Reset the Data Section of the CAPBUD2 worksheet to the original values. In requirement 4, you assessed the sensitivity of the investment’s

- a. What annual cash flow (approximately) is required to:

- (1) earn 0% rate of return? _______________

- (2) earn 10% rate of return? _______________

- (3) earn over 20% rate of return? _______________

- b. Approximately, how much is the rate of return reduced for each drop of $10,000 annual cash flow?

When the assignment is complete, close the file without saving it again.

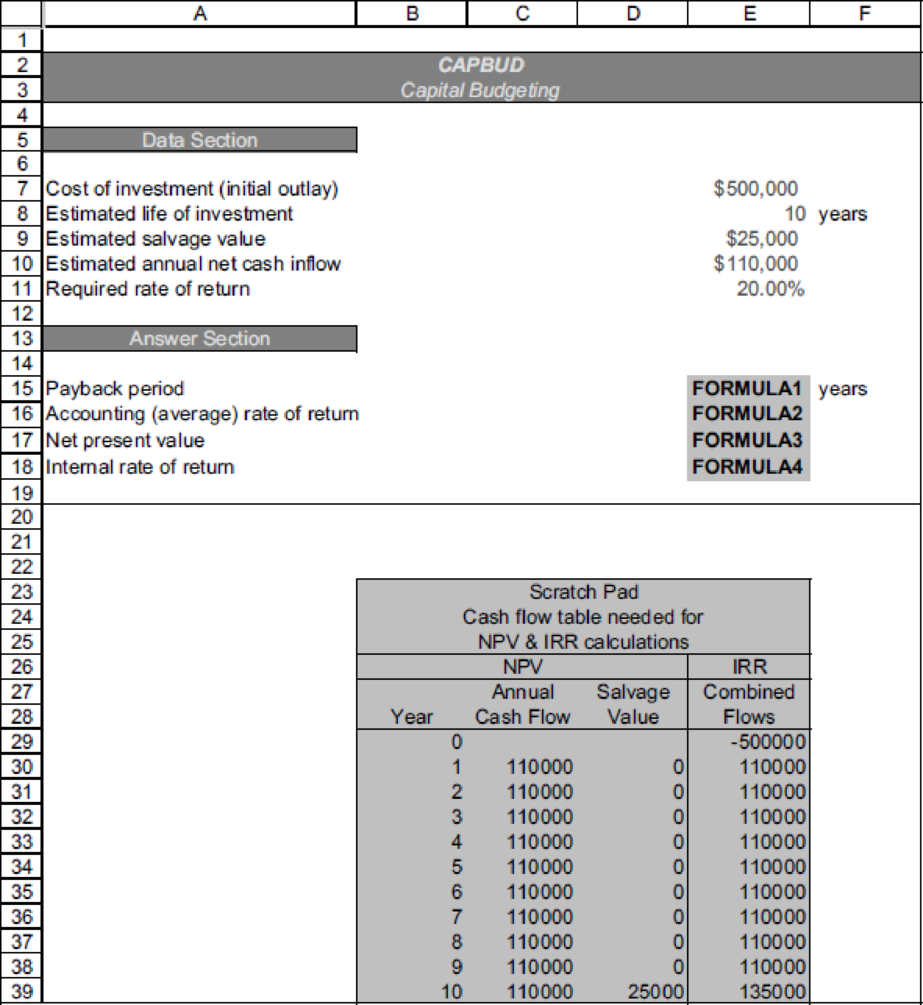

Worksheet. The CAPBUD2 worksheet handles only cash inflows that are even in amount each year. Many capital projects generate uneven cash inflows. Suppose that the new store had expected cash earnings of $80,000 per year for the first two years, $140,000 for the next four years, and $220,000 for the last four years. The new store will generate the same total cash return ($1,600,000) as in the original problem, but the timing of the cash flows is different. Alter the CAPBUD2 worksheet so that the NPV and IRR calculations can be made whether there are even or uneven cash flows. When done, preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as CAPBUDT.

Hint: One suggestion is to label column F in the scratch pad as Uneven cash flows.

Enter the uneven cash flows for each year. Modify FORMULA3 to include these cash flows. Modify the formulas in the range E30 to E39 to include the new data. Then set cell E10 (estimated Annual Net

Note that this solution causes garbage to come out in cells E15 and E16 because those formulas were not altered. Check figure for uneven cash flows: NPV (cell E17), $68,674.

Chart. Using the CAPBUD2 file, develop a chart just like the one used in requirement 6 to show the sensitivity of

Want to see the full answer?

Check out a sample textbook solution

Chapter 26 Solutions

Excel Applications for Accounting Principles

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,