a)

To determine: Earnings per share.

a)

Explanation of Solution

Calculation of EPS:

Hence, Earnings per share (EPS) is $4.20

b)

To determine: Price-to-earnings ratio.

b)

Explanation of Solution

Calculation of price-to-earnings ratio:

Hence, price earnings ratio is $7.6.

c)

To determine: Book value per share.

c)

Explanation of Solution

Calculation of book value per share:

Hence, book value per share is $16

d)

To determine: Market-to-book ratio.

d)

Explanation of Solution

Calculation of market-to-book ratio:

Hence, book value per share is $16

e)

To determine: EV-EBITDA multiple.

e)

Explanation of Solution

Calculation of EV-EBITDA multiple:

EV is nothing but the enterprise value

Calculation of enterprise value:

Hence, enterprise value is $230 million

Calculation of EBITDA:

Hence, EBITDA is $50 million

Calculation of EV-EBITDA multiple:

Hence, EV-EBITDA multiple is 4.6 times

f)

To determine: Addition to

f)

Explanation of Solution

Calculation of additions to retained earnings:

Hence, additions to retained earnings are $11million.

g)

To construct: New

g)

Explanation of Solution

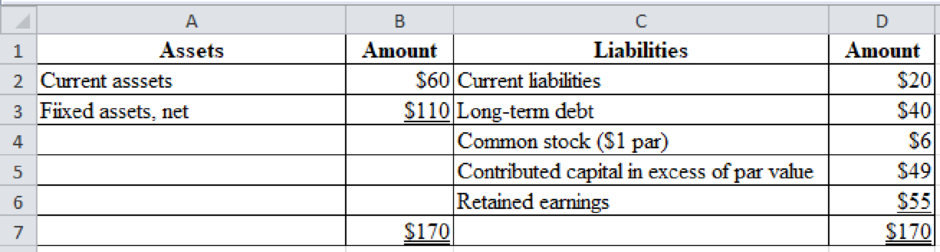

Excel spreadsheet:

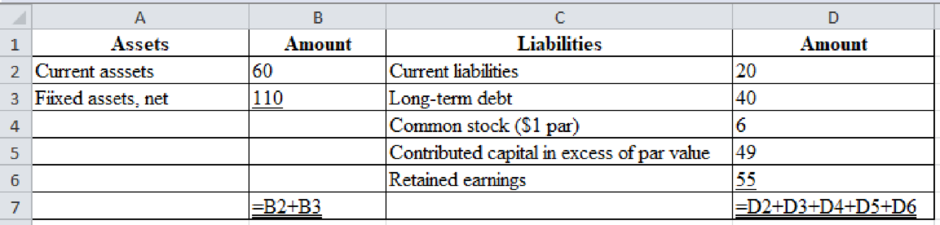

Excel workings:

Want to see more full solutions like this?

Chapter 3 Solutions

CONTEMP.FINANCIAL MGMT. (LL)-W/MINDTAP

- What are the 4 areas of finance?arrow_forwardQuestion 1 Determine the price of a zero-coupon bond that has a par value of $8000 with a maturity date in 10 years that is priced to yield 5% compounded yearly. Question 2 A bond has a face value of $10,000 and matures in 10 years. The coupon rate is 3% compounded quarterly. a) What is the amount of the dividend each quarter? b) What is the price of the bond to yield a true interest rate of 2.5% compounded quarterly? c) How much will you make if you invest in this bond? Question 5 You want to have $50,000 in 5 years. A. How much must you deposit each QUARTER in an account paying 10% compounded quarterly to reach this goal in 5 years? Round to the nearest cent. B. How much is your total contribution? Round to the nearest cent. C. How much interest did you earn for this investment? Round to the nearest cent. Question 3 The amortization schedule below is based on a $150,000, 30-year mortgage, financed at 6.01%. It has partially filled in for you. Payment…arrow_forwardHow to answer “Why” finance interview questions?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning