Concept explainers

Preparing unadjusted and adjusted trial balances, including the adjustments

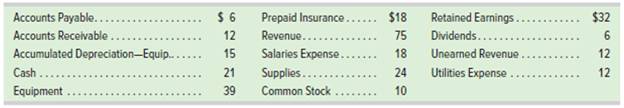

The following data are taken from the unadjusted

- Enter the accounts in proper order and enter their balances in the correct Debit or Credit column of the Unadjusted Trial Balance columns of the 10-column work sheet.

- Use the following adjustment information to complete the Adjustments columns of the work sheet from part 1.

Depreciation on equipment, $3- Accrued salaries, $6

- The $12 of unearned revenue has been earned

- Supplies available at December 31, $15

- Expired insurance, $15

- Extend the balances in the Adjusted Trial Balance columns of the work sheet to the proper financial statement columns. Compute totals for those columns, including net income.

1.

Ten Column Work Sheet:

A ten-column worksheet has five main column headings with two subheadings for debit and credit for each of those five main headings. These main headings are Unadjusted trial balance, Adjustments, Adjusted trial balance, Income statement and Balance sheet.

The complete set of financial statements can be prepared with the help of ten column worksheet.

To Prepare:

Unadjusted trial balance after determining the accounts in their proper order and entering the balances in the respective debit or credit column based onthe nature of accounts.

Explanation of Solution

| Unadjusted Trial Balance | Adjustments | Adjusted Trial Balance | Income Statement | Balance Sheet | ||||||

| Account Titles | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit |

| Cash | $21 | |||||||||

| Accounts Receivable | $12 | |||||||||

| Supplies | $24 | |||||||||

| Prepaid Insurance | $18 | |||||||||

| Equipment | $39 | |||||||||

| Accumulated Depreciation-Equipment | $15 | |||||||||

| Accounts Payable | $6 | |||||||||

| Accrued Salaries | $0 | |||||||||

| Unearned Revenue | $12 | |||||||||

| Common Stock | $10 | |||||||||

| Retained Earnings | $32 | |||||||||

| Revenue | $75 | |||||||||

| Dividends | $6 | |||||||||

| Depreciation Expense | $0 | |||||||||

| Supplies Expense | $0 | |||||||||

| Insurance Expense | $0 | |||||||||

| Salaries Expense | $18 | |||||||||

| Utilities Expense | $12 | |||||||||

| Total | $150 | $150 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Net Income | $0 | $0 | ||||||||

| $0 | $0 | $0 | $0 | |||||||

2.

Adjusting entries are passed at the end of the accounting period to determine the correct amount of revenues and expenses so that the net result can be computed therefrom.

To Complete:

Adjustment columns of the ten-column worksheet by using the adjustment entries for a through e.

Explanation of Solution

| Unadjusted Trial Balance | Adjustments | Adjusted Trial Balance | Income Statement | Balance Sheet | ||||||

| Account Titles | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit |

| Cash | $21 | |||||||||

| Accounts Receivable | $12 | |||||||||

| Supplies | $24 | $9 | ||||||||

| Prepaid Insurance | $18 | $15 | ||||||||

| Equipment | $39 | |||||||||

| Accumulated Depreciation-Equipment | $15 | $3 | ||||||||

| Accounts Payable | $6 | |||||||||

| Accrued Salaries | $0 | $6 | ||||||||

| Unearned Revenue | $12 | $12 | ||||||||

| Common Stock | $10 | |||||||||

| Retained Earnings | $32 | |||||||||

| Revenue | $75 | $12 | ||||||||

| Dividends | $6 | |||||||||

| Depreciation Expense | $0 | $3 | ||||||||

| Supplies Expense | $0 | $9 | ||||||||

| Insurance Expense | $0 | $15 | ||||||||

| Salaries Expense | $18 | $6 | ||||||||

| Utilities Expense | $12 | |||||||||

| Total | $150 | $150 | $45 | $45 | $0 | $0 | $0 | $0 | $0 | $0 |

| Net Income | $0 | $0 | ||||||||

| $0 | $0 | $0 | $0 | |||||||

3.

Adjusted trial balance is prepared after incorporating the adjusting entries to the concerned account balances.

To Complete:

The adjusted trial balances after incorporating adjusting entries, then totaling all the columns and determination of net income.

Explanation of Solution

| Unadjusted Trial Balance | Adjustments | Adjusted Trial Balance | Income Statement | Balance Sheet | ||||||

| Account Titles | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit |

| Cash | $21 | $21 | $21 | |||||||

| Accounts Receivable | $12 | $12 | $12 | |||||||

| Supplies | $24 | $9 | $15 | $15 | ||||||

| Prepaid Insurance | $18 | $15 | $3 | $3 | ||||||

| Equipment | $39 | $39 | $39 | |||||||

| Accumulated Depreciation-Equipment | $15 | $3 | $18 | $18 | ||||||

| Accounts Payable | $6 | $6 | $6 | |||||||

| Accrued Salaries | $6 | $6 | $6 | |||||||

| Unearned Revenue | $12 | $12 | $0 | $0 | ||||||

| Common Stock | $10 | $10 | $10 | |||||||

| Retained Earnings | $32 | $32 | $32 | |||||||

| Revenue | $75 | $12 | $87 | $87 | ||||||

| Dividends | $6 | $6 | ||||||||

| Depreciation Expense | $3 | $3 | $3 | |||||||

| Supplies Expense | $9 | $9 | $9 | |||||||

| Insurance Expense | $15 | $15 | $15 | |||||||

| Salaries Expense | $18 | $6 | $24 | $24 | ||||||

| Utilities Expense | $12 | $12 | $12 | |||||||

| Total | $150 | $150 | $45 | $45 | $159 | $159 | $63 | $87 | $90 | $72 |

| Net Income | $24 | $24 | ||||||||

| Dividends | $(6) | |||||||||

| $87 | $87 | $90 | $90 | |||||||

Want to see more full solutions like this?

Chapter 3 Solutions

Gen Combo Ll Financial Accounting Fundamentals; Connect Access Card

- Joe transfers land to JH Corporation for 90% of the stock in JH Corporation worth $20,000 plus a note payable to Joe in the amount of $40,000 and the assumption by JH Corporation of a mortgage on the land in the amount of $100,000. The land, which has a basis to Joe of $70,000, is worth $160,000. a. Joe will have a recognized gain on the transfer of $90,000. b. Joe will have a recognized gain on the transfer of $30,000.c. JH Corporation will have a basis in the land transferred by Joe of $70,000. d. JH Corporation will have a basis in the land transferred by Joe of $160,000. e. None of the above.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- (1) prepare the december 31 entry for bramble corporation to record amortization of intangibles. the trademark has an estimated useful life of 4 years with a residual value of $3,520arrow_forwardaccounting ?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage