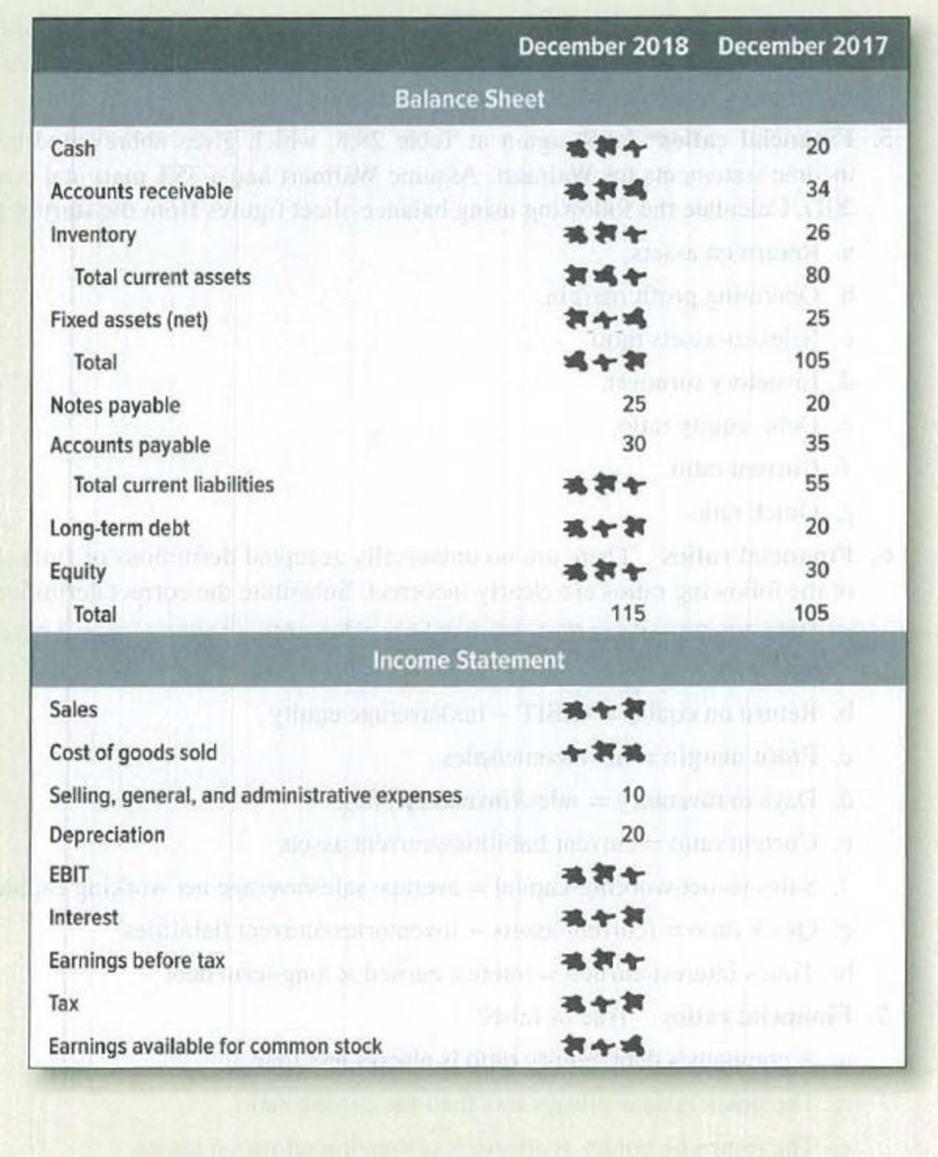

Financial ratios* As you can see, someone has spilled ink over some of the entries in the

- Long-term debt ratio: .4.

- Times-interest-earned: 8.0.

- Current ratio: 1.4.

- Quick ratio: 1.0.

- Cash ratio: .2.

- Inventory turnover: 5.0.

- Receivables collection period: 73 days. Tax rate = .4.

To determine: Various financial ratios to complete the balance sheet.

Explanation of Solution

Given information:

Long term debt ratio is 0.4

Times-interest earned is 8.0

Current ratio is 1.4

Cash ratio is 0.2

Inventory turnover ratio is 5.0

Tax rate is 0.40

Quick ratio is 1.0

Calculation of financial ratios:

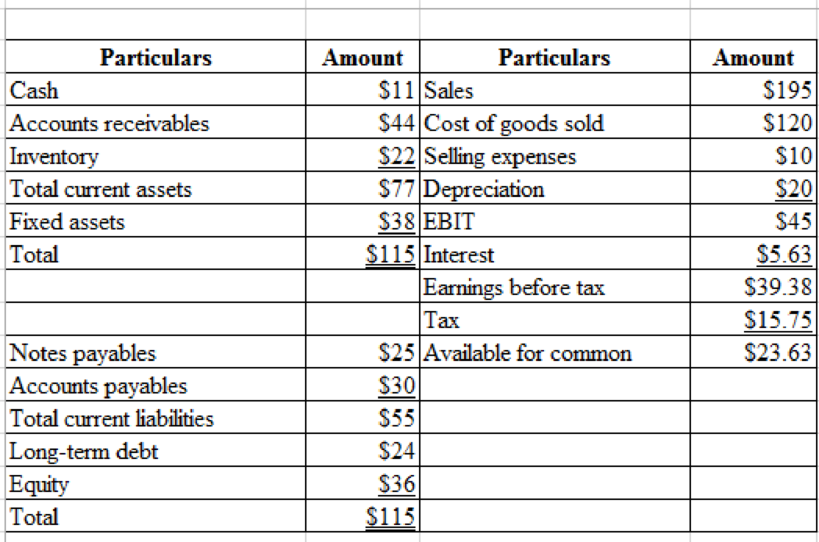

Therefore, total assets is $115

Therefore, total current liabilities is $55

Therefore, total current assets is $77

Hence, cash is $11

Therefore, accounts receivables is $44

Therefore, inventory is $22

Therefore, fixed assets are $38

Therefore, long-term debt and equity is $60

Therefore, long-term debt is $24

Therefore, equity is $36

For completing the balance sheet the following ratios are needed,

Therefore, average inventory is $24

Therefore, Cost of goods sold is $120

Therefore, average receivables is $39

Therefore, sales is $195

Therefore, EBIT is $45.

Therefore, interest is $5.625

Therefore, interest is $39.375

Therefore, tax is $15.75

Therefore, company balance sheet is as follows,

Want to see more full solutions like this?

Chapter 28 Solutions

PRIN.OF CORPORATE FINANCE

- Mr. Siya, the Chief Financial officer at WXZY Limited has noticed an increase in the company's stock returns variation over the last two financial years. He is interested in understanding the underlying influences on the company's stock returns. You have been tasked to perform a linear regression to understand whether the company's profit margins (independent variable) impact its stock returns. You have been provided with data for both the company's average monthly stock returns and profit margins over a 6-month period in 2022. Month July August September October November December Profit margins (x) Stock returns (y) 0.0263 0.0618 0.0389 0.1156 0.0158 0.0534 0.0461 0.1610 0.0030 0.0395 0.0393 0.1031 a) Calculate both the slope coefficient of the regression. b) Calculate the intercept of the regression. c) Calculate the unexplained/unexpected variation of the regression. d) Calculate the coefficient of determination. 6000 (2) (5) (3)arrow_forwardDo not answer wit incorrect values i will unhelpful!arrow_forwardWhat are the implications of missing a credit card payment in finance?arrow_forward

- Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows: Base price level 100 Current U.S. price level 105 Current South African price level 111 Base rand spot exchange rate $ 0.188 Current rand spot exchange rate $ 0.171 Expected annual U.S. inflation 7% Expected annual South African inflation 5% Expected U.S. one-year interest rate 10% Expected South African one-year interest rate 8% Required: a. The current ZAR spot rate in USD that would have been forecast by PPP.Note: Do not round intermediate calculations. Round your answer to 4 decimal places. b. Using the IFE, the expected ZAR spot rate in USD one year from now.Note: Do not round intermediate calculations. Round your answer to 4 decimal places. c. Using PPP, the expected ZAR spot rate in USD four years from now.Note: Do not round intermediate calculations.…arrow_forwardDelta Company, a U.S. MNC, is contemplating making a foreign capital expenditure in South Africa. The initial cost of the project is ZAR11,000. The annual cash flows over the five-year economic life of the project in ZAR are estimated to be 3,300, 4,300, 5,290, 6,280, and 7,250. The parent firm's cost of capital in dollars is 9,5 percent. Long-run inflation is forecasted to be 3 percent per annum in the United States and 7 percent in South Africa. The current spot foreign exchange rate is ZAR per USD = 3.75. Required:. Calculating the NPV in ZAR using the ZAR equivalent cost of capital according to the Fisher effect and then converting to USD at the current spot rate. - NPV in USD using fisher effect Converting all cash flows from ZAR to USD at purchasing power parity forecasted exchange rates and then calculating the NPV at the dollar cost of capital. - NPV in USD using PPP rates Are the two USD NPs different or the same? What is the NPV in dollars if the actual pattern of ZAR per…arrow_forwardWhat is the 50/30/20 budgeting rule in finance?arrow_forward

- How do student loans impact long-term financial health?arrow_forwardWith regard to foreign currency translation methods used by foreign MNCs, Multiple Choice a. foreign currency translation methods are generally only used by U.S. based MNCs since foreign firms have a built-in hedge by being foreign. b. are generally the same methods used by U.S.-based firms. c. are exactly the same methods used by U.S.-based firms since GAAP is GAAP. d. none of the options.arrow_forwardCray Research sold a supercomputer to the Max Planck Institute in Germany on credit and invoiced €11.60 million payable in six months. Currently, the six-month forward exchange rate is $1.18 per euro and the foreign exchange adviser for Cray Research predicts that the spot rate is likely to be $113 per euro in six months.Required: a. What is the expected gain/loss from a forward hedge?Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer in whole dollars not in millions.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education