Concept explainers

1.

Prepare general journal entries to record transactions (a) through (k) and make compound entries for (b), (d), and (h), with separate debits for each job.

1.

Explanation of Solution

Job order costing is one of the methods of cost accounting under which cost is collected and gathered for each job, work order, or project separately. It is a system by which a factory maintains a separate record of each particular quantity of product that passes through the factory. Job order costing is used when the products produced are significantly different from each other.

Prepare

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| a. | Material | 45,000 | |

| Accounts payable | 45,000 | ||

| (To record the purchase of materials on account.) | |||

| b. | Work in process | 10,000 | |

| Work in process | 11,000 | ||

| Work in process | 9,500 | ||

| Work in process | 12,200 | ||

| Materials | 42,700 | ||

| (To record issuance of direct materials for the job: job no.201,202,203,204) | |||

| c. | Factory | 7,500 | |

| Materials | 7,500 | ||

| (To record the issuance of indirect materials) | |||

| d. | Work in process | 18,000 | |

| Work in process | 19,000 | ||

| Work in process | 20,500 | ||

| Work in process | 17,500 | ||

| Wages payable | 75,000 | ||

| (To record direct labor incurred for the job: job no.201,202,203,204) | |||

| e. | Factory overhead | 11,000 | |

| Wages payable | 11,000 | ||

| (To record the indirect labor charged to production) | |||

| f. | Factory overhead | 7,000 | |

| Cash | 7,000 | ||

| (To record the payment of electricity bill, heating oil, and repairs bills for the factory and charge made to production) | |||

| g. | Factory overhead | 40,000 | |

| | 40,000 | ||

| (To record the depreciation expense on factory equipment) | |||

| h. | Work in process | 15,000 | |

| Work in process | 16,500 | ||

| Work in process | 16,500 | ||

| Work in process | 18,000 | ||

| Factory overhead | 66,000 | ||

| (To record applied factory overhead to the job: job no.201,202,203,204) | |||

| i. | Finished goods (Product C) | 43,000 | |

| Work in process | 43,000 | ||

| (To record the transfer of Job no. 201 to Product C) | |||

| Finished goods (Product D) | 46,500 | ||

| Work in process | 46,500 | ||

| (To record the transfer of Job no.202 to Product D) | |||

| Finished goods (Product E) | 46,500 | ||

| Work in process | 46,500 | ||

| (To record the transfer of Job no.203 to Product E) | |||

| j. | Accounts receivable | 47,000 | |

| Sales | 47,000 | ||

| (To record sale of product C) | |||

| Cost of goods sold | 43,000 | ||

| Finished goods (Product C) | 43,000 | ||

| (To record cost of goods sold on finished goods of Product C) | |||

| Accounts receivable | 49,000 | ||

| Sales | 49,000 | ||

| (To record sale of product D) | |||

| Cost of goods sold | 46,500 | ||

| Finished goods (Product D) | 46,500 | ||

| (To record cost of goods sold on finished goods of Product D) | |||

| k. | Factory overhead | 500 | |

| Cost of goods sold (2) | 500 | ||

| (To record cost of goods sold) |

(Table 1)

Working note:

(1) Calculate the actual factory overhead:

(2) Calculate the cost of goods sold:

2.

2.

Explanation of Solution

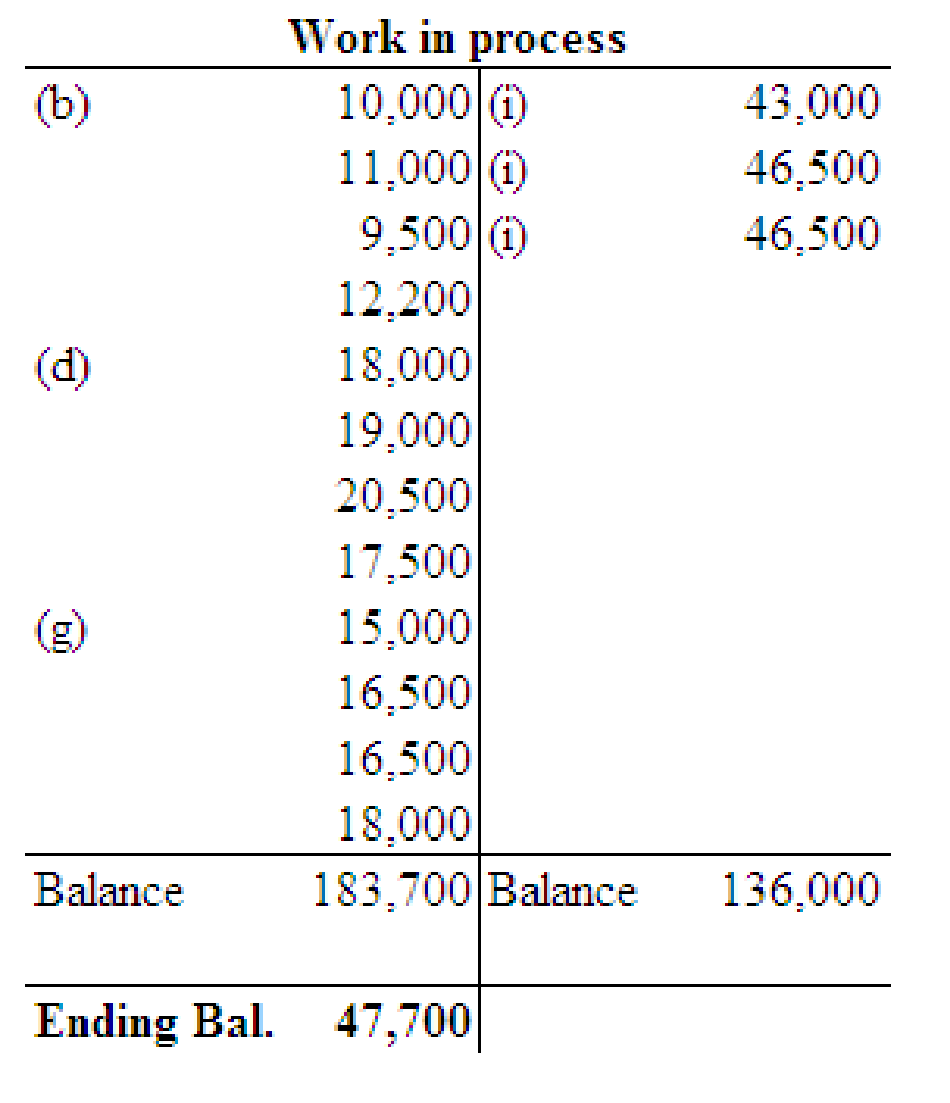

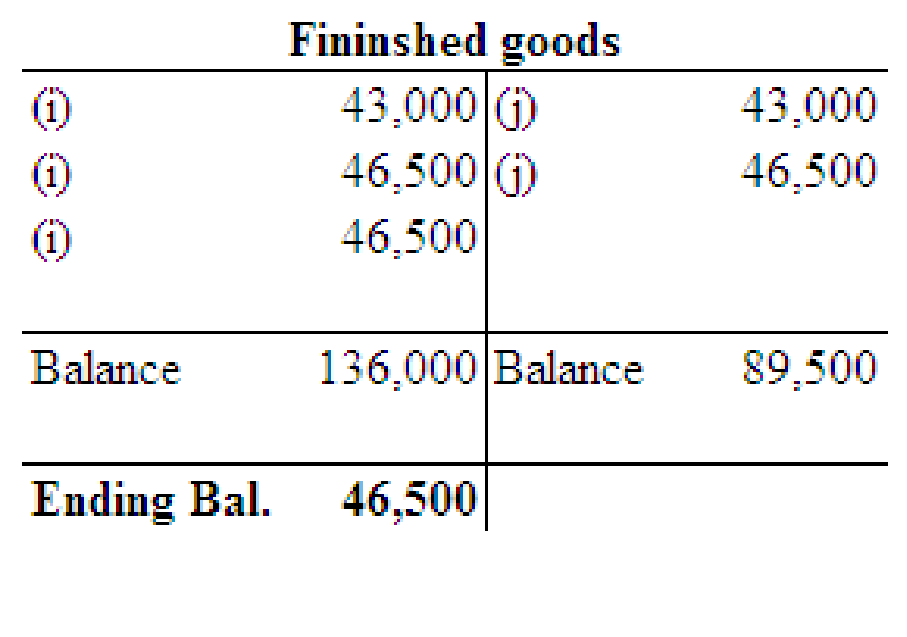

Post the entries to the work in process and finished goods T accounts and determine the ending balances in these accounts.

3.

Compute the balance in the job cost ledger and verify whether the balance agrees with that in the work in process control account.

3.

Explanation of Solution

The balance of the job cost ledger (Job No.204) is $47,700

Want to see more full solutions like this?

Chapter 26 Solutions

College accounting, chapters 1-9

- What is Internal Control in auditing?arrow_forwardWhat is independence of the audit?arrow_forwardBruno Manufacturing uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the total estimated manufacturing overhead was $680,000. At the end of the year, actual direct labor-hours for the year were 42,500 hours, manufacturing overhead for the year was underapplied by $25,500, and the actual manufacturing overhead was $695,000. The predetermined overhead rate for the year must have been closest to: A) $16.00 B) $15.75 C) $16.35 D) $16.94arrow_forward

- What was manufactured overhead?arrow_forwardWhich of the following choices is the correct status of manufacturing overhead at year-end?arrow_forwardMorris Corporation applies manufacturing overhead at the rate of $40 per machine hour. Budgeted machine hours for the current period were anticipated to be 200,000; however, higher than expected production resulted in actual machine hours worked of 225,000. Budgeted and actual manufacturing overhead figures for the year were $8,000,000 and $8,750,000, respectively. On the basis of this information, the company's year-end overhead was: A. overapplied by $250,000 B. underapplied by $250,000 C. overapplied by $750,000 D. underapplied by $750,000arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning