EBK PRINCIPLES OF CORPORATE FINANCE

12th Edition

ISBN: 9781259358487

Author: BREALEY

Publisher: MCGRAW HILL BOOK COMPANY

expand_more

expand_more

format_list_bulleted

Question

Chapter 28, Problem 1PS

Summary Introduction

To construct: A

Expert Solution & Answer

Explanation of Solution

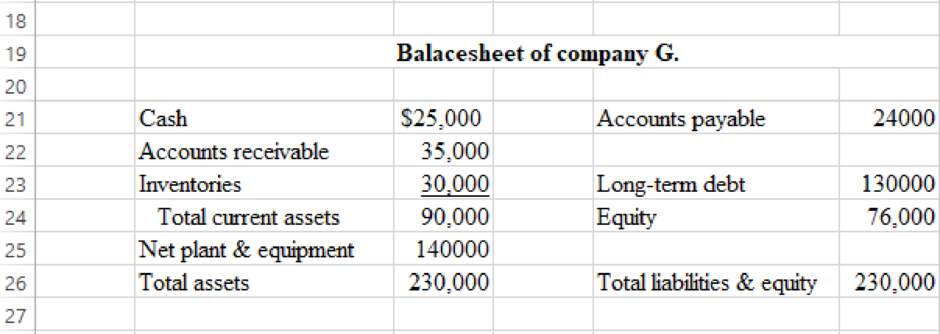

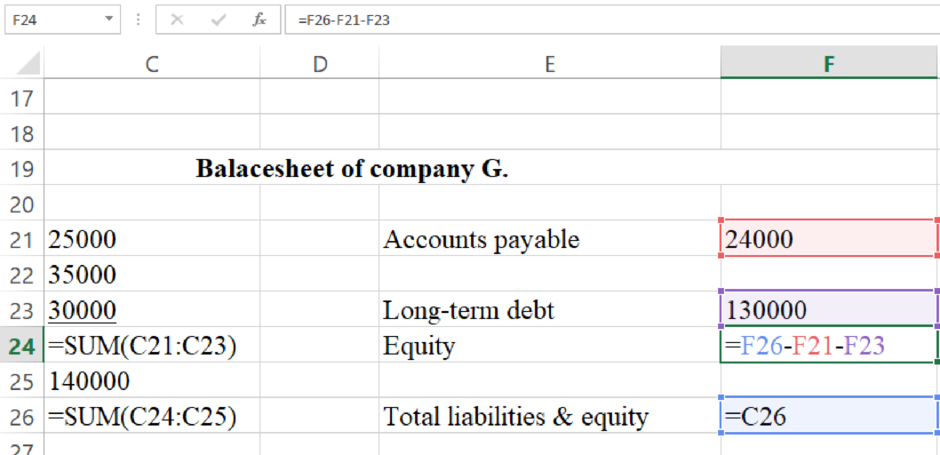

The balance sheet of company G is as follows:

The formula to calculate shareholders equity is:

Hence, the shareholders equity is 76000.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

If a bond is trading at a discount, its market price is:

a) Equal to face valueb) Above face valuec) Below face valued) Determined by inflation rate

No Ai

If a bond is trading at a discount, its market price is:a) Equal to face valueb) Above face valuec) Below face valued) Determined by inflation rate

Dividend payout ratio is calculated as:

a) Dividends / Net incomeb) Net income / Dividendsc) Retained earnings / Dividendsd) Dividends / Total equity

Chapter 28 Solutions

EBK PRINCIPLES OF CORPORATE FINANCE

Ch. 28 - Prob. 1PSCh. 28 - Performance measures Keller Cosmetics maintains an...Ch. 28 - Performance measures Table 28.8 gives abbreviated...Ch. 28 - Performance measures Describe some alternative...Ch. 28 - Financial ratios Look again at Table 28.8, which...Ch. 28 - Prob. 6PSCh. 28 - Financial ratios True or false? a. A companys...Ch. 28 - Financial ratios Sara Togas sells all its output...Ch. 28 - Financial ratios As you can see, someone has...Ch. 28 - Prob. 10PS

Ch. 28 - Prob. 11PSCh. 28 - Prob. 12PSCh. 28 - Prob. 13PSCh. 28 - Prob. 14PSCh. 28 - Prob. 15PSCh. 28 - Prob. 16PSCh. 28 - Prob. 17PSCh. 28 - Prob. 18PSCh. 28 - Prob. 19PSCh. 28 - Prob. 20PSCh. 28 - Prob. 21PSCh. 28 - Prob. 22PSCh. 28 - Prob. 23PSCh. 28 - Prob. 25PSCh. 28 - Prob. 26PSCh. 28 - Prob. 27PS

Knowledge Booster

Similar questions

- No Ai Dividend payout ratio is calculated as: a) Dividends / Net incomeb) Net income / Dividendsc) Retained earnings / Dividendsd) Dividends / Total equityarrow_forwardDon't use chatgpt!! What does a negative net present value (NPV) indicate? a) The project is profitable.b) The project is not viable.c) The project’s return is equal to the discount rate.d) The project has no cash inflows.arrow_forwardWhat does a negative net present value (NPV) indicate? a) The project is profitable.b) The project is not viable.c) The project’s return is equal to the discount rate.d) The project has no cash inflows.arrow_forward

- I need help in this question. What does a negative net present value (NPV) indicate? a) The project is profitable.b) The project is not viable.c) The project’s return is equal to the discount rate.d) The project has no cash inflows.arrow_forwardI need help!! The time value of money concept is based on the idea that: a) Money loses value over time.b) A dollar today is worth more than a dollar tomorrow.c) Future money is worth more than present money.d) Inflation has no effect on money.arrow_forwardDon't use chatgpt. What does diversification mean in the context of investments?arrow_forward

- Don't use chatgpt. The time value of money concept is based on the idea that: a) Money loses value over time.b) A dollar today is worth more than a dollar tomorrow.c) Future money is worth more than present money.d) Inflation has no effect on money.arrow_forwardSimilar projects, E and Z, are being considered using the payback method. Each has an initial cost of $100,000. Annual cash flows for each project are provided in the table at the right. a) What is the pay back period in years for E? (round to two decimal places) b) What is the pay back period in years for Z? Determine the cumulative cash flows for each year in the column next to the table (round to two decimal places)arrow_forwardno ai What is compound interest, and why is it important in personal finance?arrow_forward

- No ai The time value of money concept suggests:A. Money loses value over timeB. Inflation doesn’t matterC. Future money is more valuableD. Money today is worth more than tomorrowarrow_forwardA food processing company is considering replacing essential machinery. Cost and relevant cash flow details are provided in the table at the right. The company requires an 11% return on its capital. a) What is the present value of the yearly cash flows? Use a Time Value of Money function for full credit. (round to nearest dollar) b) What is the net present value of the project? (round to nearest dollar) c) What is the internal rate of return of the project? Use a Time Value of Money function for full credit. (round to two decimal places)arrow_forwardwhat is the firms' weighted average cost of capital? please show me weight calculation for each capital source.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,