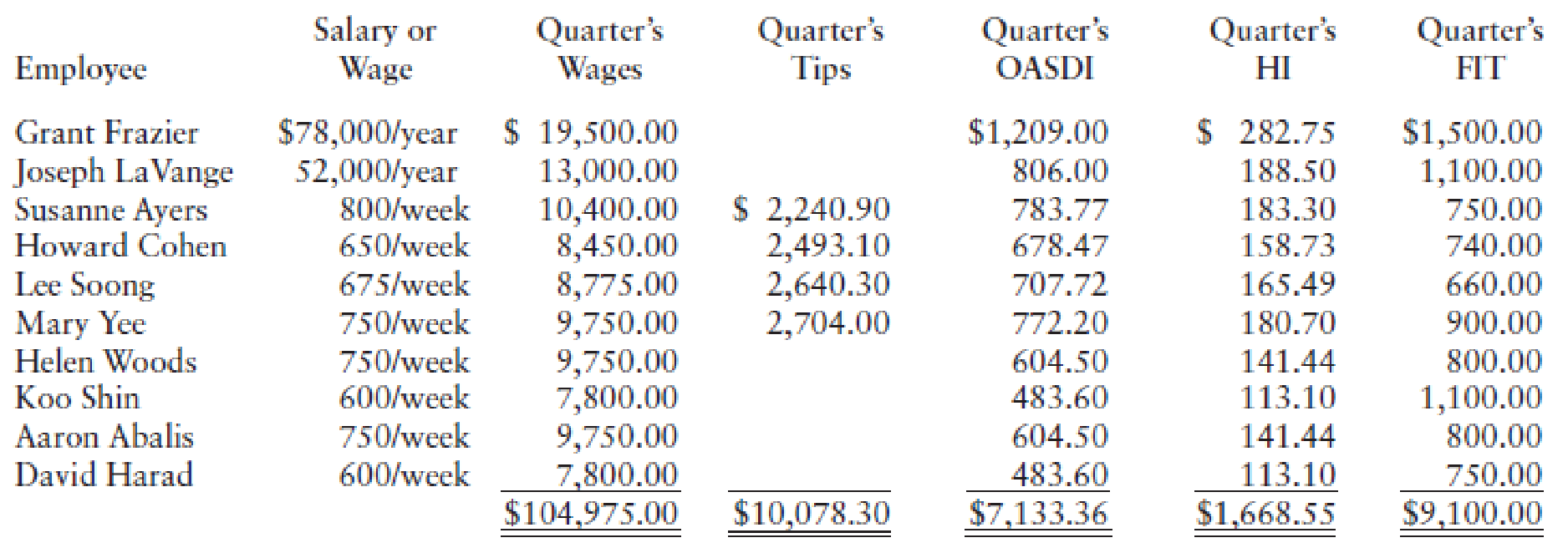

During the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees’ salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employer’s portion of FICA tax on the tips was estimated as the same amount.

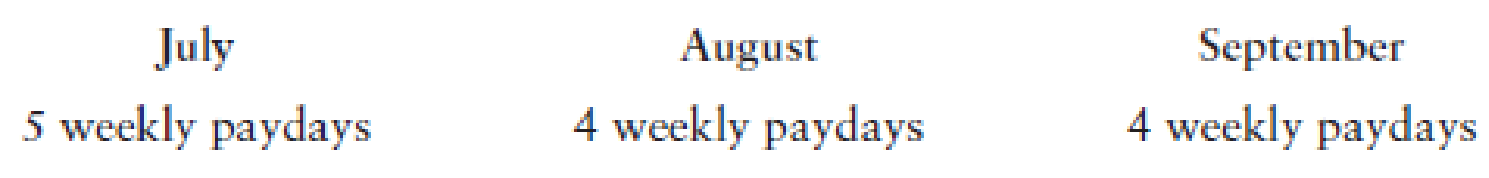

Employees are paid weekly on Friday. The following paydays occurred during this quarter:

Taxes withheld for the 13 paydays in the third quarter follow:

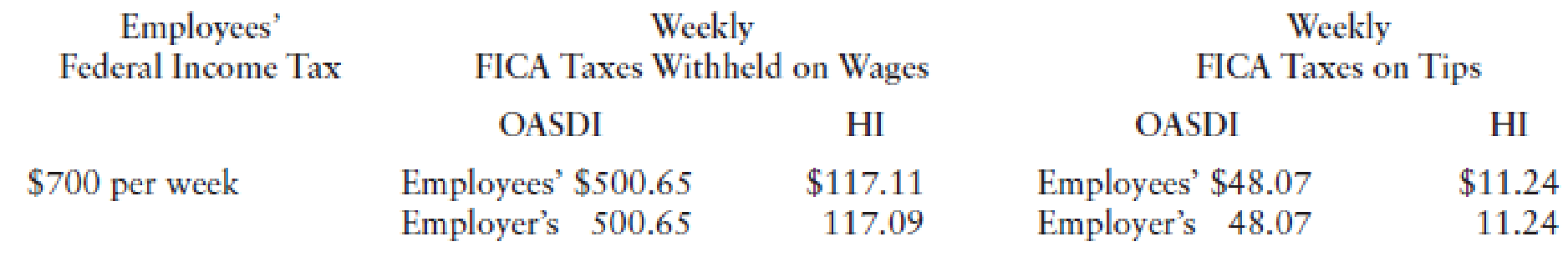

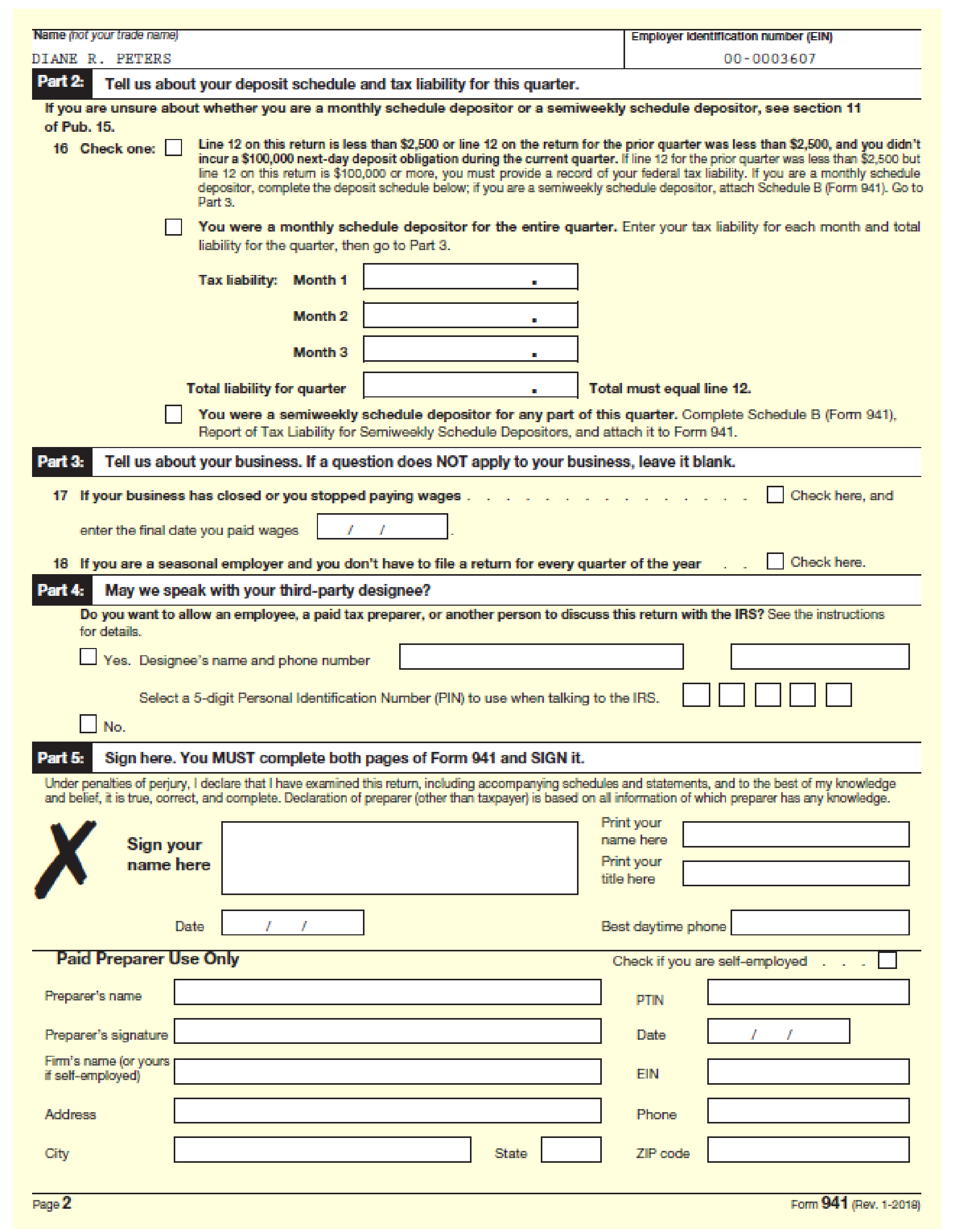

Based on the information given, complete Form 941 on the following pages for Diane R. Peters.

Phone number: (901) 555-7959

Date filed: October 31, 20--

Trending nowThis is a popular solution!

Chapter 3 Solutions

PAYROLL ACCT.,2019 ED.(LL)-W/ACCESS

- Nicholas Johnson is a single individual. He claims a standard deduction of $13,500. His salary for the year was $156,800. What is his taxable income?arrow_forwardWhat amount should Estefan report as a current liability for advances from customers in its Dec. 31, 2022, balance sheet?arrow_forwardHow many gallons will RZT budget to purchase in August?arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Please help me solve this financial accounting problem with the correct financial process.arrow_forwardDear expDon't solve if you solve with incorrect values then i will give unhelpful .arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning