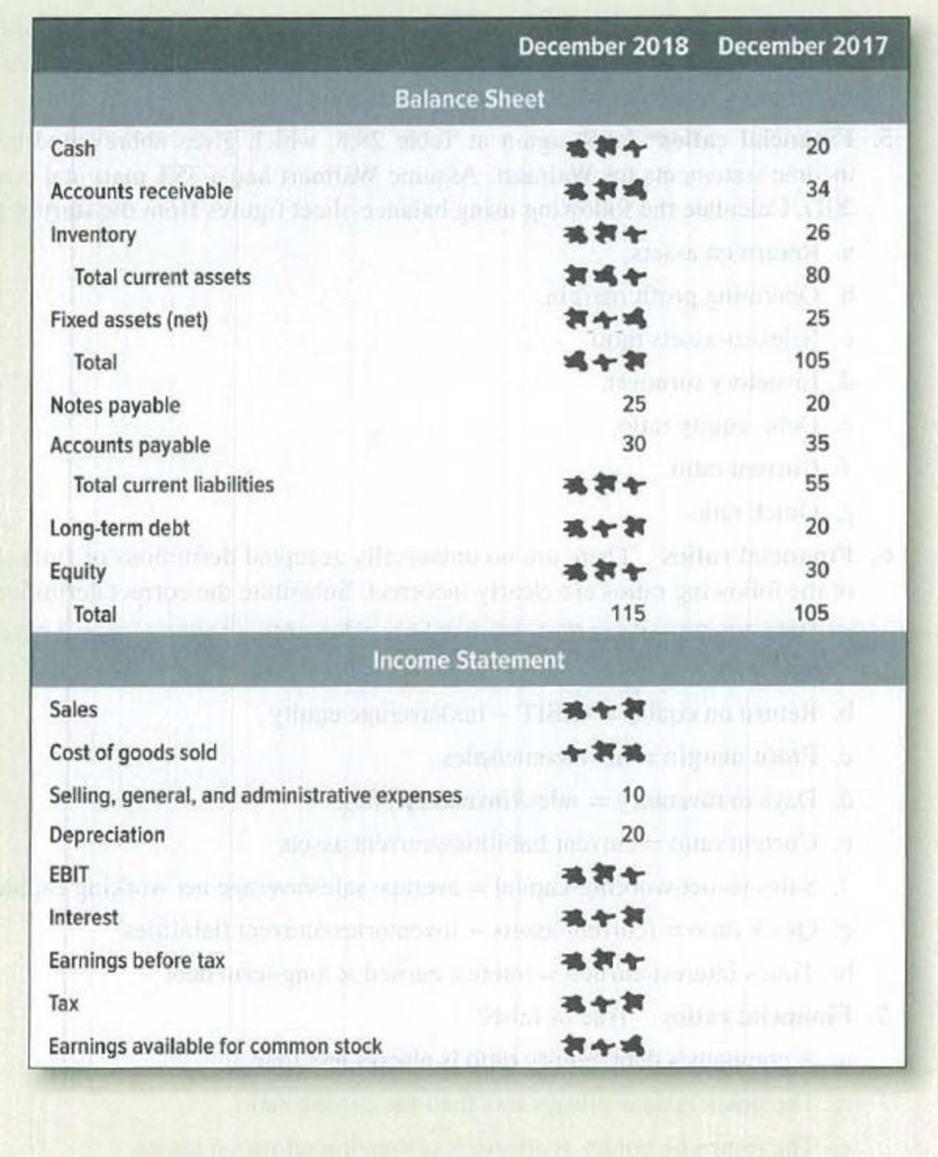

Financial ratios* As you can see, someone has spilled ink over some of the entries in the

- Long-term debt ratio: .4.

- Times-interest-earned: 8.0.

- Current ratio: 1.4.

- Quick ratio: 1.0.

- Cash ratio: .2.

- Inventory turnover: 5.0.

- Receivables collection period: 73 days. Tax rate = .4.

To determine: Various financial ratios to complete the balance sheet.

Explanation of Solution

Given information:

Long term debt ratio is 0.4

Times-interest earned is 8.0

Current ratio is 1.4

Cash ratio is 0.2

Inventory turnover ratio is 5.0

Tax rate is 0.40

Quick ratio is 1.0

Calculation of financial ratios:

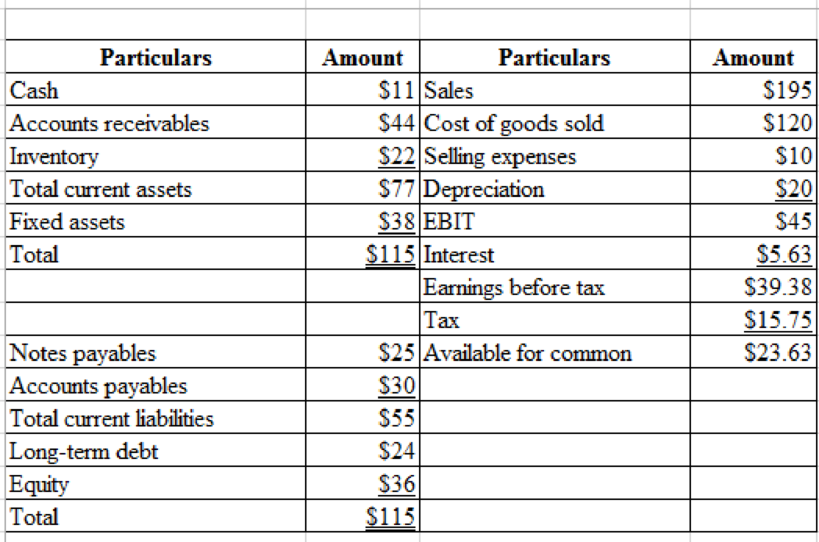

Therefore, total assets is $115

Therefore, total current liabilities is $55

Therefore, total current assets is $77

Hence, cash is $11

Therefore, accounts receivables is $44

Therefore, inventory is $22

Therefore, fixed assets are $38

Therefore, long-term debt and equity is $60

Therefore, long-term debt is $24

Therefore, equity is $36

For completing the balance sheet the following ratios are needed,

Therefore, average inventory is $24

Therefore, Cost of goods sold is $120

Therefore, average receivables is $39

Therefore, sales is $195

Therefore, EBIT is $45.

Therefore, interest is $5.625

Therefore, interest is $39.375

Therefore, tax is $15.75

Therefore, company balance sheet is as follows,

Want to see more full solutions like this?

Chapter 28 Solutions

Gen Combo Looseleaf Principles Of Corporate Finance With Connect Access Card

- 4. A company has $100,000 in assets and $50,000 in liabilities. What is its equity? Need a helpful..???arrow_forward4. A company has a debt-to-equity ratio of 1:2. If debt is $200,000, what is equity?arrow_forward9. If a company's current ratio is 2 and its current liabilities are $50,000, what are its current assets?no chatgpt???arrow_forward

- 5. Calculate the return on equity (ROE) for a company with net income $150,000 and equity $750,000.arrow_forward6. What is the price of a bond with face value $1,000, coupon rate 8%, and market interest rate 10%?arrow_forward9. A company has fixed costs $50,000, variable costs $10/unit, and sells products at $20/unit. What is the break-even point?arrow_forward

- 8. Calculate the weighted average cost of capital (WACC) for a company with 60% equity (cost 12%) and 40% debt (cost 8%). no gpt ..???arrow_forward8. Calculate the weighted average cost of capital (WACC) for a company with 60% equity (cost 12%) and 40% debt (cost 8%). Need a helpful..??arrow_forward3. If a company's net income is $100,000 and it has 10,000 shares outstanding, what is the earnings per share (EPS)? Correctly answer..???arrow_forward

- 10. If a stock's dividend yield is 5% and stock price is $100, what is the annual dividend payment? no gpt..???arrow_forward8. A stock has a beta of 1.2 and the market return is 10%. If the risk-free rate is 2%, what is the expected return? need a ai ..???arrow_forwardA corporation buys on terms of 2/8, net 45 days, it does not take discountes, and it actually pays after 62 days, what is the effective annual percentage cost of its non-free trade credit? Use a 365-day year) keep to the 6th decimal place for accuracyarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education