Concept explainers

Introduction:

Contribution Margin:

Contribution Margin is the profit earned from the sale of per unit and is the sum of turnover of the company less their direct sales costs. The margin is computed to measure the company’s ability to pay the fixed costs with the generated revenue after the payment of direct sales costs.

The Company always prefer a product with high contribution margins as they can easily cover the cost of manufacturing a product and generate a profit.

Requirement-1:

To determine:

The contribution margin per machine hour of Edgerron Company that is generated by each product.

Answer to Problem 5APSA

Solution:

Explanation of Solution

The contribution margin per machine hour is calculated by using the formula:

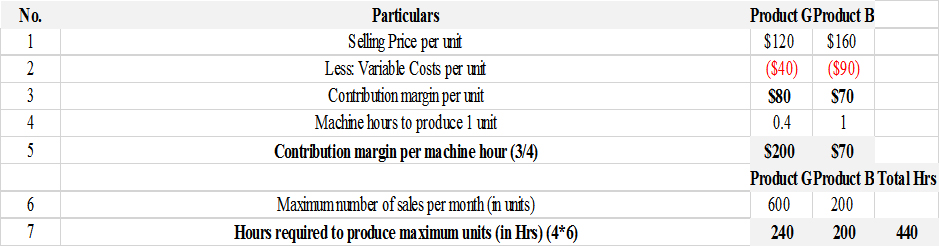

Therefore the Contribution Margin per machine hour for the Products G and B are calculated as follows:

Product G:

Given,

Contribution Margin per unit= $80

Machine hours to produce 1 unit= 0.4

Contribution Margin per Unit= $80/0.4=$200

Product B:

Given,

Contribution Margin per unit= $70

Machine hours to produce 1 unit= 1

Contribution Margin per Unit= $70/1=$70

Hence the contribution margin per machine hour for Product G is $200 and Product B is $70.

Requirement-2:

To determine:

The number of units of Products G and Products B produced by the company and total contribution margin , if the company continues to operate with only one shift.

Answer to Problem 5APSA

Solution:

Explanation of Solution

Step-1:

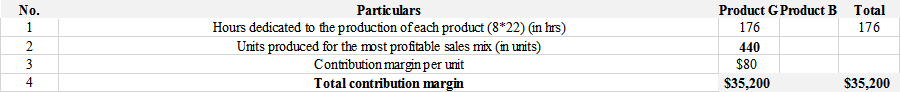

The hours dedicated to the production of each product in single shift = 8 Hours * 22 Working Days

The hours dedicated to the production of each product in single shift = 176 hours

Step-2:

Calculation of Units produced for most profitable sales mix when the company continues

with single shift.

Units Produced for the most profitable sales mix is calculated by using the formula:

Therefore the units produced for the most profitable sales mix=176/0.4=440 units

Step-3:

Calculation of contribution margin:

The contribution margin is computed by using the formula below:

Units produced for the most profitable sales mix*Contribution margin per unit

Therefore the contribution margin of the product =440 units*$80=$35,200

Hence the total units produced will be 440 units if the company operates in single shift of 8 hours for 22 working days and its total contribution margin is $35,200.

Requirement-3a:

To determine:

The number of units of Product G and B produced by the company and total contribution marginif the company adds another shift in addition to 8 hours.

Answer to Problem 5APSA

Solution:

Below table shows the number of units produced by the company when it adds additional shift, total contribution margin in respect to change of shift.

Explanation of Solution

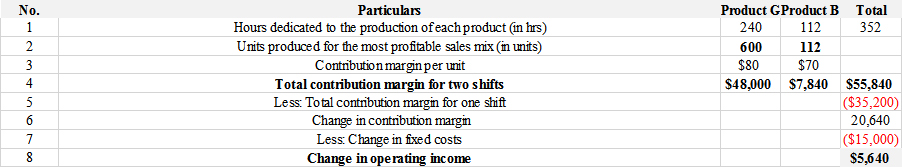

Step-1:

Hours dedicated for the production of products is done based on the ratio of maximum sales unit and machine hours to produce each unit.

Hours dedicated for the production of Product G= 600*0.4=240 hours

Total hours available after adding additional shift=22*16=352 hours

Hours dedicated for the production of Product B=352-240=112 hours

Step-2:

Calculation of Units produced for most profitable sales mix when the company adds additional shift:

Product G:

Units produced for most profitable sales mix =240/0.4=600 Units

Product B:

Units produced for most profitable sales mix =112/1=112 Units

Step-3:

Calculation of Total Contribution Margin:

The contribution margin is computed by using the formula below:

Contribution Margin for Product G:

Units produced for the most profitable sales mix: 600 Units

Contribution margin per unit: $80

Therefore the contribution margin of Product G is 600 units*$80=$48,000.

Contribution Margin for Product B:

Units produced for the most profitable sales mix: 112 Units

Contribution margin per unit: $70

Therefore the contribution of Product B is 112 units*$70=$7,840.

Therefore the total contribution margin will be $48,000+$7,840=$55,840.

Requirement-3b:

To discuss:

The company whether to prefer adding new shift in addition to existing single shift of 8 hours.

Answer to Problem 5APSA

Solution:

Yes, the company should add the new shift in addition to the existing shift of 8 hours.

Explanation of Solution

Increase in additional shift of 8 hours per day promotes the increase in productivity of the Edgerron Company to 712 Units compared to productivity of 440 units when it operates in single shift.

Requirement-4:

To discuss:

The company whether to pursue the marketing strategy by spending $12,000 additional costs to increase the maximum sales to 700 units of Product G by doubling the shift.

Answer to Problem 5APSA

Solution:

No, the company should not pursue this marketing strategy with additional costs as this leads to the operating loss of the company.

Explanation of Solution

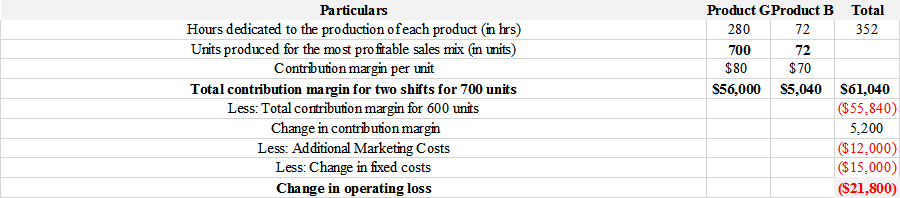

Below table shows the calculation for products by doubling the shifts and increasing the marketing costs by $12,000 to increase the maximum sales to 700 units.

Hours dedicated for the production of Product G= 700*0.4=280 hours

Total hours available after adding additional shift=22*16=352 hours

Hours dedicated for the production of Product B=352-280=72 hours

Thereis an operating loss of sales mix for the company of $21,800 and hence the idea of doubling the shift and spending additional costs for marketing to increase sales is not advisable to the management to proceed with.

Want to see more full solutions like this?

Chapter 25 Solutions

FUNDAMENTAL ACCT PRIN TEXT+CONNECT CODE

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education