Concept explainers

Introduction:

Contribution Margin:

Contribution Margin is the profit earned from the sale of per unit and is the sum of turnover of the company less their direct sales costs. The margin is computed to measure the company’s ability to pay the fixed costs with the generated revenue after the payment of direct sales costs.

The Company always prefer a product with high contribution margins as they can easily cover the cost of manufacturing a product and generate a profit.

Requirement-1:

To determine:

The contribution margin per machine hour of Sung Company that is generated by each product.

Answer to Problem 5BPSB

Solution:

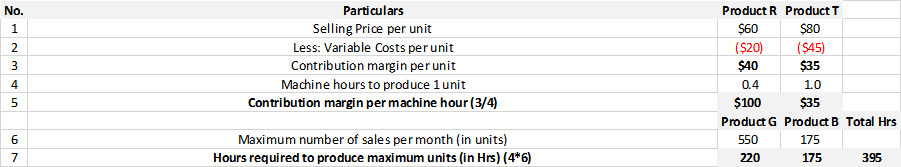

Below table shows the contribution of per machine hour for Project R and Project T.

Explanation of Solution

The contribution margin per machine hour is calculated by using the formula:

Therefore the Contribution Margin per machine hour for the Products R and T are calculated as follows:

Product R:

Given,

Contribution Margin per unit= $40

Machine hours to produce 1 unit= 0.4

Contribution Margin per Unit= $40/0.4=$100

Product T:

Given,

Contribution Margin per unit= $35

Machine hours to produce 1 unit= 1

Contribution Margin per Unit= $35/1=$35

Hence the contribution margin per machine hour for Product R is $100 and Product T is $35.

Requirement-2:

To determine:

The number of units of Products R and Products T produced by the company and total contribution margin , if the company continues to operate with only one shift.

Answer to Problem 5BPSB

Solution:

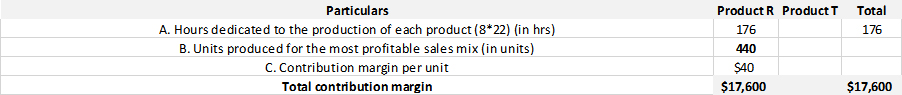

Below table shows the calculation of units produced for the most profitable sales mix and total contribution margin if the company continues with single shift.

Explanation of Solution

Step-1:

The hours dedicated to the production of each product in single shift = 8 Hours * 22 Working Days

The hours dedicated to the production of each product in single shift = 176 hours

Step-2:

Calculation of Units produced for most profitable sales mix when the company continues

with single shift.

Units Produced for the most profitable sales mix is calculated by using the formula:

Therefore the units produced for the most profitable sales mix=176/0.4=440 units

Step-3:

Calculation of contribution margin:

The contribution margin is computed by using the formula below:

Therefore the contribution margin of the product mix =440 units*$40=$17,600.

Hence the total units produced will be 440 units if the company operates in single shift of 8 hours for 22 working days and its total contribution margin is $17,600.

Requirement-3a:

To determine:

The number of units of Product R and T produced by the company and total contribution margin if the company adds another shift in addition to 8 hours.

Answer to Problem 5BPSB

Solution:

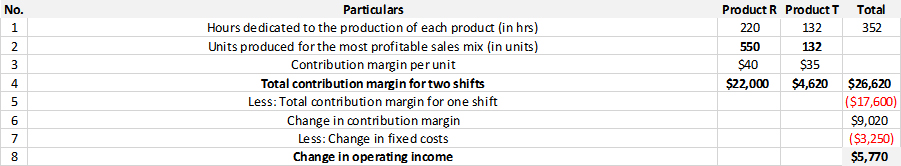

Below table shows the number of units produced by the company when it adds additional shift, total contribution margin in respect to change of shift.

Explanation of Solution

Step-1:

Hours dedicated for the production of products is done based on the ratio of maximum sales unit and machine hours to produce each unit.

Hours dedicated for the production of Product R= 550*0.4=220 hours

Total hours available after adding additional shift=22*16=352 hours

Hours dedicated for the production of Product T= Total hours available-Hours dedicated for the production of Product R

Hours dedicated for the production of Product T=352-220=132 hours

Step-2:

Calculation of Units produced for most profitable sales mix when the company adds additional shift:

Product R:

Units produced for most profitable sales mix =220/0.4=550 Units

Product T:

Units produced for most profitable sales mix =132/1=132 Units

Step-3:

Calculation of Total Contribution Margin:

The contribution margin is computed by using the formula below:

Units produced for the most profitable sales mix*Contribution margin per unit

Contribution Margin for Product R:

Units produced for the most profitable sales mix: 550 Units

Contribution margin per unit: $40

Therefore the contribution margin of Product R is 550 units*$40=$22,000.

Contribution Margin for Product T:

Units produced for the most profitable sales mix: 132 Units

Contribution margin per unit: $35

Therefore the contribution of Product T is 132 units*$35=$4,620.

Therefore the total contribution margin will be $22,000+$4,620=$26,620.

Requirement-3b:

To discuss:

The company whether to prefer adding new shift in addition to existing single shift of 8 hours.

Answer to Problem 5BPSB

Solution:

Yes, the company should add the new shift in addition to the existing shift of 8 hours.

Explanation of Solution

Increase in additional shift of 8 hours per day promotes the increase in productivity of the Sung Company to 682 Units compared to productivity of 440 units when it operates in single shift.

Requirement-4:

To discuss:

The company whether to pursue the marketing strategy by spending $4,500 additional costs to increase the maximum sales to 675 units of Product R by doubling the shift.

Answer to Problem 5BPSB

Solution:

No, the company should not pursue this marketing strategy with additional costs as this leads to the operating loss of the company.

Explanation of Solution

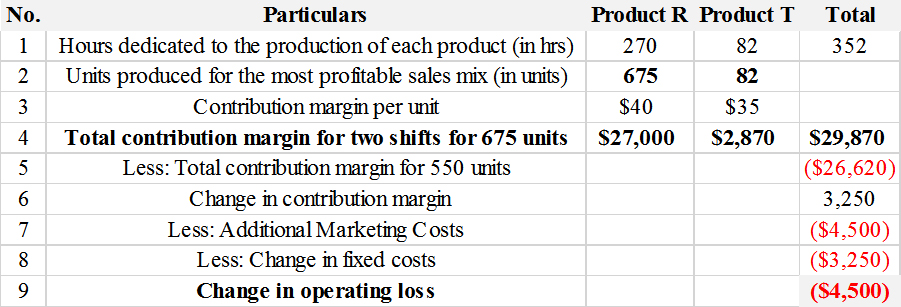

Below table shows the calculation for products by doubling the shifts and increasing the marketing costs by $4,500 to increase the maximum sales of Product R to 675 units.

Hours dedicated for the production of Product R= 675*0.4=270 hours

Total hours available after adding additional shift=22*16=352 hours

Hours dedicated for the production of Product T= Total hours available-Hours dedicated for the production of Product R

Hours dedicated for the production of Product T=352-270=82 hours

There is an operating loss of sales mix for the company of $4,500 and hence the idea of doubling the shift and spending additional costs for marketing to increase sales is not advisable to the management to proceed with.

Want to see more full solutions like this?

Chapter 25 Solutions

Connect Access Card for Fundamental Accounting Principles

- I need assistance with this financial accounting question using appropriate principles.arrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forwardCan you explain the process for solving this financial accounting problem using valid standards?arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forward

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardWhen incorporating his sole proprietorship, Joe transfers all of its assets and liabilities. Included in the $30,000 of liabilities assumed by the corporation is $500 that relates to a personal expenditure. Under these circumstances, the entire $30,000 will be treated as boot. / Provide explanation please a. True b. Falsearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education