(a)

To explain:

The effect of an increase in government purchase in the short run on the given two diagrams.

Answer to Problem 1P

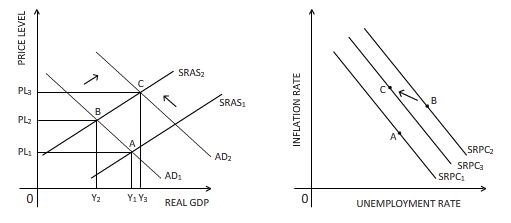

The effect of an increase in government purchase is shown on the diagrams below:

Explanation of Solution

Government purchase is a part of aggregate

Government purchase:

The goods and services bought by the government to undertake infrastructural developments and other developmental activities is referred as government purchase.

(b)

To explain:

The effect of reduced growth rate of money supply in the short run on the given two diagrams.

Answer to Problem 1P

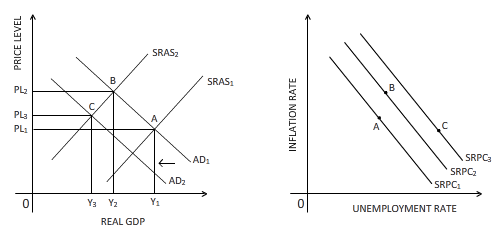

The effect of decrease in growth rate of money supply is shown on the diagrams below:

Explanation of Solution

A reduction in the growth rate of money supply affects the aggregate demand negatively through the real balance effect. This leads to a leftward shift of the aggregate demand curve from AD1 to AD2. The new equilibrium point is established at point C, where both real GDP and price level are lower than that of the equilibrium point at B. Due to fall in real GDP, there will be rise in unemployment, and hence the SRPC line shifts rightward from SRPC2 to SRPC3. The new equilibrium point C is shown on the SRPC3 in the right-hand side diagram.

Money supply:

The amount of money in the form of currency and other financial liquid instruments supplied in an economy over a specific time period is referred as money supply.

(c)

To explain:

The effect of an expected higher inflation in the short run on the given two diagrams.

Answer to Problem 1P

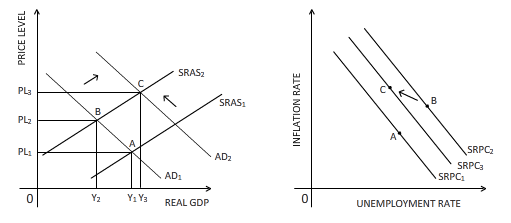

The effect of an expected higher inflation is shown on the diagrams below:

Explanation of Solution

If people expect that higher inflation is approaching, they will increase their consumption expenditure to ward off the high inflation. Therefore, the aggregate demand will rise in the short run. This is reflected in the rightward shift of the aggregate demand curve from AD1 to AD2 in the above diagram. This results in a new equilibrium point C in the diagram where both real GDP and price level are higher than that of point B. On the right-hand side diagram, the SRPC line shifts from SRPC2 to SRPC3 because as real GDP grows at each level of inflation rate, unemployment falls. The new equilibrium point C is marked on SRPC3 line.

Inflation rate:

The rate at which the price level of an economy rises is termed as the rate of inflation. An increased inflation rate decreases the

(d)

To explain:

The effect of a favorable supply shock on the given two diagrams.

Answer to Problem 1P

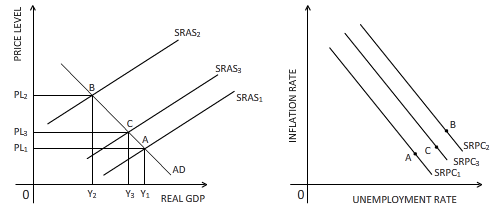

The effect of supply shock is shown on the diagrams below:

Explanation of Solution

A favorable supply shock will push the supply of the economy upward, causing the

Supply shock:

An event which leads to a sudden rise or fall in the supply of goods and services is referred as supply shock.

Want to see more full solutions like this?

- how commond economies relate to principle Of Economics ?arrow_forwardCritically analyse the five (5) characteristics of Ubuntu and provide examples of how they apply to the National Health Insurance (NHI) in South Africa.arrow_forwardCritically analyse the five (5) characteristics of Ubuntu and provide examples of how they apply to the National Health Insurance (NHI) in South Africa.arrow_forward

- Outline the nine (9) consumer rights as specified in the Consumer Rights Act in South Africa.arrow_forwardIn what ways could you show the attractiveness of Philippines in the form of videos/campaigns to foreign investors? Cite 10 examples.arrow_forwardExplain the following terms and provide an example for each term: • Corruption • Fraud • Briberyarrow_forward

- In what ways could you show the attractiveness of a country in the form of videos/campaigns?arrow_forwardWith the VBS scenario in mind, debate with your own words the view that stakeholders are the primary reason why business ethics must be implemented.arrow_forwardThe unethical decisions taken by the VBS management affected the lives of many of their clients who trusted their business and services You are appointed as an ethics officer at Tyme Bank. Advise the management regarding the role of legislation in South Africa in providing the legal framework for business operations.arrow_forward

- Tyme Bank is a developing bank in South Africa and could potentially encounter challenges similar to those faced by VBS in the future. Explain five (5) benefits of applying business ethics at Tyme Bank to prevent similar ethical scandals.arrow_forward1.3. Explain the five (5) ethical challenges that can be associated with the implementation of the National Health Insurance (NHI) in South Africa.arrow_forward1.2. Fourie (2018:211) suggests that Ubuntu emphasises the willingness to share and participate in a community. However, it does not privilege the community over the dignity and life of the individual. With the above in mind, discuss how the implementation of the National Health Insurance (NHI) is a way to uphold the concept of Ubuntu.arrow_forward

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning