a.

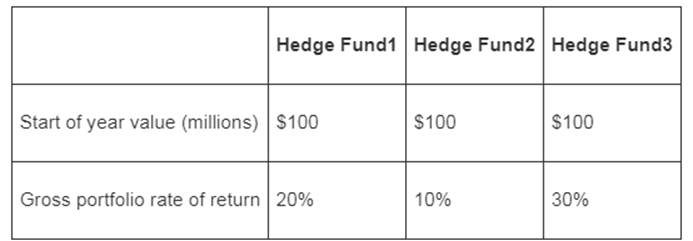

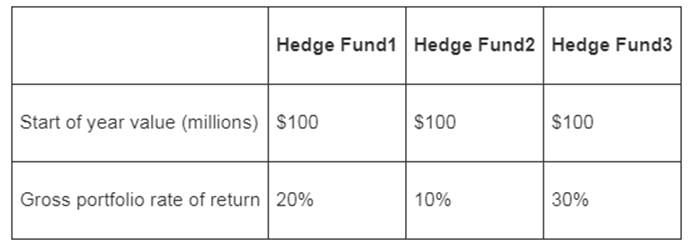

To compute: The

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

b.

Adequate information:

To compute: The value of the investor’s portfolio at the end of the year.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

c.

To evaluate: The investor’s rate of return in SA fund is higher than in FF.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

d.

To compute: The return on the portfolio held by hedge fund.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

e.

Adequate information:

To evaluate: Whether the FF and SA funds will charge incentive fees.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

f.

To evaluate: The reason behind the investor of FF still doing worse than the investor in SA funds.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

Want to see the full answer?

Check out a sample textbook solution

Chapter 26 Solutions

GEN COMBO LOOSELEAF INVESTMENTS; CONNECT ACCESS CARD

- 3. After discussing things with a bank, the family learned that they can (1) refinance the remaining $15 comma 400 amount on the vehicle 1 at 13%, over 4 years, (2) refinance the remaining $8500 loan amount on the vehicle 2 at 13%, over 3 years, (3) refinance the remaining $119 comma 900 loan amount on their home at 5%, over 25 years, and (4) reduce their car insurance payments by $30 per month. Complete the following table. (Round to the nearest cent as needed. Do not include the $ symbol in your answer.) Part 9Part 10Part 11Part 12Part 13Part 14 Item Current Loan Amount New Interest Rate New Term of Loan New Monthly Payment Motor vehicle 1 $ enter your response here enter your response here% enter your response here years $ enter your response here Motor vehicle 2 $ enter your response here enter your response here% enter your response here years $ enter your response here Home $ enter your response here enter your response here%…arrow_forwardConsider the data below for six furniture companies. 2 A Variance- covariance matrix B D E F G H La-Z-Boy Kimball Flexsteel Leggett Miller Shaw Means 3 La-Z-Boy 0.1152 0.0398 0.1792 0.0492 0.0568 0.0989 29.24% 4 Kimball 0.0398 5 Flexsteel 0.1792 6 Leggett 0.0492 0.0649 0.0447 0.0447 0.3334 0.0062 0.0775 0.0062 0.0349 0.0269 20.68% 0.0775 0.0886 0.1487 25.02% 0.1033 0.0191 0.0597 31.64% 7 Miller 8 Shaw 0.0568 0.0349 0.0989 0.0269 0.1487 0.0886 0.0191 0.0594 0.0243 15.34% 0.0597 0.0243 0.1653 43.87% a. Given this matrix, and assuming that the risk-free rate is 0%, calculate the efficient portfolio of these six firms. b. Repeat, assuming that the risk-free rate is 10%. c. Use these two portfolios to generate an efficient frontier for the six furniture companies. Plot this frontier.arrow_forwardNoor HOME PROFILE « CENGAGE MINDTAP Homework - Chapter 9: Stock Valuation Assignment: Homework - Chapter 9: Stock Valuation Questions Problem 9.04 (Nonconstant Growth Valuation) Q Search th Assignment Score: 93 Save Submit Assignment for Grad Question 3 of Check My Work (1 remainin ORDERS 1. RENTALS 2. 3. eBook COURSES 4. 5. 6. Holt Enterprises recently paid a dividend, Do, of $2.75. It expects to have nonconstant growth of 14% for 2 years followed by a constant rate of 4% thereafter. The firm's required return is 8%. a. How far away is the horizon date? I. The terminal, or horizon, date is Year 0 since the value of a common stock is the present value of all future expected dividends at time zero. II. The terminal, or horizon, date is the date when the growth rate becomes nonconstant. This occurs at time zero. Study Tools 7. III. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2. IV. The terminal, or horizon, date…arrow_forward

- 2. These monthly expenses do not include car insurance ($215.00215.00 per month), health insurance ($280.00280.00 per month), or real estate taxes and insurance on their home ($33503350 per year), among other expenses. Find their total monthly outlay for all of these expenses. (Round to the nearest cent as needed. Do not include the $ symbol in your answer.) Part 7 Expenses Monthly Outlay Payments on debt from (a) $enter your response here Car insurance $ Health insurance $ Real estate taxes and insurance on home $ Total $arrow_forwardABC Corporation issued a 10-year 5.85% coupon bond on February 15, 2018. Today is February 15, 2020 and the bond is trading at $1,025.50 (face value $1,000). What is the yield to maturity of this bond?arrow_forwardA couple is struggling to make their monthly payments as they accumulated too much debt. Roberto took on a second job during the evenings and they have been making payments regularly for 8 months. Answer parts 1 through 4. LOADING... Click here to view the Real Estate Amortization Table (Principal and Interest per Thousand Dollars Borrowed). LOADING... Click here to view the Loan Payoff Table. Question content area bottom Part 1 1. Find the monthly payments on each of the following purchases and the total monthly payment. (Round to the nearest cent as needed. Do not include the $ symbol in your answer.) Part 2Part 3Part 4Part 5 Purchase Original Loan Amount Interest Rate Term of Loan Monthly Payment Motor vehicle 1 $18 comma 900 13% 4 years $ enter your response here Motor vehicle 2 $14 comma 500 18% 4 years $ enter your response here Home $126 comma 400 6 and one half % 10 years $ enter your response here 2nd mortgage on home $4000 14% 3 years $ enter your…arrow_forward

- Please Help. All the examples I see have the incorrect answer. The correct answer to this problem is $154,750. I need to know how to get this answer. Specifically, I would like to know how to enter this into a financial calculator, if possible. Thank you! Question: Charlie wants to retire in 15 years, and he wants to have an annuity of $50,000 a year for 20 years after retirement. Charlie wants to receive the first annuity payment the day he retires. Using an interest rate of 8%, how much must Charlie invest today in order to have his retirement annuity (rounded to nearest $10)?arrow_forwardWhat is finance? give fully detailarrow_forwardSolve this financearrow_forward

- Citibank is a US Bank which lost US$500 million due to human error in August 2020. Read the case noted in the link below, and answer the following questions: https://finopsinfo.com/investors/citis-900m-blunder-casts-light-on-poor-loan-ops/ Develop a risk management programme appropriate for this case (use attached template) Explain how compliance to this risk management programme can prevent the operation risk issue experienced by Citibank. Discuss the importance of an internal risk assessment and auditing process in relation to this case Step 1 Risks Brief description & how it relates to the case Step 2 List of possible risks Likelihood/Probability of occurrenceH/M/L or Nil Impact (if occurred)H/M/L or Nil What is being done about it now What more can be done about it Dept. where risk exposure exists Step 3 Risk identified Impact (if occurred)H/M/L Probability of occurrenceH/M/L Dept. where risk…arrow_forwardCitibank is a US Bank which lost US$500 million due to human error in August 2020. Read the case noted in the link below, and answer the following questions: https://finopsinfo.com/investors/citis-900m-blunder-casts-light-on-poor-loan-ops/ Develop a risk management programme appropriate for this case (use attached template) Explain how compliance to this risk management programme can prevent the operation risk issue experienced by Citibank. Discuss the importance of an internal risk assessment and auditing process in relation to this case Step 1 Risks Brief description & how it relates to the case Step 2 List of possible risks Likelihood/Probability of occurrenceH/M/L or Nil Impact (if occurred)H/M/L or Nil What is being done about it now What more can be done about it Dept. where risk exposure exists Step 3 Risk identified Impact (if occurred)H/M/L…arrow_forwardCitibank is a US Bank which lost US$500 million due to human error in August 2020. Read the case noted in the link below, and answer the following questions: https://finopsinfo.com/investors/citis-900m-blunder-casts-light-on-poor-loan-ops/ Develop a risk management programme appropriate for this case (use attached template) Explain how compliance to this risk management programme can prevent the operation risk issue experienced by Citibank. Discuss the importance of an internal risk assessment and auditing process in relation to this casearrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning