Concept explainers

a

Prepare the necessary journal entries and post to the ledger accounts.

a

Explanation of Solution

Prepare the journal entries in the books of Corporation B.

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| December 1 | Cash (A+) | 35,000 | |

| Common stock (E+) | 35,000 | ||

| (To record the issuance of common stock) | |||

| December 2 | Rent expenses (E-) | 1,200 | |

| Cash(A-) | 1,200 | ||

| (To record the rent expense) | |||

| December 3 | Advertising expense (E-) | 750 | |

| Accounts payable (L+) | 750 | ||

| (To record the purchase of T-shirt on account) | |||

| December 4 | Accounts payable (L-) | 750 | |

| Cash (A-) | 750 | ||

| (To record the accounts payable) | |||

| December 5 | Cash (A+) | 4,500 | |

| Wanted ad revenue (E+) | 4,500 | ||

| (To record the wanted ad revenue) | |||

| December 6 | Delivery expense (E-) | 910 | |

| Cash (A-) | 910 | ||

| (To record the delivery expense) | |||

| December 7 | 5,600 | ||

| Advertising revenue (E+) | 5,600 | ||

| (To record the advertising revenue) | |||

| December 8 | Delivery expense (E-) | 50 | |

| Cash (A-) | 50 | ||

| (To record the delivery expense) | |||

| December 9 | Printing expense(E-) | 2,900 | |

| Cash (A-) | 2,900 | ||

| (To record the printing expense) | |||

| December 10 | Cash (A+) | 2,570 | |

| Wanted Ad revenue (E+) | 2,570 | ||

| (To record the wanted Ad revenue) | |||

| December 11 | Utilities expense (E-) | 610 | |

| Accounts payable (L+) | 610 | ||

| (To record the utilities expense) | |||

| December 12 | Printing expense (E-) | 2,900 | |

| Cash (A-) | 2,900 | ||

| (To record the printing expense) | |||

| December 13 | Salaries expense (E-) | 4,100 | |

| Cash(A-) | 4,100 | ||

| (To record the salaries expense) | |||

| December 14 | Accounts receivable (A+) | 8,850 | |

| Advertising revenue (E+) | 8,850 | ||

| (To record the advertising revenue) | |||

| December 15 | Delivery expense (E-) | 930 | |

| Cash (A-) | 930 | ||

| (To record the delivery expense for bulk mailing) | |||

| December 16 | Delivery expense (E-) | 350 | |

| Cash (A-) | 350 | ||

| (To record the delivery expense for courier service) | |||

| December 17 | Cash(A+) | 5,100 | |

| Accounts receivable (A-) | 5,100 | ||

| (To record the collection of accounts receivable) | |||

| December 18 | Office equipment (A+) | 1,400 | |

| Notes payable(L+) | 1,400 | ||

| (To record the purchase of office equipment) |

Table (1)

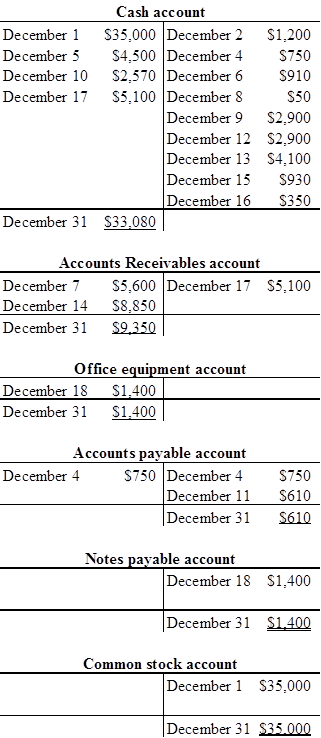

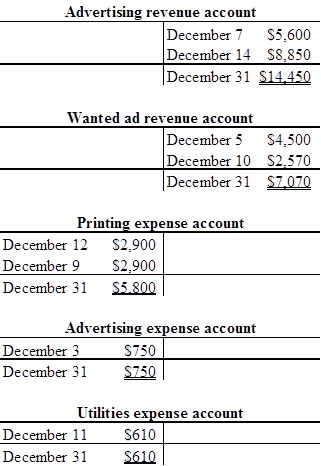

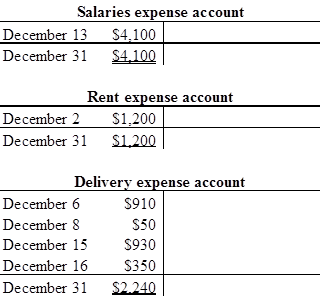

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Prepare the T-accounts:

b.

Prepare an unadjusted

b.

Explanation of Solution

Trial balance:

Trial balance is the summary of accounts, and their debit and credit balances at a given time. It is usually prepared at end of the accounting period. Debit balances are listed in left column and credit balances are listed in right column. The totals of debit and credit column should be equal. Trial balance is useful in the preparation of the financial statements.

Prepare the trial balance as of 31st December.

| Company B | ||

| Trial Balance | ||

| December 31 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | 33,080 | |

| Accounts receivable | 9,350 | |

| Office equipment | 1,400 | |

| Printing Expense | 5,800 | |

| Advertising expense | 750 | |

| Utilities expense | 610 | |

| Salaries expense | 4,100 | |

| Rent expense | 1,200 | |

| Delivery expense | 2,240 | |

| Advertising revenue | 14,450 | |

| Wanted AD Revenue | 7,070 | |

| Notes payable | 1,400 | |

| Accounts payable | 610 | |

| Common stock | 35,000 | |

| Total | 58,350 | 58,350 |

Table (2)

The debit column and credit column of the trial balance are agreed, both having balance of $58,530

c.

Prepare the income statement for the month of December.

c.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the year ended December 31.

|

Company B Income statement For the year ended December 31 | ||

| Details | Amount ($) | Amount ($) |

| Revenues: | ||

| Advertising revenue | 14,450 | |

| Wanted Ad revenue | 7,070 | |

| Total revenue | 21520 | |

| Less: Expenses | ||

| Printing Expense | 5,800 | |

| Advertising expense | 750 | |

| utilities expense | 610 | |

| Salaries expense | 4,100 | |

| Rent expense | 1,200 | |

| Delivery expense | 2,240 | |

| Total Expenses | (14,700) | |

| Net Income | 6,820 | |

Table (2)

d.

Prepare the

d.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (

Prepare a balance sheet of Company B.

|

Company B Balance Sheet As on December 31 | ||

| ASSETS | Amount($) | Amount($) |

| Current Assets: | ||

| Cash | 33,080 | |

| Account receivable | 9,350 | |

| Total Current Assets | 42,430 | |

| Office Equipment | 1,400 | |

| Total Assets | 43,830 | |

| LIABILITIES | ||

| Accounts payable | 610 | |

| Notes payable | 1,400 | |

| Total liabilities | 2,010 | |

| Stockholders’ equity | ||

| Common stock | 35,000 | |

| 6,820 | ||

| Total Stockholders’ Equity | 41,820 | |

| Total Liabilities and Stockholders’ Equity | 43,830 | |

Table (4)

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting for Undergr. -Text Only (Instructor's)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education