Concept explainers

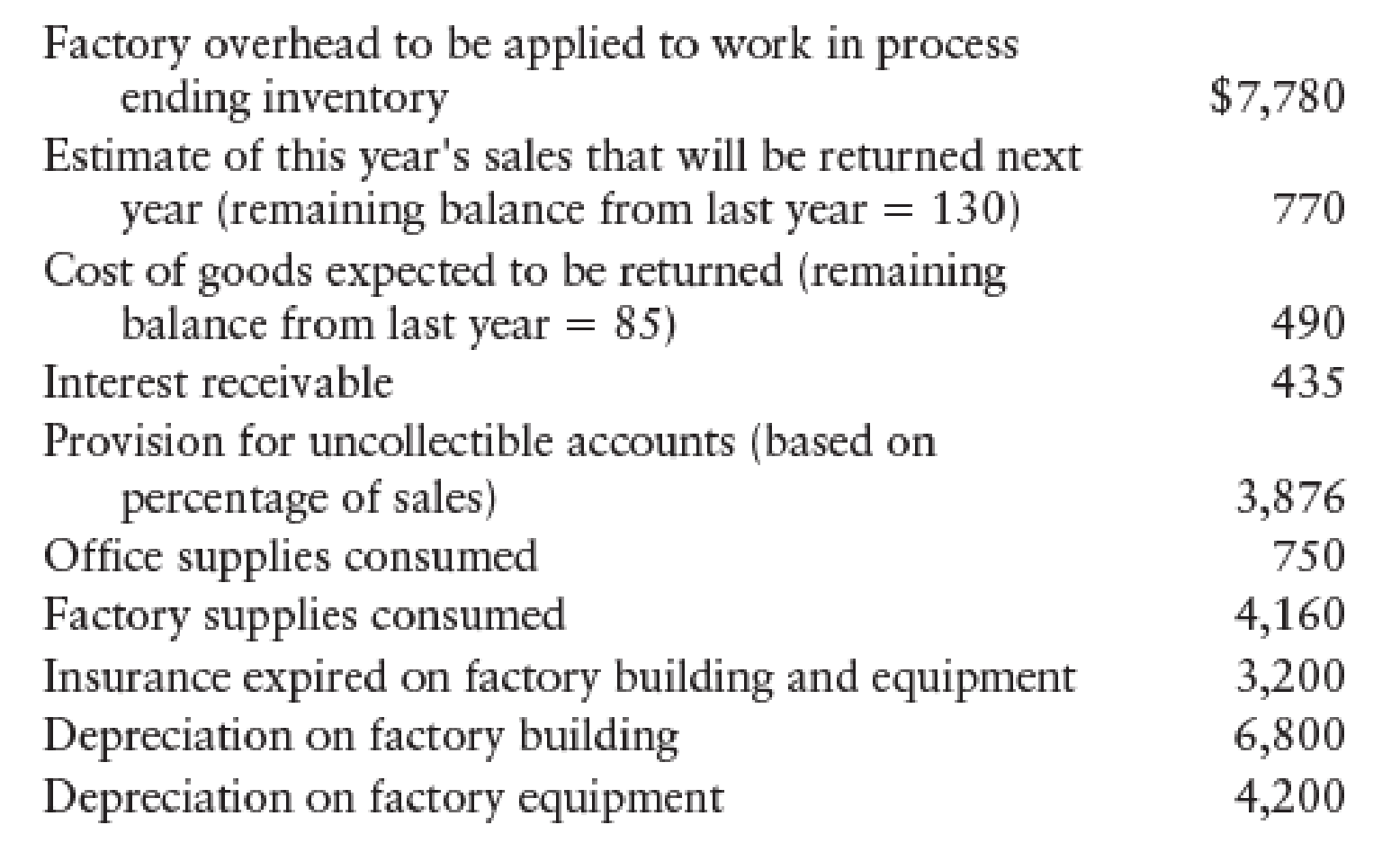

Prepare the necessary adjusting entries of Company O for the year ended December 31.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Factory Overhead Cost:

Factory overhead cost is the cost other than the direct material cost, and the direct labor cost which is not directly involved in the production of converting the raw materials to the finished products. If the direct material cost or direct labor cost does not constitute the major portion of the total cost of the finished product, then it may be classified as the factory overhead cost. For example: Cost of repairing, and maintaining factory equipment.

Prepare an adjusting entry to record the sales return from the customer during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Sales return and allowances | 770 | ||

| Customer refunds payable | 770 | |||

| (To record the sales return from the customer) |

Table (1)

- ■ Sales return and allowances (contra-revenue) is a component of owner’s equity, and it decreases the value of owner’s equity. Hence, debit the sales return and allowances account with $770.

- ■ Customer refund payable is a liability account, and it increases the value of liabilities. Hence, credit the customer refund payable account with $770.

Prepare an adjusting entry to record the expected return of cost of goods sold during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Estimated returns inventory | 490 | ||

| Cost of goods sold | 490 | |||

| (To record the expected return of cost of goods sold) |

Table (2)

- ■ Expected return in inventory is an asset account, and it increases the value of asset. Hence, debit the expected return in inventory account with $490.

- ■ Cost of goods sold is an expense account, and there is a decrease in the value of expense. Hence, credit the cost of goods sold with $490.

Prepare an adjusting entry to record the factory overhead applied to work in process ending inventory.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Work in process inventory | 7,780 | ||

| Factory overheads | 7,780 | |||

| (To record the transfer of factory overheads to work in process) |

Table (3)

- ■ Work in process inventory is an asset account, and it increases the value of asset. Hence, debit the work in process inventory account with $7,780.

- ■ Factory overhead (expense) is a component of owner’s equity, and there is a decrease in the value of expense. Hence, credit the factory overhead account with $7,780.

Prepare an adjusting entry to record the interest revenue earned during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Interest receivable | 435 | ||

| Interest revenue | 435 | |||

| (To record the interest revenue earned at the end of the year) |

Table (4)

- ■ Interest receivable is an asset account, and it increases the value of asset. Hence, debit the interest receivable account with $435.

- ■ Interest revenue is a component of owner’s equity, and it increases the value of owner’s equity. Hence, credit the interest revenue account with $435.

Prepare an adjusting entry to record the bad debt expense incurred during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Bad debt expense | 3,876 | ||

| Allowance for doubtful account | 3,876 | |||

| (To record the bad debt expense estimated at the end of the year) |

Table (5)

- ■ Bad expense is component of owner’ equity and it decreases the value of owner’s equity. Hence, debit the bad expense with $3,876.

- ■ Allowance for doubtful accounts is a contra-asset account, and it decreases the value of assets. Hence, credit the allowance for doubtful account with $3,876.

Prepare an adjusting entry to record the office supplies expense incurred during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Office supplies expense | 750 | ||

| Office supplies | 750 | |||

| (To adjust the office supplies expense incurred at the end of the accounting year) |

Table (6)

- ■ Offices supplies expense is component of shareholders’ equity, and it decreases the value of owner’s equity. Hence, debit the office supplies expense with $750.

- ■ Office supplies are asset account, and it decreases the value of assets. Hence, credit the office supplies account with $750.

Prepare an adjusting entry to record the factory supplies used during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Factory overhead (factory supplies expense) | 4,160 | ||

| Factory supplies | 4,160 | |||

| (To record the supplies expense incurred at the end of the year) |

Table (7)

- ■ Factory overhead (expense) is a component of owner’s equity, and there is an increase in the value of expense. Hence, debit the factory overhead account with $4,160.

- ■ Factory supplies are asset account, and it decreases the value of asset. Hence, credit the factory overhead account with $4,160.

Prepare an adjusting entry to record the insurance expense on the factory building and equipment incurred during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Factory overhead (insurance expense-factory and equipment) | 3,200 | ||

| Prepaid insurance | 3,200 | |||

| (To record the insurance expense incurred at the end of the year) |

Table (8)

- ■ Factory overhead (insurance expense) is a component of owner’s equity, and there is an increase in the value of expense. Hence, debit the factory overhead account with $3,200.

- ■ Prepaid insurance is an asset account, and it decreases the value of asset. Hence, credit the prepaid insurance account with $3,200.

Prepare an adjusting entry to record the depreciation expense on building incurred at the end of the accounting year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Factory overhead (depreciation expense) | 6,800 | ||

| Accumulated depreciation-Factory building | 6,800 | |||

| (To record the depreciation expense incurred at the end of the year) |

Table (9)

- ■ Factory overhead (depreciation expense) is a component of owner’s equity, and there is an increase in the value of expenses. Hence, debit the factory overhead account with $6,800.

- ■ Accumulated depreciation-factory building is a contra-asset account, and it decreases the value of asset. Hence, credit the accumulated depreciation-Factory building account with $6,800.

Prepare an adjusting entry to record the depreciation expense on equipment incurred at the end of the accounting year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Factory overhead (depreciation expense) | 4,200 | ||

| Accumulated depreciation-Factory equipment | 4,200 | |||

| (To record the depreciation expense incurred at the end of the year) |

Table (10)

- ■ Factory overhead (depreciation expense) is a component of owner’s equity, and there is an increase in the value of expenses. Hence, debit the factory overhead account with $4,200.

- ■ Accumulated depreciation-factory equipment is a contra-asset account, and it decreases the value of asset. Hence, credit the accumulated depreciation-factory equipment account with $4,200.

Want to see more full solutions like this?

Chapter 27 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 23rd + Cengagenowv2, 2 Terms Printed Access Card

- Net sales total $438,000. Beginning and ending accounts receivable are $35,000 and $37,000, respectively. Calculate days' sales in receivables. A.27 days B.30 days C.36 days D.31 daysarrow_forwardProvide correct answerarrow_forwardFor the system shown in figure below, the per unit values of different quantities are E-1.2, V 1, X X2-0.4. Xa-0.2 Determine whether the system is stable for a sustained fault. The fault is cleared at 8-60°. Is the system stable? If so find the maximum rotor swing. Find the critical clearing angle. E25 G X'd 08 CB X2 F CB V28 Infinite busarrow_forward

- Geisner Inc. has total assets of $1,000,000 and total liabilities of $600,000. The industry average debt-to-equity ratio is 1.20. Calculate Geisner's debt-to-equity ratio and indicate whether the company's default risk is higher or lower than the average of other companies in the industry.arrow_forwardHy expert give me solution this questionarrow_forwardBaker's Market began the current month with inventory costing $35,250, then purchased additional inventory at a cost of $78,400. The perpetual inventory system indicates that inventory costing $82,500 was sold during the month for $88,250. An inventory count at month-end shows that inventory costing $29,000 is actually on hand. What amount of shrinkage occurred during the month? a) $350 b) $1,150 c) $1,750 d) $2,150arrow_forward

- A pet store sells a pet waste disposal system for $60 each. The cost per unit, including the system and enzyme digester, is $42.50. What is the contribution margin per unit? A. $15.00 B. $17.50 C. $12.25 D. $19.00arrow_forwardNarchie sells a single product for $40. Variable costs are 80% of the selling price, and the company has fixed costs that amount to $152,000. Current sales total 16,000 units. What is the break-even point in units?arrow_forwardA company sells 32,000 units at $25 per unit. The variable cost per unit is $20.50, and fixed costs are $52,000. (a) Determine the contribution margin ratio. (b) Determine the unit contribution margin. (c) Determine the income from operations.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning