Concept explainers

Rework the cash budget and short-term financial plan assuming Keafer changes to a minimum cash balance of $90,000.

KEAFER MANUFACTURING

WORKING CAPITAL MANAGEMENT

You have recently been hired by Keafer Manufacturing to work in its established treasury department. Keafer Manufacturing is a small company that produces highly customized cardboard boxes in a variety of sizes for different purchasers. Adam Keafer, the owner of the company, works primarily in the sales and production areas of the company. Currently, the company basically puts all receivables in one pile and all payables in another, and a part-lime bookkeeper periodically comes in and attacks the piles. Because of this disorganized system, the finance area needs work, and that's what you've been brought in to do.

The company currently has a cash balance of $210,000, and it plans to purchase new machinery in the third quarter at a cost of 5390,000. The purchase of the machinery will be made with cash because of the discount offered for a cash purchase. Adam wants to maintain a minimum cash balance of $135,000 to guard against unforeseen contingencies. All of Keafer’s sales to customers and purchases from suppliers are made with credit, and no discounts are offered or taken.

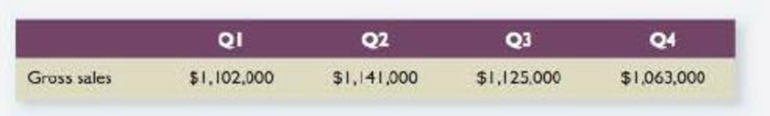

The company had the following sales each quarter of the year just ended:

After some research and discussions with customers, you’re projecting that sales will be 8 percent higher in each quarter next year. Sales for the first quarter of the following year are also expected to grow at 8 percent. You calculate that Keafer currently has an accounts receivable period of 57 days and an accounts receivable balance of $675,000. However, 10 percent of the accounts receivable balance is from a company that has just entered bankruptcy, and it is likely that this portion will never be collected.

You’ve also calculated that Keafer typically orders supplies each quarter in the amount of 50 percent of the next quarter’s projected gross sales, and suppliers are paid in 53 days on average. Wages, taxes, and other costs run about 25 percent of gross sales. The company has a quarterly interest payment of $185,000 on its long-term debt. Finally, the company uses a local bank for its short-term financial needs. It currently pays 1.2 percent per quarter on all short-term borrowing and maintains a

Adam has asked you to prepare a cash budget and short-term financial plan for the company under the current policies. He has also asked you to prepare additional plans based on changes in several inputs.

Want to see the full answer?

Check out a sample textbook solution

Chapter 26 Solutions

CORPORATE FINANCE ACCESS CARD

- King’s Park, Trinidad is owned and operated by a private company,Windy Sports Ltd. You work as the Facilities Manager of the Park andthe CEO of the company has asked you to evaluate whether Windy shouldembark on the expansion of the facility given there are plans by theGovernment to host next cricket championship.The project seeks to increase the number of seats by building fournew box seating areas for VIPs and an additional 5,000 seats for thegeneral public. Each box seating area is expected to generate $400,000in incremental annual revenue, while each of the new seats for thegeneral public will generate $2,500 in incremental annual revenue.The incremental expenses associated with the new boxes and seatingwill amount to 60 percent of the revenues. These expenses includehiring additional personnel to handle concessions, ushering, andsecurity. The new construction will cost $15 million and will be fullydepreciated (to a value of zero dollars) on a straight-line basis overthe 5-year…arrow_forwardYou are called in as a financial analyst to appraise the bonds of Ollie’s Walking Stick Stores. The $5,000 par value bonds have a quoted annual interest rate of 8 percent, which is paid semiannually. The yield to maturity on the bonds is 12 percent annual interest. There are 12 years to maturity. a. Compute the price of the bonds based on semiannual analysis. b. With 8 years to maturity, if yield to maturity goes down substantially to 6 percent, what will be the new price of the bonds?arrow_forwardLonnie is considering an investment in the Cat Food Industries. The $10,000 par value bonds have a quoted annual interest rate of 12 percent and the interest is paid semiannually. The yield to maturity on the bonds is 14 percent annual interest. There are seven years to maturity. Compute the price of the bonds based on semiannual analysis.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning