Concept explainers

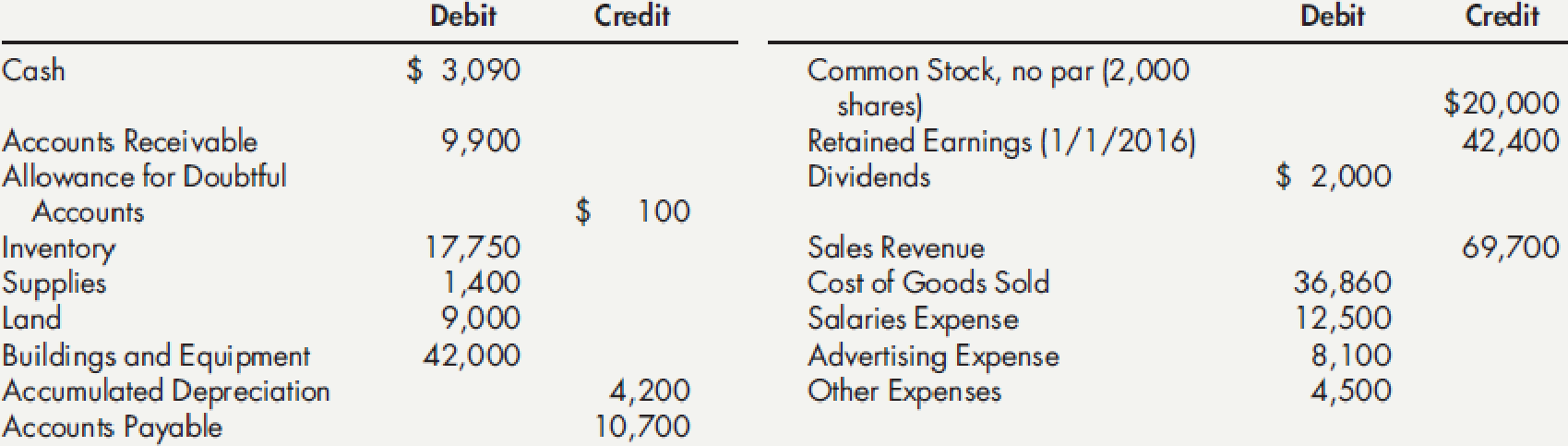

Comprehensive On November 30, 2016, Davis Company had the following account balances:

During the month of December, Davis entered into the following transactions:

Required:

- 1. Prepare general

journal entries to record the preceding transactions. - 2. Post to general ledger T-accounts.

- 3. Prepare a year-end

trial balance on a worksheet and complete the worksheet using the following information: (a) accrued salaries at year-end total $1,200; (b) for simplicity, the building and equipment are beingdepreciated using the straight-line method over an estimated life of 20 years with no residual value; (c) supplies on hand at the end of the year total $630; (d)bad debts expense for the year totals $830; and (e) the income tax rate is 30%; income taxes are payable in the first quarter of 2017. - 4. Prepare the company’s financial statements for 2016.

- 5. Prepare the 2016 (a) adjusting and (b) closing entries in the general journal.

1.

Prepare the journal entries to record the given transactions.

Explanation of Solution

Accounting rules for journal entries:

- To record the increase of balance in account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record the decrease of balance in account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Prepare the journal entries to record the given transactions:

| Date | Account Title and Explanation | Debit($) | Credit($) |

| December 4 | Cash | 3,000 | |

| Sales Revenue | 3,000 | ||

| (To record the cash sales) | |||

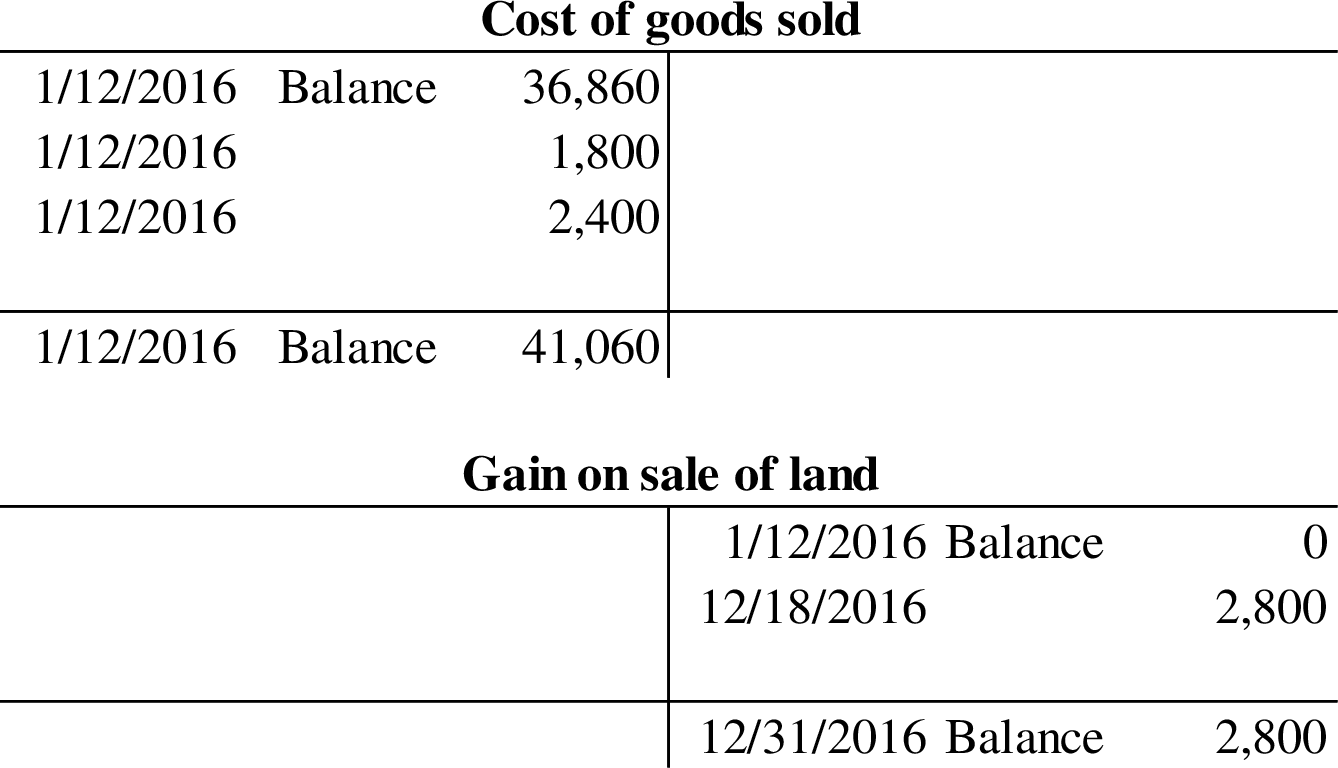

| December 4 | Cost of Goods Sold | 1,800 | |

| Inventory | 1,800 | ||

| (To record the cost of ale) | |||

| December 7 | Inventory | 2,400 | |

| Accounts Payable | 2,400 | ||

| (To record the purchase of inventory on account) | |||

| December 14 | Cash | 900 | |

| Accounts Receivable | 900 | ||

| (To record amount of accounts receivable collected) | |||

| December 18 | Cash | 7,800 | |

| Gain on sale of land | 2,800 | ||

| Land | 5,000 | ||

| (To record the gain on sale of land) | |||

| December 20 | Accounts Receivable | 4,000 | |

| Sales Revenue | 4,000 | ||

| (To record the credit sales) | |||

| December 20 | Cost of goods sold | 2,400 | |

| Inventory | 2,400 | ||

| (To record the cost of goods sold) | |||

| December 21 | Accounts Payable | 360 | |

| Inventory | 360 | ||

| (To record the returned defective merchandise for credit) | |||

| December 27 | Inventory | 1,250 | |

| Cash | 1,250 | ||

| (To record purchased inventory for cash) | |||

| December 28 | Accounts payable | 1,100 | |

| Cash | 1,100 | ||

| (To record accounts payable amount paid) | |||

| December 31 | Land | 6,000 | |

| Cash | 1,000 | ||

| Notes Payable | 5,000 | ||

| (To record the purchase of land by paying cash and issuing 12% of note) |

Table (1)

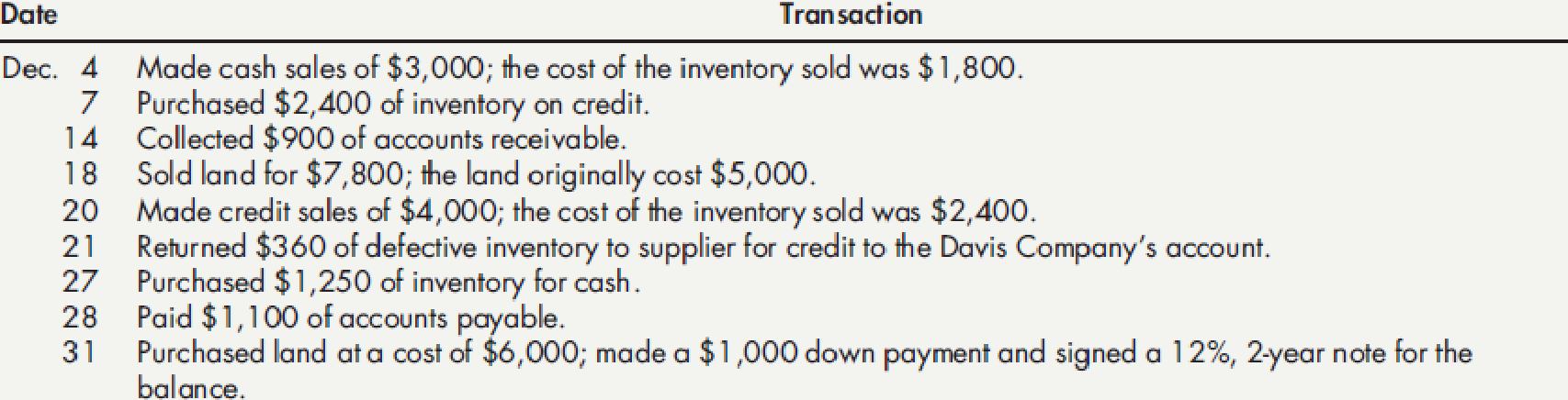

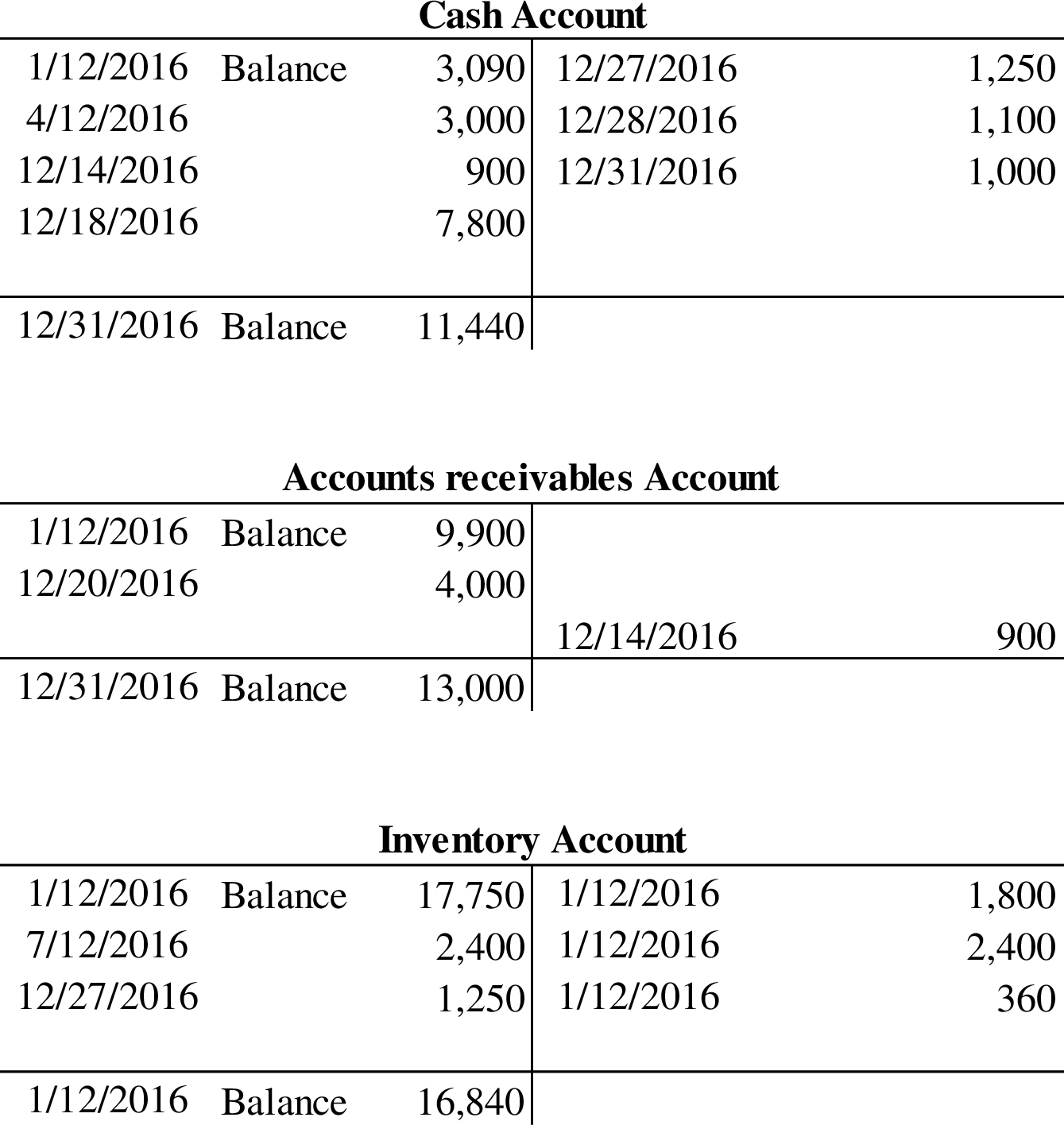

2.

Post the part 1 entries to general ledger T-Accounts.

Explanation of Solution

T-account: T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

Post the part 1 entries to general ledger T-Accounts:

3.

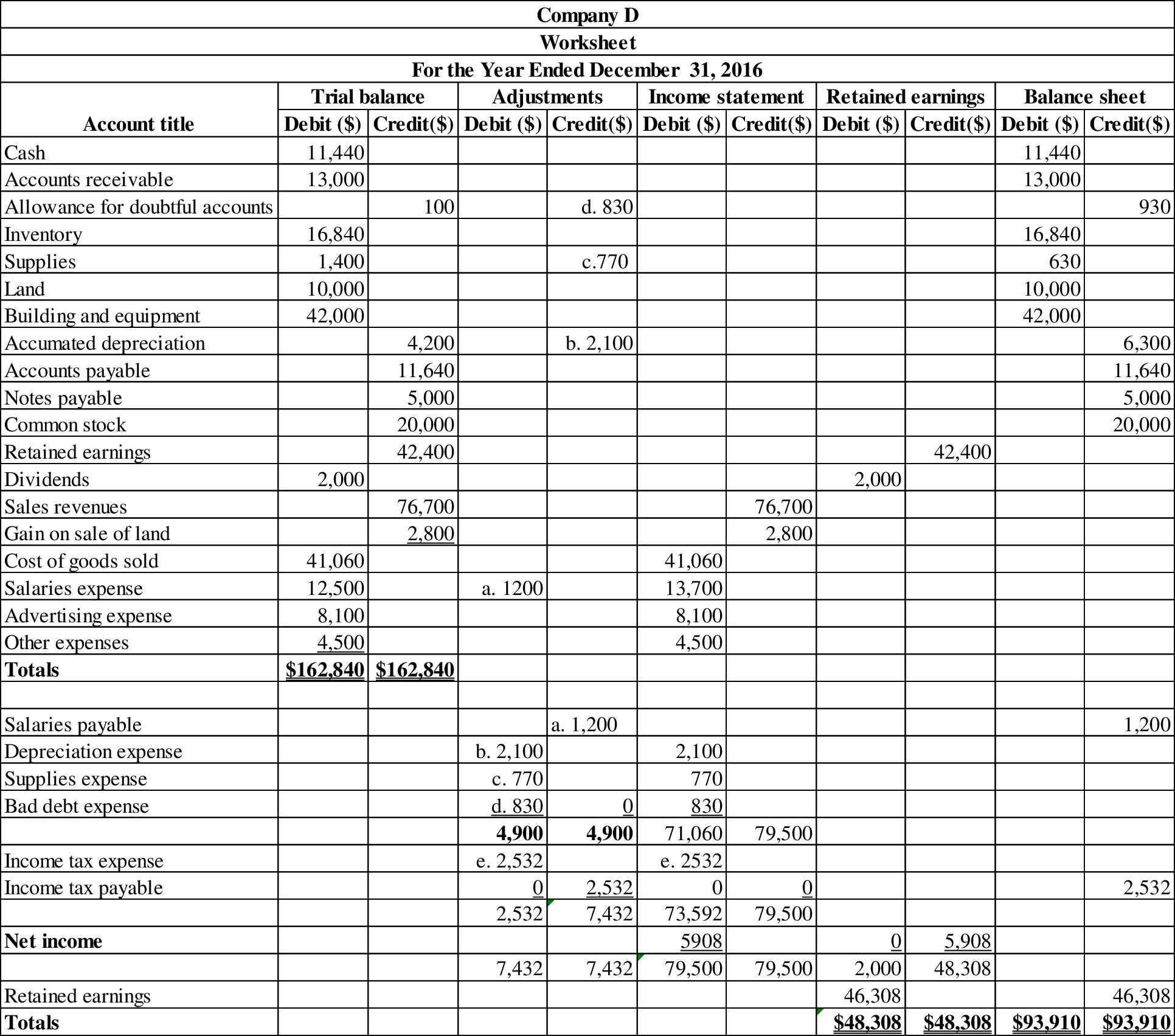

Prepare the worksheet with the given information.

Explanation of Solution

Prepare the worksheet with the given information:

Worksheet: A worksheet is a tool that is used while preparing a financial statement. It is a type of form, having multiple columns and it is used in the adjustment process.

Table (2)

4.

Prepare the financial statements of Company D.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare income statement:

| Company D | ||

| Income statement | ||

| For the Year Ended December 31, 2016 | ||

| Particulars | Amount($) | Amount($) |

| Sales revenue | 76,700 | |

| Less: Cost of goods sold | (41,060) | |

| Gross profit | 35,640 | |

| Less: Operating expenses: | ||

| Salaries expense | 13,700 | |

| Advertising expense | 8,100 | |

| Depreciation expense | 2,100 | |

| Supplies expense | 770 | |

| Bad debt expense | 830 | |

| Other expenses | 4,500 | |

| Total operating expense | (30,000) | |

| Income from operations | 5,640 | |

| Other items: | ||

| Gain on sale of land | 2,800 | |

| Income before income taxes | 8,440 | |

| Less: Income tax expense | (2,532) | |

| Net income | $5,908 | |

| Earnings per share | $2.95 | |

Table (3)

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare statement of retained earnings:

| D Company | ||

| Statement of Retained Earnings | ||

| For the Year Ended December 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, January 1, 2016 | 42,400 | |

| Add: Net income | 5,908 | |

| Subtotal | 48,308 | |

| Less: Dividends | (2,000) | |

| Retained earnings at December 31, 2016 | $46,308 | |

Table (4)

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet:

| Company D | ||

| Balance Sheet | ||

| At December 31, 2016 | ||

| Assets | ||

| Current assets: | Amount ($) | Amount ($) |

| Cash | 11,440 | |

| Accounts receivable | 13,000 | |

| Less: Allowance for doubt accounts | (930) | 12,070 |

| Inventory | 16,840 | |

| Supplies | 630 | |

| Total current assets | 40,980 | |

| Property, plant and equipment: | ||

| Land | 10,000 | |

| Building and equipment | 42,000 | |

| Less: Accumulated depreciation | (6,300) | 35,700 |

| Net property, plant and equipment | 45,700 | |

| Total assets | $86,680 | |

| Liabilities | ||

| Current liabilities: | ||

| Accounts payable | 11,640 | |

| Salaries payable | 1,200 | |

| Income taxes payable | 2,532 | |

| Total liabilities | ||

| Long-term liabilities: | 15,372 | |

| Notes payable due 31/12/18 | 5,000 | |

| Shareholders’ Equity | ||

| Contributed Capital: | ||

| Common stock | 20,000 | |

| Retained earnings | 46,308 | |

| Total shareholders’ equity | 66,308 | |

| Total liabilities and shareholders’ equity | $86,680 | |

Table (5)

5 (a)

Prepare adjusting entries for the year 2016.

Explanation of Solution

Adjusting entries: Adjusting entries are the journal entries which are recorded at the end of the accounting period to correct or adjust the revenue and expense accounts, to concede with the accrual principle of accounting.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare adjusting entries for the year 2016:

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| 2016 | Salaries Expense | 1,200 | |

| December 31 | Salaries Payable | 1,200 | |

| (To record the amount of accrued salaries for the period) | |||

| 2016 | Depreciation Expense | 2,100 | |

| December 31 | Accumulated Depreciation - Building and Equipment | 2,100 | |

| (To record the amount of depreciation expense for the period) | |||

| 2016 | Supplies Expense | 770 | |

| December 31 | Supplies | 770 | |

| (To record the amount of supplies used during the period) | |||

| 2016 | Bad debt expense | 830 | |

| December 31 | Allowance for Doubtful Accounts | 830 | |

| (To record the bad debt expense for the period) | |||

| 2016 | Income Tax Expense | 2,532 | |

| December 31 | Income Tax Payable | 2,532 | |

| (To record the income tax liability on earnings |

Table (6)

5 (b)

Prepare the closing entries for December 31, 2016.

Explanation of Solution

Closing entries: Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts such as revenues account, expenses account and dividend account to the retained earnings account. Closing entries produce a zero balance in each temporary account.

Prepare the closing entries for December 31, 2016.

| Date | Accounts title and explanation | Debit | Credit |

| ($) | ($) | ||

| December 31, 2016 | Sales Revenue | 76,700 | |

| Gain on Sale of Land | 2,800 | ||

| Income Summary | 79,500 | ||

| (To close the revenue accounts) | |||

|

December 31, 2016 | Income Summary | 73,592 | |

| Cost of Goods Sold | 41,060 | ||

| Salaries Expense | 13,700 | ||

| Advertising Expense | 8,100 | ||

| Depreciation Expense | 2,100 | ||

| Supplies Expense | 770 | ||

| Bad Debt Expense | 830 | ||

| Other Expense | 4,500 | ||

| Income Tax Expense | 2,532 | ||

| (To close the expense accounts) | |||

| December 31, 2016 | Income Summary | 5,908 | |

| Retained Earnings | 5,908 | ||

| (To close the income summary account) | |||

| December 31, 2016 | Retained Earnings | 2,000 | |

| Dividends | 2,000 | ||

| (To close the dividends account) |

Table (7)

Want to see more full solutions like this?

Chapter 3 Solutions

Intermediate Accounting: Reporting and Analysis, 2017 Update

- need help this questions account subjectarrow_forwardaccount questionsarrow_forwardcompared to the individual risks of constituting assets. Question 5 (6 marks) The common shares of Almond Beach Inc, have a beta of 0.75, offer a return of 9%, and have an historical standard deviation of return of 17%. Alternatively, the common shares of Palm Beach Inc. have a beta of 1.25, offer a return of 10%, and have an historical standard deviation of return of 13%. Both firms have a marginal tax rate of 37%. The risk-free rate of return is 3% and the expected rate of return on the market portfolio is 9½%. 1. Which company would a well-diversified investor prefer to invest in? Explain why and show all calculations. 2. Which company Would an investor who can invest in the shares of only one firm prefer to invest in? Explain why. RELEASED BY THE CI, MGMT2023, MARCH 2, 2025 5 Use the following template to organize and present your results: Theoretical CAPM Actual offered prediction for expected return (%) return (%) Standard deviation of return (%) Beta Almond Beach Inc. Palm Beach…arrow_forward

- provide correct answerarrow_forwardPlease solve. The screen print is kind of split. Please look carefully.arrow_forwardCoronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forward

- Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardThe completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forwardPlease given step by step explanation general accounting questionarrow_forward

Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning