Principles of Corporate Finance

13th Edition

ISBN: 9781260465099

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 28, Problem 8PS

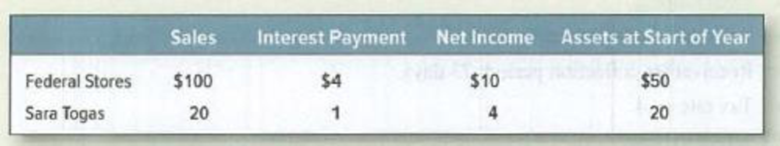

Financial ratios Sara Togas sells all its output to Federal Stores. The following table shows selected 2017 financial data, in millions, for the two firms:

The company’s tax rate is 35%. Calculate the sales-to-assets ratio, the operating profit margin, and the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between a bond's coupon rate and its yield to maturity (YTM)?no AI

What is the difference between a bond's coupon rate and its yield to maturity (YTM)?

What is the difference between a bond's coupon rate and its yield to maturity (YTM)? Need help

Chapter 28 Solutions

Principles of Corporate Finance

Ch. 28 - Prob. 1PSCh. 28 - Performance measures Keller Cosmetics maintains an...Ch. 28 - Performance measures Table 28.8 gives abbreviated...Ch. 28 - Performance measures Describe some alternative...Ch. 28 - Financial ratios Look again at Table 28.8, which...Ch. 28 - Prob. 6PSCh. 28 - Financial ratios True or false? a. A companys...Ch. 28 - Financial ratios Sara Togas sells all its output...Ch. 28 - Financial ratios As you can see, someone has...Ch. 28 - Prob. 10PS

Ch. 28 - Prob. 11PSCh. 28 - Prob. 12PSCh. 28 - Prob. 13PSCh. 28 - Prob. 14PSCh. 28 - Prob. 15PSCh. 28 - Prob. 16PSCh. 28 - Prob. 17PSCh. 28 - Prob. 18PSCh. 28 - Prob. 19PSCh. 28 - Prob. 20PSCh. 28 - Prob. 21PSCh. 28 - Prob. 22PSCh. 28 - Prob. 23PSCh. 28 - Prob. 25PSCh. 28 - Prob. 26PSCh. 28 - Prob. 27PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How do you calculate the net present value (NPV) of a project, and what does it indicate? Need helparrow_forwardHow do you calculate the net present value (NPV) of a project, and what does it indicate?arrow_forwardHow do you calculate the internal rate of return (IRR) for an investment, and what does it represent?helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License