Capital rationing decision for a service company involving four proposals

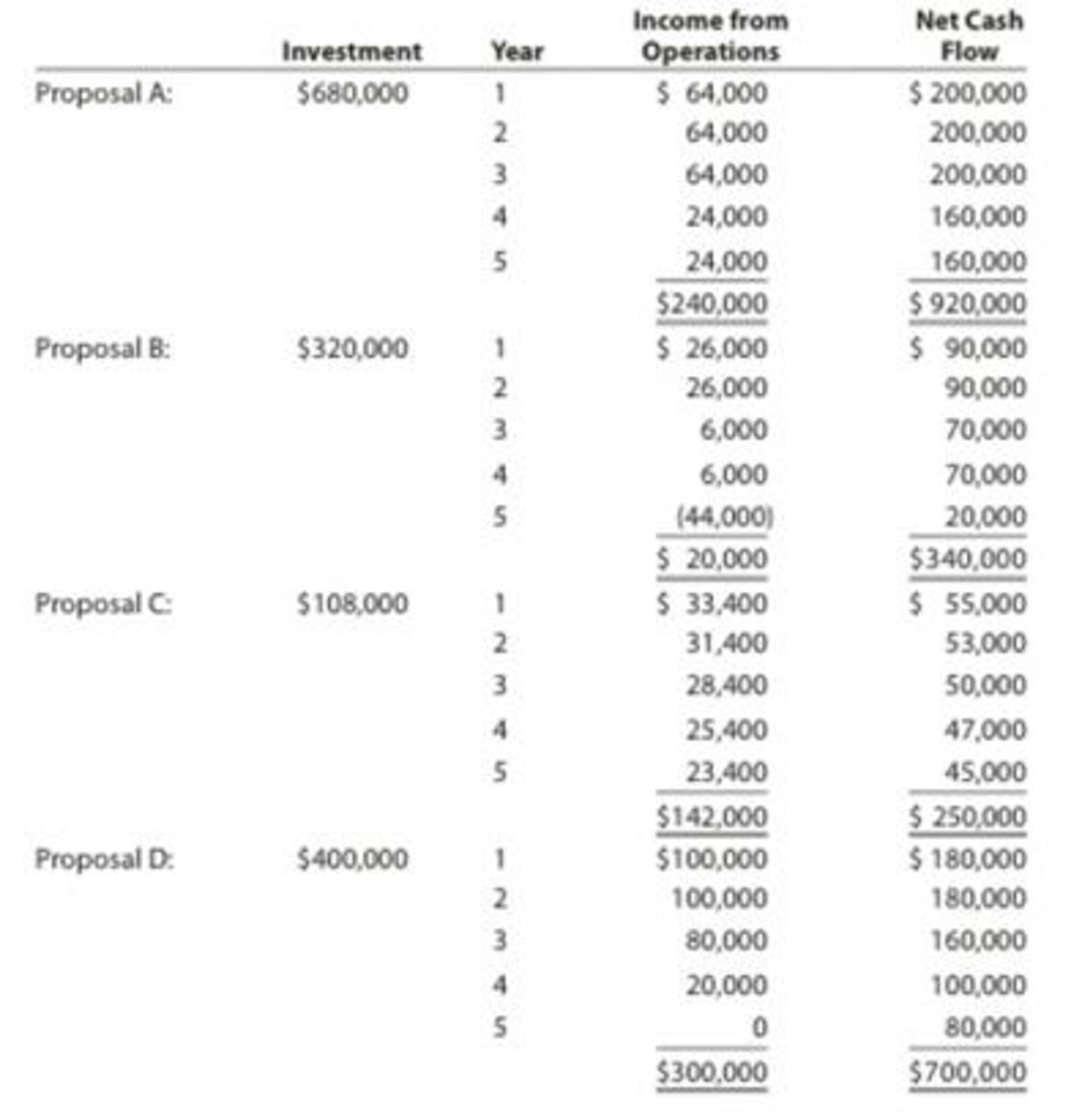

Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating income, and net cash flow for each proposal are as follows:

The company’s capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average

Instructions

- 1. Compute the cash payback period for each of the four proposals.

- 2. Giving effect to straight-line depreciation on the investments and assuming no estimated residual value, compute the average rate of return for each of the four proposals. (Round to one decimal place.)

- 3. Using the following format, summarize the results of your computations in parts (1) and (2). By placing the computed amounts in the first two columns on the left and by placing a check mark in the appropriate column to the right, indicate which proposals should be accepted for further analysis and which should be rejected.

- 4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 15% and the present value table appearing in Exhibit 2 of this chapter.

- 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places.

- 6. Rank the proposals from most attractive to least attractive, based on the present values of net

cash flows computed in part (4). - 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5).

- 8. Based on the analyses, comment on the relative attractiveness of the proposals ranked in parts (6) and (7).

1.

Calculate the cash payback period for the given proposals.

Explanation of Solution

Cash payback method:

Cash payback period is the expected time period which is required to recover the cost of investment. It is one of the capital investment method used by the management to evaluate the long-term investment (fixed assets) of the business.

The cash payback period for the given proposals is as follows:

Proposal A:

Initial investment=$680,000

| Cash payback period of Proposal A | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 200,000 | 200,000 | ||

| 2 | 200,000 | 400,000 | ||

| 3 | 200,000 | 600,000 | ||

| 6 months (1) | 80,000 | 680,000 | ||

Table (1)

Hence, the cash payback period of proposal A is 3 years and 6 months.

Working note:

1. Calculate the no. of months in the cash payback period:

Proposal B:

Initial investment=$320,000

| Cash payback period of Proposal B | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 90,000 | 90,000 | ||

| 2 | 90,000 | 180,000 | ||

| 3 | 70,000 | 250,000 | ||

| 4 | 70,000 | 320,000 | ||

Table (2)

Hence, the cash payback period of proposal B is 4 years.

Proposal C:

Initial investment=$108,000

| Cash payback period of Proposal C | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 55,000 | 55,000 | ||

| 2 | 53,000 | 108,000 | ||

Table (3)

Hence, the cash payback period of proposal C is 2 years.

Proposal D:

Initial investment=$400,000

| Cash payback period of Proposal D | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 180,000 | 180,000 | ||

| 2 | 180,000 | 360,000 | ||

| 3 months (2) | 40,000 | 400,000 | ||

Table (4)

Hence, the cash payback period of proposal D is 2 years and 3 months.

Working note:

2. Calculate the no. of months in the cash payback period:

2.

Calculate the average rate of return for the give proposals.

Explanation of Solution

Average rate of return method:

Average rate of return is the amount of income which is earned over the life of the investment. It is used to measure the average income as a percent of the average investment of the business, and it is also known as the accounting rate of return.

The average rate of return is computed as follows:

The average rate of return for the given proposals is as follows:

Proposal A:

Hence, the average rate of return for Proposal A is 14.1%.

Proposal B:

Hence, the average rate of return for Proposal B is 2.5%.

Proposal C:

Hence, the average rate of return for Proposal C is 52.6%.

Proposal D:

Hence, the average rate of return for Proposal D is 30.0%.

3.

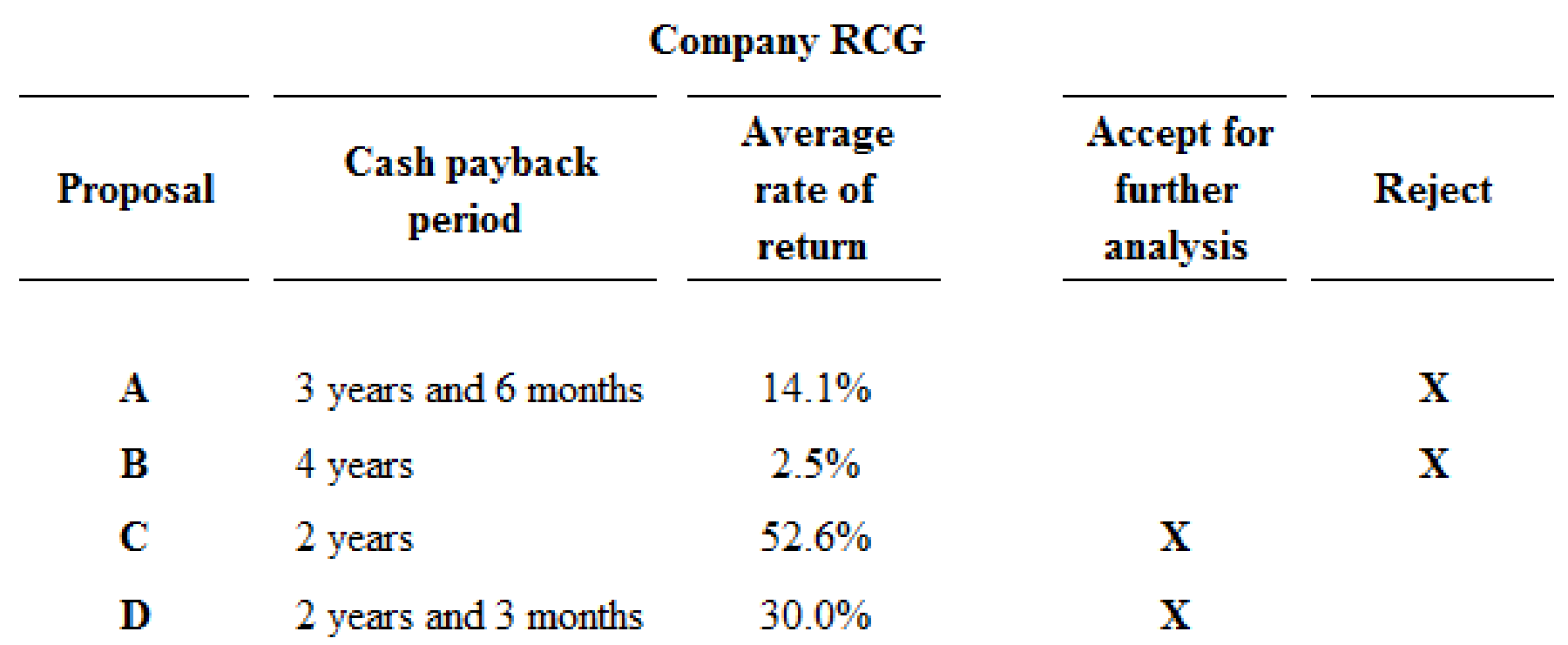

Indicate the proposals which should be accepted for further analysis, and which should be rejected.

Explanation of Solution

The proposals which should be accepted for further analysis, and which should be rejected is as follows:

Figure (1)

Proposals A and B are rejected, because proposal A and B fails to meet the required maximum cash back period of 3 years, and they has less rate of return than the other proposals. Hence, Proposals C and D are preferable.

4.

Calculate the net present value of preferred proposals.

Explanation of Solution

Net present value method:

Net present value method is the method which is used to compare the initial cash outflow of investment with the present value of its cash inflows. In the net present value, the interest rate is desired by the business based on the net income from the investment, and it is also called as the discounted cash flow method.

Calculate the net present value of the proposals which has 12% rate of return as follows:

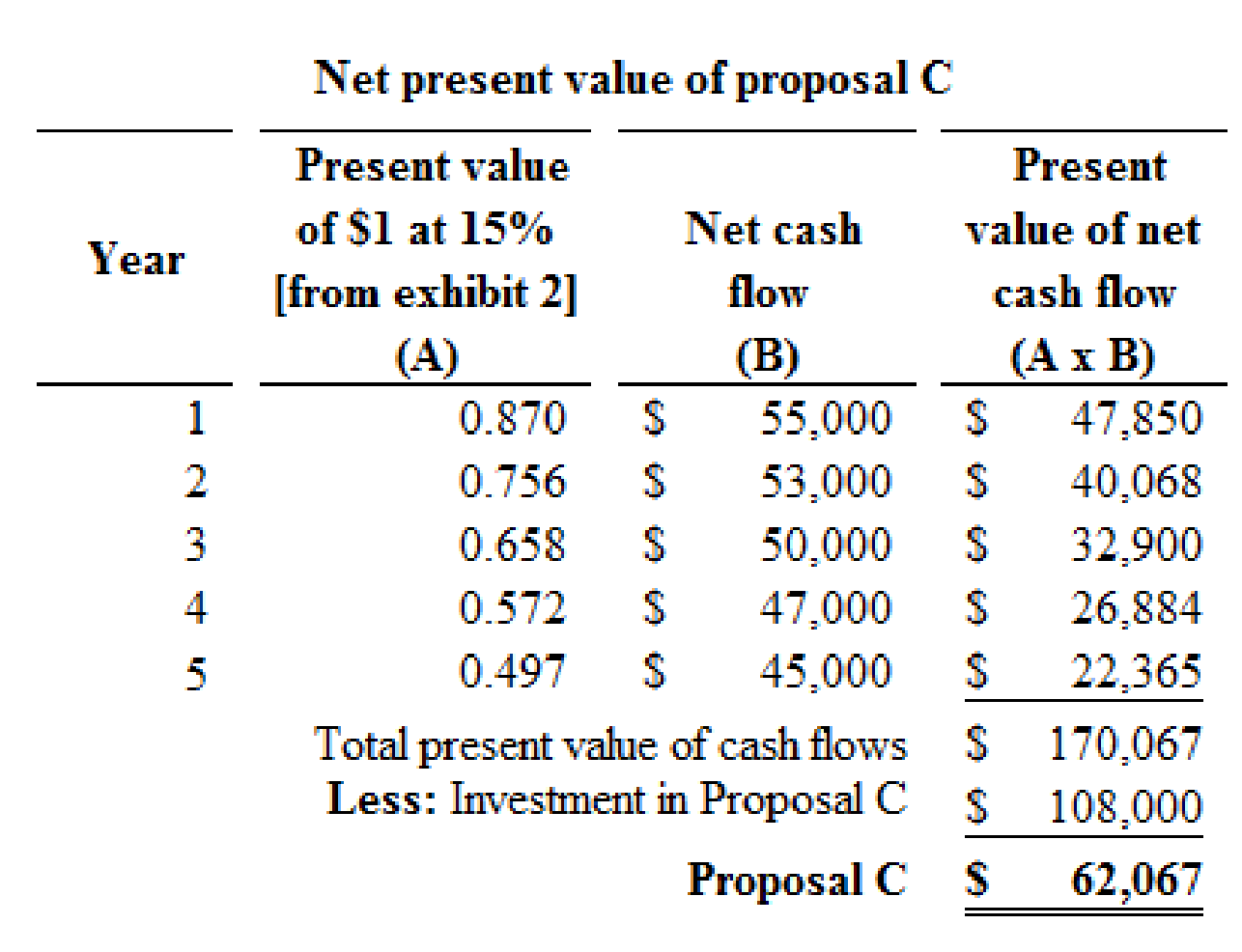

Proposal C:

Figure (2)

Hence, the net present value of proposal C is $62,067.

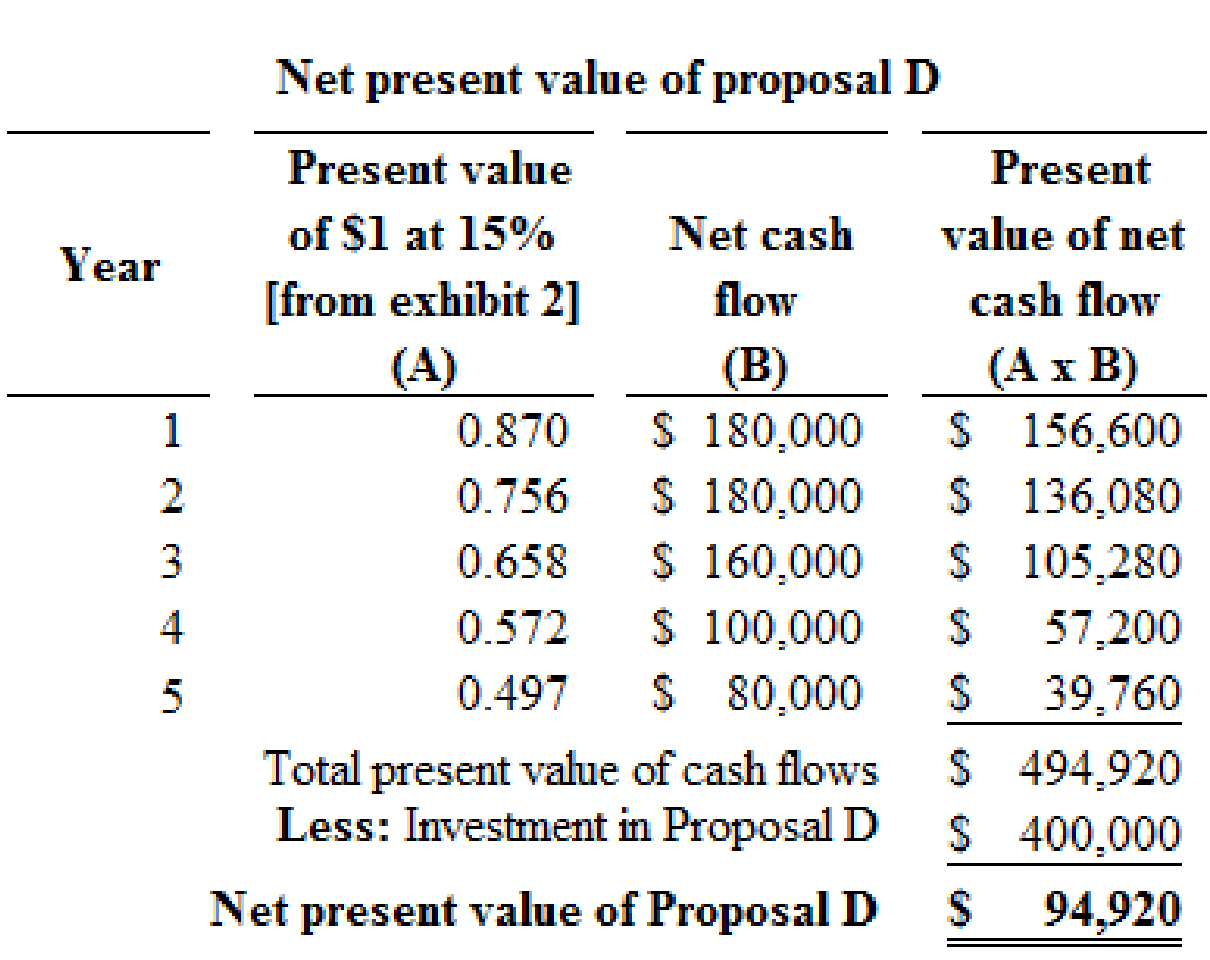

Proposal D:

Figure (3)

Hence, the net present value of proposal D is $94,920.

5.

Calculate the present value index for each proposal.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index for each proposal is as follows:

Proposal C:

Calculate the present value index for proposal C:

Hence, the present value index for proposal C is 1.575.

Proposal D:

Calculate the present value index for proposal D:

Hence, the present value index for proposal D is 1.237.

6.

Rank the proposal from most attractive to least attractive, based on the present value of net cash flows.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index is computed as follows:

Proposals are arranged by rank is as follows:

| Proposals | Net present value | Rank |

| Proposal D | $ 94,920 | 1 |

| Proposal C | $ 62,067 | 2 |

Table (5)

7.

Rank the proposal from most attractive to least attractive, based on the present value of index.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index is computed as follows:

Proposals are arranged by rank is as follows:

| Proposals | Present value index | Rank |

| Proposal C | 1.57 | 1 |

| Proposal D | 1.24 | 2 |

Table (6)

8.

Analyze the proposal which is favor to investment, and comment on the relative attractiveness of the proposals based on the rank.

Explanation of Solution

On the basis of net present value:

The net present value of Proposal C is $62,067, and Proposal D is $94,920. In this case, the net present value of proposal D is more than the net present value of proposal C. Hence, investment in Proposal D is preferable.

On the basis of present value index:

The present value index of Proposal C is 1.57, and the present value index of Proposal D is 1.24. In this case, Proposal C has the favorable present value index, because the present value index of Proposal C (1.57) is more than Proposal D (1.24). Thus, the investment in Proposal C is preferable (favorable).

Every business tries to get maximum profit with minimum investment. Hence, the cost of investment in Proposal C is less than the proposal D. Thus, investment in Proposal C is preferable.

Want to see more full solutions like this?

Chapter 26 Solutions

Financial and Managerial Accounting - Workingpapers

- Using the following balance sheet and income statement data, what is the total amount of working capital? Current assets $39700 Net income $52100 Current liabilities 19800 Stockholders' equity 96700 Average assets 198400 Total liabilities 52100 Total assets 148800 Average common shares outstanding was 18600. ○ $9900 ○ $39700 ○ $19900 ○ $12400arrow_forwardSuppose that Old Navy has assets of $4265000, common stock of $1018000, and retained earnings of $659000. What are the creditors' claims on their assets? ○ $2588000 ○ $3906000 ○ $1677000 ○ $4624000arrow_forwardBrody Corp. uses a process costing system. Beginning inventory for January consisted of 1,400 units that were 46% completed. 10,300 units were started during January. On January 31, the inventory consisted of 550 units that were 77% completed. How many units were completed during the period?arrow_forward

- Current Attempt in Progress Whispering Winds Corp. has five plants nationwide that cost $275 million. The current fair value of the plants is $460 million. The plants will be reported as assets at $735 million. O $460 million. $275 million. O $185 million.arrow_forwardBased on the following data, what is the amount of current assets? Accounts payable $62000 Accounts receivable 116000 Cash 66000 Intangible assets 116000 Inventory 142000 Long-term investments 161500 Long-term liabilities 199000 Short-term investments 85000 Notes payable 56500 Property, plant, and equipment 132000 Prepaid insurance 2500arrow_forwardCalculate the firm's estimated free cash flowarrow_forward

- #10. Recall that Unique Industries had estimated $1,055,000 of MOH for the year and 64,500 DL hours, resulting in a predetermined MOH rate of $14/DL hour. By the end of the year, the company had actually incurred $925,000 of MOH costs and used a total of 64,000 DL hours on jobs. By how much had Unique Industries overallocated or underallocated MOH for the year? Part 1 Compute the underallocated or overallocated overhead. (Use parentheses or a minus sign for overallocated overhead.) Actual MOH – Allocated MOH = (Over) Under Allocated - =arrow_forwardSterling Equipment Ltd. purchased machinery for $80,000 with a salvage value of $5,000 and a 6-year useful life. The company initially used the straight-line method, but after two years, switched to the double-declining balance method. What is the depreciation expense for Year 3?arrow_forwardHow many units were completed during the period?arrow_forward

- I need correct answer general accounting questionarrow_forwardBased on the following data, what are total liabilities? Accounts payable $65000 Accounts receivable 69000 Cash 75000 Inventory 154000 Buildings 165000 Bonds payable 509000 Supplies 8900 Notes payable 58000 Equipment 367000arrow_forwardAt September 1, 2010, Kern Enterprises reported a cash balance of $45,000. During the month, Kern collected cash of $15,000 and made disbursements of $25,000. At September 31, 2010, what is the cash balance? A. $25,000 credit B. $35,000 credit C. $60,000 debit D. $35,000 debitarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College