Concept explainers

NET INCOME AND CHANGE IN OWNER’S EQUITY Refer to the

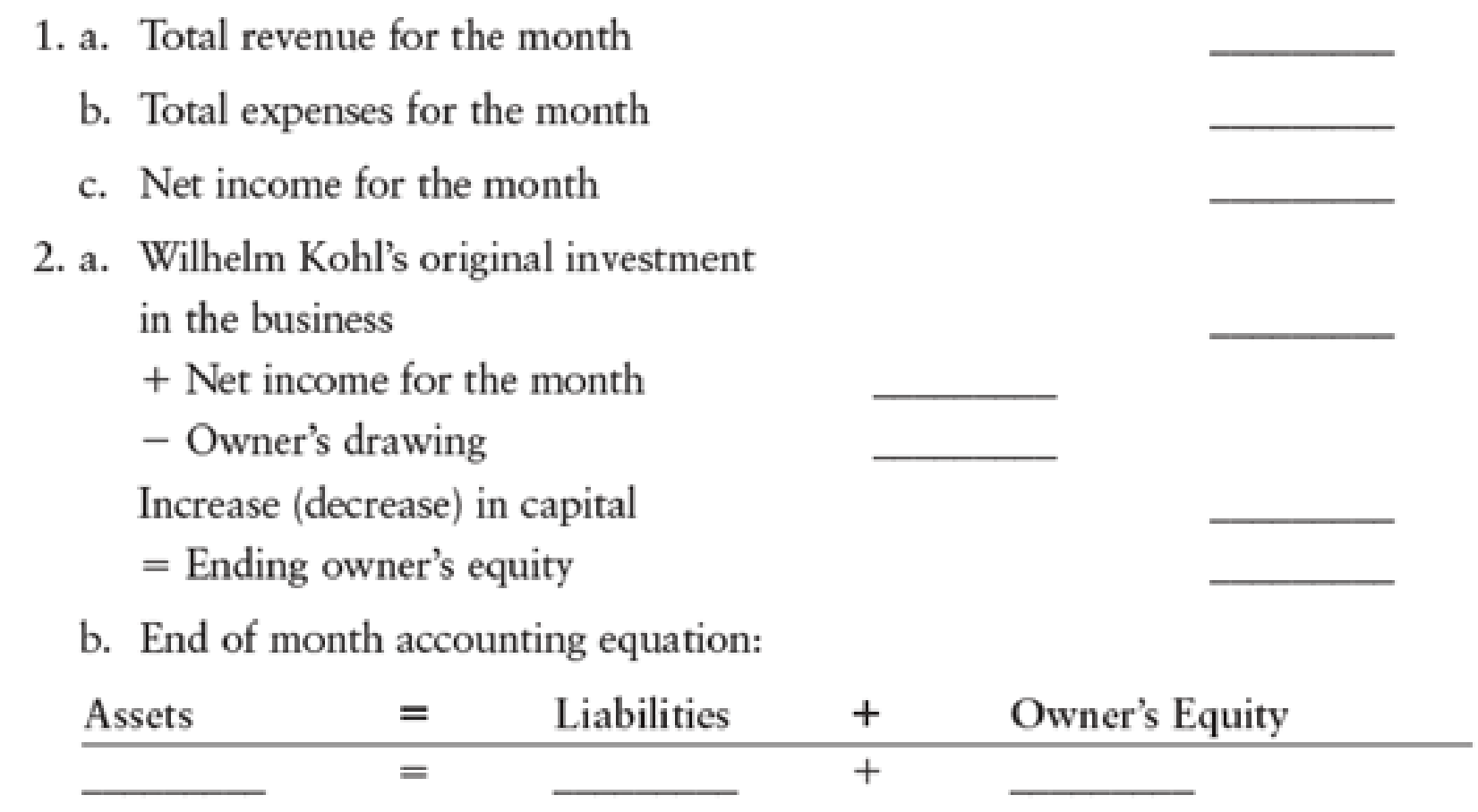

1. a

Determine the total revenue for the month of May.

Explanation of Solution

Revenue is known as “Top line” because it appears very top on the income statement of the company. It is used to imply profits or net income (bottom line) of the company by subtracting the total expenses from total revenues.

Determine the total revenue for the month of May:

Hence, the total revenue for the month of May is $15,500.

1.b

Determine the total expenses for the month of May.

Explanation of Solution

Expense is the cost borne by a company to produce and sell the goods and services to the customers. This involves outflow of cash by making a payment for an individual or company for a particular item and service.

Determine the total expenses for the month of May:

Hence, the total expense for the month of May is $2,035.

1.c

Determine the net income for the month of May.

Explanation of Solution

Net income: The bottom line of income statement which is the result of excess of earnings from operations (revenues) over the costs incurred for earning revenues (expenses) is referred to as net income.

Determine the net income for the month of May:

Hence, the net income for the month of May is $13,465.

2.a

Determine the amount of ending owner’s equity.

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and a drawing is deducted from beginning owner’s equity to arrive at the result, ending owner’s equity.

Determine the amount of ending owner’s equity:

| K Home Repair | ||

| Statement of Owner’s Equity | ||

| For Month Ended May 31, 20-- | ||

| Particulars | Amount ($) | Amount ($) |

| Invested cash in the business | 25,000 | |

| Add: Net income for May | 13,465 | |

| Less: Withdrawals for May | (2,900) | |

| Increase in capital | 10,565 | |

| Ending owner’s equity | $35,565 | |

Table (1)

2.b

Show the accounting equation for the end of month.

Explanation of Solution

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relation between resources or assets of a company and claims of resources to creditors and owners. Accounting equation is expressed as shown below:

Show the accounting equation for the end of month:

Working note:

Calculate the amount of assets:

Want to see more full solutions like this?

Chapter 3 Solutions

College Accounting - Study Guide / Working Papers 1-15

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage