CENGAGENOWV2 FOR HEINTZ/PARRY'S COLLEGE

22nd Edition

ISBN: 9781305669840

Author: Parry

Publisher: IACCENGAGE

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 26, Problem 9SPB

1.

To determine

Prepare general journal entries to record transactions (a) through (i).

1.

Expert Solution

Explanation of Solution

Job order costing is one of the methods of cost accounting under which cost is collected and gathered for each job, work order, or project separately. It is a system by which a factory maintains a separate record of each particular quantity of product that passes through the factory. Job order costing is used when the products produced are significantly different from each other.

Prepare

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| a. | Material | 44,000 | |

| Accounts payable | 44,000 | ||

| (To record the purchase of materials on account.) | |||

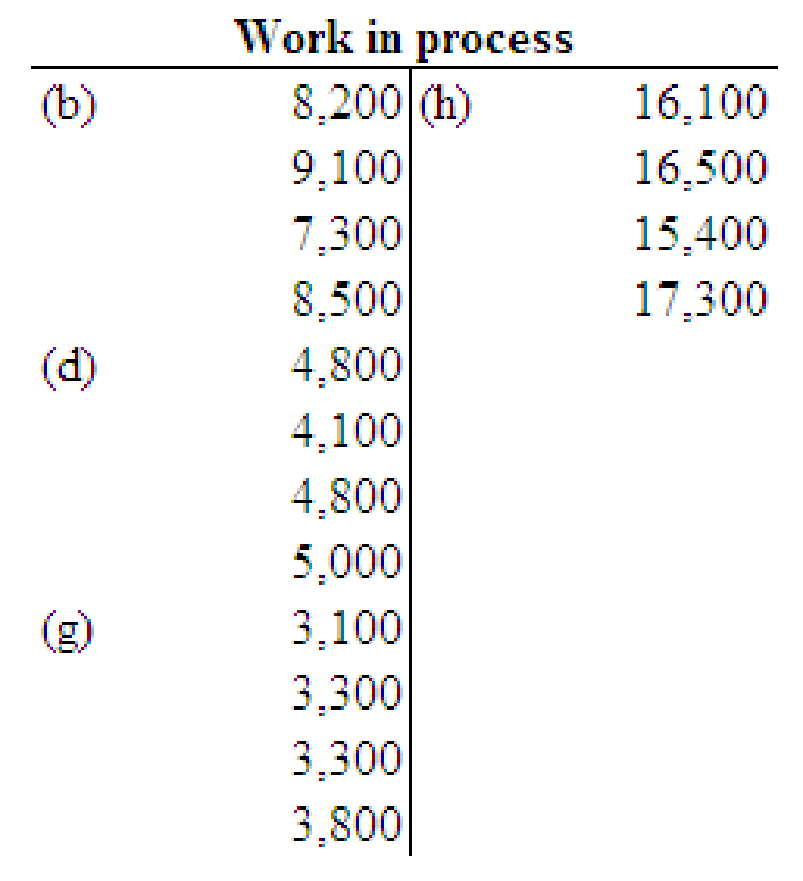

| b. | Work in process | 8,200 | |

| Work in process | 9,100 | ||

| Work in process | 7,300 | ||

| Work in process | 8,500 | ||

| Materials | 33,100 | ||

| (To record direct materials incurred for the job: job no.501, 502,503,504) | |||

| c. | Factory | 5,000 | |

| Materials | 5,000 | ||

| (To record the issuance of indirect materials) | |||

| d. | Work in process | 4,800 | |

| Work in process | 4,100 | ||

| Work in process | 4,800 | ||

| Work in process | 5,000 | ||

| Wages payable | 18,700 | ||

| (To record direct labor incurred for the job: job no.501, 502,503,504) | |||

| e. | Factory overhead | 3,300 | |

| Wages payable | 3,300 | ||

| (To record the indirect labor charged to production) | |||

| f. | Factory overhead | 5,200 | |

| Cash | 5,200 | ||

| (To record the payment of electricity bill, heating oil, and repairs bills for the factory and charge made to production) | |||

| g. | Work in process | 3,100 | |

| Work in process | 3,300 | ||

| Work in process | 3,300 | ||

| Work in process | 3,800 | ||

| Factory overhead | 13,500 | ||

| (To record applied factory overhead to the job: job no.501,502,503,504) | |||

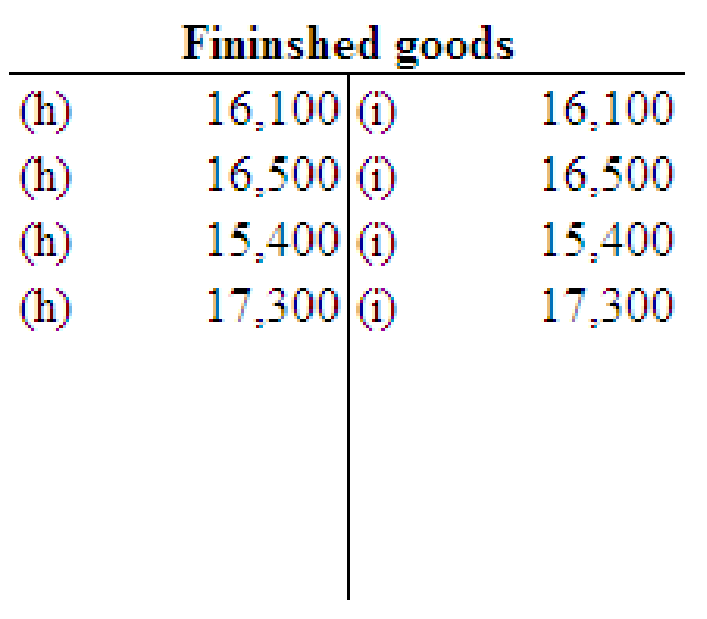

| h. | Finished goods (Product W) | 16,100 | |

| Work in process | 16,100 | ||

| (To record the transfer of Job no. 501 to Product W) | |||

| Finished goods (Product X) | 16,500 | ||

| Work in process | 16,500 | ||

| (To record the transfer of Job no.502 to Product X) | |||

| Finished goods (Product Y) | 15,400 | ||

| Work in process | 15,400 | ||

| (To record the transfer of Job no.503 to Product Y) | |||

| Finished goods (Product Z) | 17,300 | ||

| Work in process | 17,300 | ||

| (To record the transfer of Job no.504 to Product Z) | |||

| i. | 17,500 | ||

| Sales | 17,500 | ||

| (To record sale of product W) | |||

| Cost of goods sold | 16,100 | ||

| Finished goods (Product W) | 16,100 | ||

| (To record cost of goods sold on finished goods of Product W) | |||

| Accounts receivable | 18,000 | ||

| Sales | 18,000 | ||

| (To record sale of product X) | |||

| Cost of goods sold | 16,500 | ||

| Finished goods (Product X) | 16,500 | ||

| (To record cost of goods sold on finished goods of Product X) | |||

| Accounts receivable | 16,900 | ||

| Sales | 16,900 | ||

| (To record sale of product Y) | |||

| Cost of goods sold | 15,400 | ||

| Finished goods (Product Y) | 15,400 | ||

| (To record cost of goods sold on finished goods of Product Y) | |||

| Accounts receivable | 19,000 | ||

| Sales | 19,000 | ||

| (To record sale of product Z) | |||

| Cost of goods sold | 17,300 | ||

| Finished goods (Product Z) | 17,300 | ||

| (To record cost of goods sold on finished goods of Product Z) |

(Table 1)

2.

To determine

2.

Expert Solution

Explanation of Solution

Post the entries to the work in process and finished goods T accounts.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Hello tutor please given General accounting question answer do fast and properly explain all answer

What is the company net income for the year?

Westfield corp is evaluating a project general accounting requiring $500,000 in asset

Chapter 26 Solutions

CENGAGENOWV2 FOR HEINTZ/PARRY'S COLLEGE

Ch. 26 - Prob. 1TFCh. 26 - Prob. 2TFCh. 26 - Prob. 3TFCh. 26 - Prob. 4TFCh. 26 - Prob. 5TFCh. 26 - Prob. 1MCCh. 26 - Prob. 2MCCh. 26 - When total anticipated factory overhead is 500,000...Ch. 26 - When direct labor hours for Job 101 are 30 and the...Ch. 26 - Prob. 5MC

Ch. 26 - Prob. 1CECh. 26 - Prob. 2CECh. 26 - Prob. 3CECh. 26 - Prob. 1RQCh. 26 - Prob. 2RQCh. 26 - Prob. 3RQCh. 26 - Prob. 4RQCh. 26 - Prob. 5RQCh. 26 - Prob. 6RQCh. 26 - Prob. 7RQCh. 26 - Prob. 8RQCh. 26 - Prob. 9RQCh. 26 - Prob. 10RQCh. 26 - Prob. 11RQCh. 26 - Prob. 12RQCh. 26 - Prob. 13RQCh. 26 - Prob. 14RQCh. 26 - Prob. 15RQCh. 26 - COST OF GOODS SOLD SECTION The following...Ch. 26 - SCHEDULE OF COST OF GOODS MANUFACTURED The...Ch. 26 - JOURNAL ENTRIES FOR MATERIAL, LABOR, AND OVERHEAD...Ch. 26 - JOURNAL ENTRIES FOR FACTORY OVERHEAD Huang Company...Ch. 26 - PREDETERMINED FACTORY OVERHEAD RATE Millerlile...Ch. 26 - JOURNAL ENTRIES FOR MATERIAL, LABOR, OVERHEAD, AND...Ch. 26 - SCHEDULE OF COST OF GOODS MANUFACTURED AND COST OF...Ch. 26 - JOURNAL ENTRIES FOR MATERIAL, LABOR, AND OVERHEAD...Ch. 26 - JOB ORDER COSTING TRANSACTIONS Stonestreet...Ch. 26 - JOB ORDER COSTING WITH UNDER- AND OVERAPPLIED...Ch. 26 - COST OF GOODS SOLD SECTION The following...Ch. 26 - SCHEDULE OF COST OF GOODS MANUFACTURED The...Ch. 26 - JOURNAL ENTRIES FOR MATERIAL, LABOR, AND OVERHEAD...Ch. 26 - JOURNAL ENTRIES FOR FACTORY OVERHEAD Bandy Company...Ch. 26 - PREDETERMINED FACTORY OVERHEAD RATE Marston...Ch. 26 - JOURNAL ENTRIES FOR MATERIAL, LABOR, OVERHEAD, AND...Ch. 26 - SCHEDULE OF COST OF GOODS MANUFACTURED AND COST OF...Ch. 26 - Prob. 8SPBCh. 26 - Prob. 9SPBCh. 26 - Prob. 10SPBCh. 26 - Prob. 1MYWCh. 26 - Forester Manufacturing Company uses a job order...Ch. 26 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY