College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

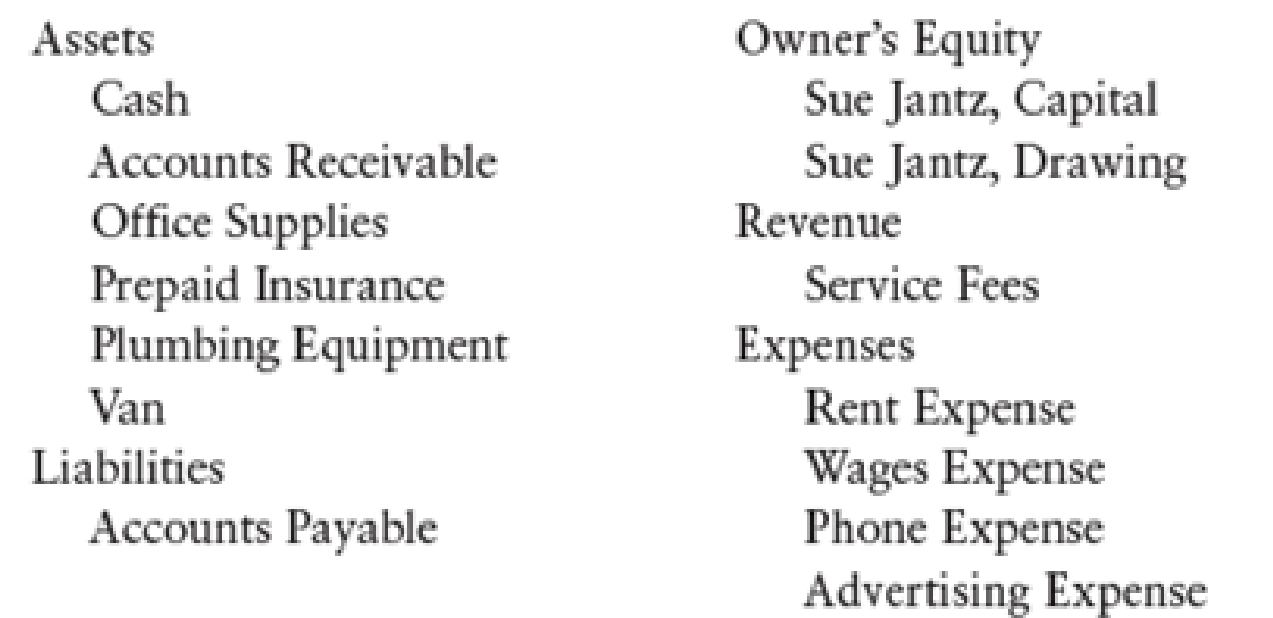

Chapter 3, Problem 13SPB

T ACCOUNTS AND

The following transacrions occurred during August:

- (a) Invested cash in the business, $30,000.

- (b) Purchased a used van for cash, $8,000.

- (c) Purchased plumbing equipment on account, $4,000.

- (d) Received cash for services rendered, $3,000.

- (e) Paid cash on account owed from transaction (c), $1,000.

- (f) Paid rent for the month, $700.

- (g) Paid phone bill, $100.

- (h) Earned revenue on account, $4,000.

- (i) Purchased office supplies for cash, $300.

- (j) Paid wages to student, $500.

- (k) Purchased a one-year insurance policy, $800.

- (l) Received cash from services performed in transaction (h), $3,000.

- (m) Paid cash for advertising expense, $2,000.

- (n) Purchased additional plumbing equipment for $2,000, paying $500 cash and spreading the remaining payments over the next six months.

- (o) Earned revenue from services for the remainder of the month of $2,800: $1,100 in cash and $1,700 on account.

- (p) Withdrew cash at the end of the month, $3,000.

REQUIRED

- 1. Enter the transactions in T accounts, identifying each transaction with its responding letter.

- 2. Foot and balance the accounts where necessary.

- 3. Prepare a trial balance as of August 31, 20--.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please explain the correct approach for solving this general accounting question.

Can you solve this general accounting question with accurate accounting calculations?

Taron Productions has the following information from its process costing system: beginning work-in-process of 4,800 units (60% complete for conversion costs), 22,500 units started during the period, and ending work-in-process of 3,900 units (40% complete for conversion costs). Using the weighted average method, what are the equivalent units for conversion costs for the period?

Chapter 3 Solutions

College Accounting, Chapters 1-27

Ch. 3 - LO3 To debit an account is to enter an amount on...Ch. 3 - Liability accounts normally have debit balances.Ch. 3 - LO3 Increases in owners equity are entered as...Ch. 3 - Prob. 4TFCh. 3 - LO3 To credit an account is to enter an amount on...Ch. 3 - LO3 A debit to an asset account will decrease it.Ch. 3 - A common example of an asset is (a) Professional...Ch. 3 - The accounting equation may be expressed as (a)...Ch. 3 - LO3 Liability, owners equity, and revenue accounts...Ch. 3 - LO4 To record the payment of rent expense, an...

Ch. 3 - Prob. 5MCCh. 3 - Foot and balance the accounts receivable T account...Ch. 3 - LO3 Complete the following questions using either...Ch. 3 - Analyze the following transaction using the T...Ch. 3 - The following accounts have normal balances....Ch. 3 - What are the three major parts of a T account?Ch. 3 - Prob. 2RQCh. 3 - What is a footing?Ch. 3 - What is the relationship between the revenue and...Ch. 3 - What is the function of the trial balance?Ch. 3 - Prob. 1SEACh. 3 - DEBIT AND CREDIT ANALYSIS Complete the following...Ch. 3 - ANALYSIS OF T ACCOUNTS Richard Gibbs began a...Ch. 3 - NORMAL BALANCE OF ACCOUNT Indicate the normal...Ch. 3 - TRANSACTION ANALYSIS Linda Kipp started a business...Ch. 3 - TRANSACTION ANALYSIS Linda Kipp starred a business...Ch. 3 - ANALYSIS OF TRANSACTIONS Charles Chadwick opened a...Ch. 3 - ANALYSIS OF TRANSACTIONS Charles Chadwick opened a...Ch. 3 - TRIAL BALANCE The following accounts have normal...Ch. 3 - Provided below is a trial balance for Juanitas...Ch. 3 - Provided below is a trial balance for Juanitas...Ch. 3 - Provided below is a trial balance for Juanitas...Ch. 3 - T ACCOUNTS AND TRIAL BALANCE Wilhelm Kohl started...Ch. 3 - NET INCOME AND CHANGE IN OWNERS EQUITY Refer to...Ch. 3 - FINANCIAL STATEMENTS Refer to the trial balance in...Ch. 3 - FOOT AND BALANCE A T ACCOUNT Foot and balance the...Ch. 3 - DEBIT AND CREDIT ANALYSIS Complete the following...Ch. 3 - ANALYSIS OF T ACCOUNTS Roberto Alvarez began a...Ch. 3 - NORMAL BALANCE OF ACCOUNT Indicate the normal...Ch. 3 - TRANSACTION ANALYSIS George Atlas started a...Ch. 3 - TRANSACTION ANALYSIS George Atlas started a...Ch. 3 - ANALYSIS OF TRANSACTIONS Nicole Lawrence opened a...Ch. 3 - ANALYSIS OF TRANSACTIONS Nicole Lawrence opened a...Ch. 3 - TRIAL BALANCE The following accounts have normal...Ch. 3 - Provided below is a trial balance for Bills...Ch. 3 - Provided below is a trial balance for Bills...Ch. 3 - Provided below is a trial balance for Bills...Ch. 3 - T ACCOUNTS AND TRIAL BALANCE Sue Jantz started a...Ch. 3 - NET INCOME AND CHANGE IN OWNERS EQUITY Refer to...Ch. 3 - FINANCIAL STATEMENTS Refer to the trial balance in...Ch. 3 - Craig Fisher started a lawn service called Craigs...Ch. 3 - Your friend Chris Stevick started a part-time...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardAnswerarrow_forwardReliable Production company has a beginning finished goods inventory of $24,500, raw material purchases of $31,200, cost of goods manufactured of $42,800, and an ending finished goods inventory of $27,300. The cost of goods sold for this company is?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY