 | ||||

| 27 | 2 | 915 | 10,835 | ||||

| 28 | 2 | 1,200 | 9,635 | ||||

| 29 | 2 | 540 | 9,095 | ||||

| 30 | 2 | 500 | 9,595 | ||||

| 31 | 2 | 3,000 | 12,595 | ||||

| 31 | 2 | 1,400 | 11,195 | ||||

| 31 | 2 | 1,250 | 9,945 | ||||

Table (2)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 1,000 | |||

| 2 | 1 | 1,000 | |||||

| 23 | 2 | 1,750 | 1,750 | ||||

| 30 | 2 | 1,000 | 2,750 | ||||

| 31 | Adjusting | 3 | 1,400 | 4,150 | |||

Table (3)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 170 | |||

| 18 | 850 | 1,020 | |||||

| 31 | Adjusting | 745 | 275 | ||||

Table (4)

| Account: Prepaid Insurance Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | 1 | 2,700 | 2,700 | |||

| 31 | Adjusting | 3 | 225 | 2,475 | |||

Table (5)

| Account: Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 5 | 1 | 7,500 | 7,500 | |||

Table (6)

| Account: Accumulated Depreciation Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 250 | |||

| 3 | 1 | 250 | |||||

| 5 | 1 | 7,500 | 7,500 | ||||

| 18 | 2 | 850 | 8,350 | ||||

Table (8)

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 140 | 140 | ||

Table (9)

| Account: Unearned revenue Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | 1 | 7,200 | 7,200 | |||

| 31 | Adjusting | 3 | 3,600 | 3,600 | |||

Table (10)

| Account: P’s capital Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 4,000 | |||

| 1 | 1 | 5,000 | 9,000 | ||||

Table (11)

| Account: P’s drawings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 31 | 2 | 1,250 | 1,750 | ||||

Table (12)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 6,200 | |||

| 11 | 1 | 1,000 | 7,200 | ||||

| 16 | 2 | 2,000 | 9,200 | ||||

| 23 | 2 | 2,500 | 11,700 | ||||

| 30 | 2 | 1,500 | 13,200 | ||||

| 31 | 2 | 3,000 | 16,200 | ||||

| 31 | Adjusting | 3 | 1,400 | 17,600 | |||

| 31 | Adjusting | 3 | 3,600 | 21,200 | |||

Table (13)

| Account: Wages expense Account no. 50 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 400 | |||

| 14 | 1 | 1,200 | 1,600 | ||||

| 28 | 2 | 1,200 | 2,800 | ||||

| 31 | Adjusting | 3 | 140 | 2,940 | |||

Table (14)

| Account: Office rent expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 800 | |||

| 1 | 1 | 1,750 | 2,550 | ||||

Table (15)

| Account: Equipment rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 675 | |||

| 13 | 1 | 700 | 1,375 | ||||

Table (16)

| Account: Utilities expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 300 | |||

| 27 | 2 | 915 | 1,215 | ||||

Table (17)

| Account: Music expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 1,590 | |||

| 21 | 2 | 620 | 2,210 | ||||

| 31 | 2 | 1,400 | 3,610 | ||||

Table (18)

| Account: Advertising expense Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 8 | 1 | 200 | 700 | ||||

| 22 | 2 | 800 | 1,500 | ||||

Table (19)

| Account: Supplies expense Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 180 | |||

| 31 | Adjusting | 3 | 745 | 925 | |||

Table (20)

| Account: Insurance expense Account no. 57 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 225 | 225 | ||

Table (21)

| Account: Depreciation expense Account no. 58 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (22)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 415 | |||

| 4 | 900 | 1,315 | |||||

| 29 | 540 | 1,855 | |||||

Table (23)

3.

To prepare: An adjusted trial balance of Company PS at July 31, 2019.

Explanation of Solution

Prepare an adjusted trial balance of Company PS at July 31, 2019 as follows:

| Company PS | |||

| Adjusted Trial Balance | |||

| July 31, 2019 | |||

| Particulars | Account No. |

Debit $ | Credit $ |

| Cash | 11 | 9,945 | |

| Accounts receivable | 12 | 4,150 | |

| Supplies | 14 | 275 | |

| Prepaid insurance | 15 | 2,475 | |

| Office equipment | 17 | 7,500 | |

| Accumulated depreciation-Equipment | 18 | 50 | |

| Accounts payable | 21 | 8,350 | |

| Wages payable | 22 | 140 | |

| Unearned revenue | 23 | 3,600 | |

| P's capital | 31 | 9,000 | |

| P's drawings | 32 | 1750 | |

| Fees earned | 41 | 21,200 | |

| Wages expense | 50 | 2,940 | |

| Office rent expense | 51 | 2,550 | |

| Equipment rent expense | 52 | 1,375 | |

| Utilities expense | 53 | 1,215 | |

| Music expense | 54 | 3,610 | |

| Advertising expense | 55 | 1,500 | |

| Supplies expense | 56 | 925 | |

| Insurance expense | 57 | 225 | |

| Depreciation expense | 58 | 50 | |

| Miscellaneous expense | 59 | 1,855 | |

| 42,340 | 42,340 | ||

Table (24)

The debit column and credit column of the adjusted trial balance are agreed, both having the balance of $42,340.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial & Managerial Accounting, Loose-Leaf Version

Additional Business Textbook Solutions

Principles of Microeconomics (MindTap Course List)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Macroeconomics

Management (14th Edition)

Horngren's Accounting (12th Edition)

- This Question Solution Provide With Relevant General Accounting Subjectarrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardApplying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table. Assets, beginning Assets, end Liabilities, Liabilities, Stockholders’ Equity, (in $ millions) of year of year beginning of year end of year end of year AMD Answer 1 $4,556 $2,956 Answer 2 Answer 3 Intel $123,249 Answer 4 Answer 5 $53,400 Answer 6 b. Calculate average assets for each company. (in $ millions) Average Assets AMD Answer 7 Intel Answer 8 c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9arrow_forward

- Applying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table. Assets, beginning Assets, end Liabilities, Liabilities, Stockholders’ Equity, (in $ millions) of year of year beginning of year end of year end of year AMD Answer 1 $4,556 $2,956 Answer 2 Answer 3 Intel $123,249 Answer 4 Answer 5 $53,400 Answer 6 b. Calculate average assets for each company. (in $ millions) Average Assets AMD Answer 7 Intel Answer 8 c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9arrow_forwardFormulating Financial Statements from Raw Data and Calculating RatiosFollowing is selected financial information from JM Smucker Co. for a recent fiscal year ($ millions). Current assets, end of year $2,010.1 Noncurrent liabilities, end of year $5,962.1 Cash, end of year 169.9 Stockholders' equity, end of year 8,140.1 Cash for investing activities (355.5) Cash from operating activities 1,136.3 Cost of product sold 5,298.2 Total assets, beginning of year 16,284.2 Total liabilities, end of year 7,914.9 Revenue 7,998.9 Cash for financing activities (945.2) Total expenses, other than cost of product sold 2,069.0 Stockholders' equity, beginning of year 8,124.8 Dividends paid (418.1) Requireda. Prepare the income statement for the year. J.M. Smucker Company, Inc. Income Statement ($ millions) Answer 1 Answer 2 Answer 3 Answer 4 Answer 5 Answer 6 Answer 7 Answer 8 Answer 9 Answer 10 b. Prepare the balance sheet at the end of the year. J.M.…arrow_forwardCalculate Total Fixed Cost With General Accounting Methodarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning