Average

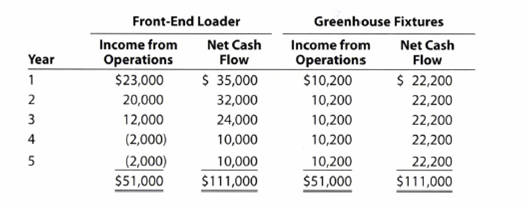

The capital Investment committee of Touch of Eden Landscaping Company is considering two capital investments. The estimated income from operations and net

Each project requires an investment of $60,000. Straight-line

Instructions

1. Compute the following:

a. The average rate of

b. The net present value for each investment. Use the present value of $1 table appearing in this chapter (Exhibit 2). Round present values to the nearest dollar.

2. Prepare a brief report for the capital investment committee, advising it on the relative merits of the two investments .

Trending nowThis is a popular solution!

Chapter 26 Solutions

Accounting (Text Only)

- Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recordedarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- Which of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning