MASTERY PROBLEM

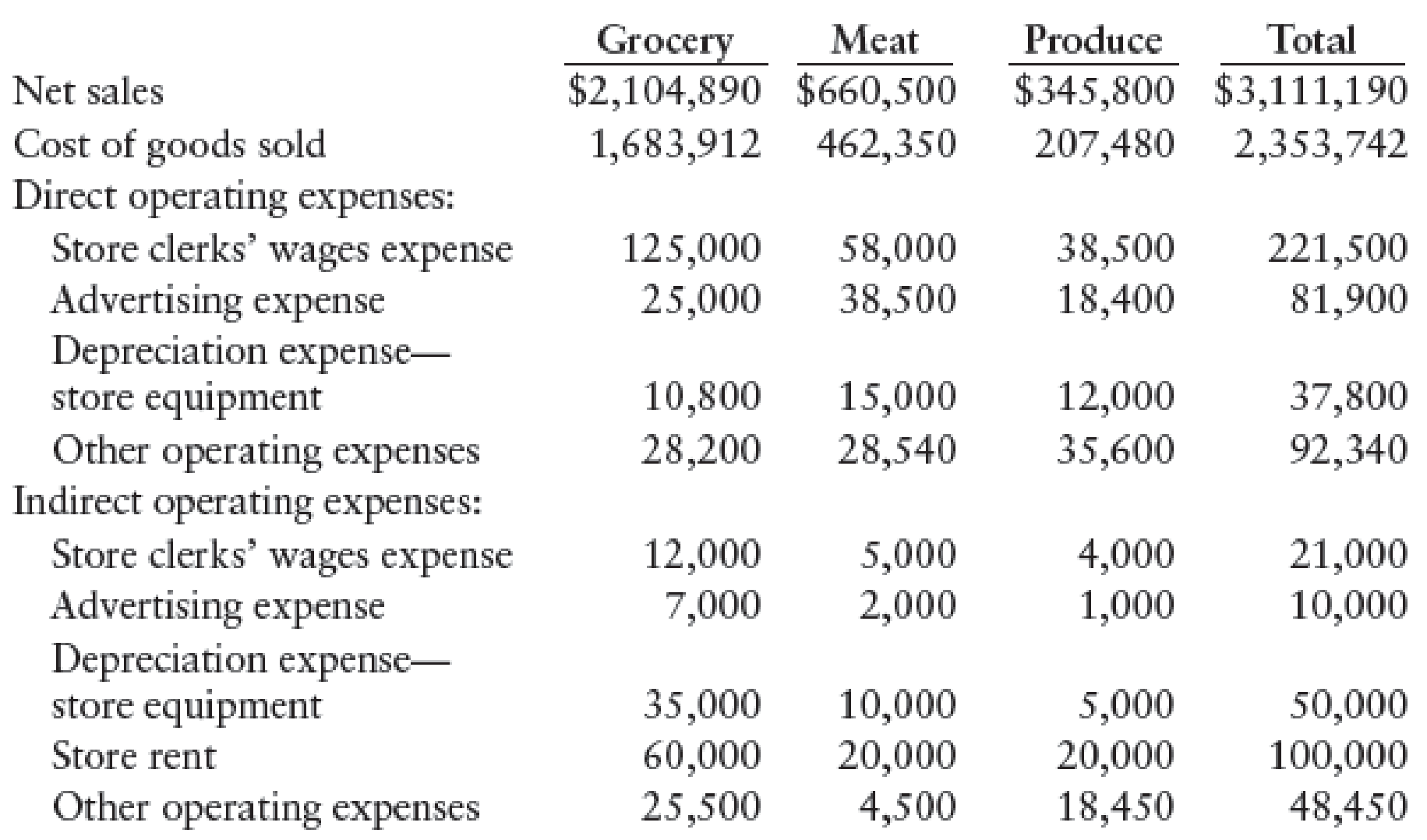

Bob’s Acme Supermarket has been in operation for many years, offering high-quality groceries, produce, and meat at reasonable prices. Accounting records are maintained on a departmental basis with assignment of direct expenses and allocation of indirect expenses through the use of various procedures. Selected operating information for the year ended December 31, 20--, is as follows:

REQUIRED

1. (a) Prepare an income statement showing departmental operating income.

(b) Compute the gross profit percentage and operating income percentage for each department (round to the nearest tenth of a percent).

2. (a) Prepare an income statement showing departmental and total direct operating margins.

(b) Compute the departmental direct operating margin percentage for each department (round to the nearest tenth of a percent).

3. Should Bob be concerned about the profitability of the three departments? Should any of the departments be discontinued?

1-a

Prepare an income statement for A Supermarket for the year ended December 31, 20--, showing the departmental operating income.

Explanation of Solution

Departmental operating income: The departmental income statement reports the departmental operating income, which is the excess of departmental gross profit over the operating expenses incurred.

Formula for departmental operating income:

Prepare an income statement for A Supermarket for the year ended December 31, 20--, showing the departmental operating income.

| A Supermarket | ||||

| Income Statement | ||||

| For the Year Ended December 31, 20-- | ||||

| Grocery | Meat | Produce | Total | |

| Sales | $2,104,890 | $660,500 | $345,800 | $3,111,190 |

| Cost of goods sold | 1,683,912 | 462,350 | 207,480 | 2,353,742 |

| Gross profit | $420,978 | $198,150 | $138,320 | $757,448 |

| Operating expenses: | ||||

| Store clerks’ wages expense | $137,000 | $63,000 | $42,500 | $242,500 |

| Advertising expense | 32,000 | 40,500 | 19,400 | 91,900 |

| Depreciation expense-Equipment | 45,800 | 25,000 | 17,000 | 87,800 |

| Store rent | 60,000 | 20,000 | 20,000 | 100,000 |

| Other operating expenses | 53,700 | 33,040 | 54,050 | 140,790 |

| Total operating expenses | 328,500 | 181,540 | 152,950 | 662,990 |

| Operating income | $92,478 | $16,610 | $(14,630) | $94,458 |

Table (1)

Thus, the income statement of A Supermarket shows a departmental operating income (loss) of $92,478 and $16,610, and $(14,630) for grocery, meat, and produce departments respectively.

b.

Ascertain the gross profit percentage and operating income percentage for all the departments.

Explanation of Solution

Gross profit percentage: The percentage of gross profit generated by every dollar of net sales is referred to as gross profit percentage. This ratio measures the profitability of a company by quantifying the amount of income earned from sales revenue generated after cost of goods sold are paid. The higher the ratio, the more ability to cover operating expenses.

Formula to compute gross profit percentage:

Operating income percentage: This ratio gauges the operating profitability by quantifying the amount of operating income earned from business operations from the sales generated.

Formula of operating income percentage:

Ascertain the departmental gross profit percentage for all the departments.

| Departments | Departmental Gross Profit | ÷ | Sales | = | Departmental Gross Profit Percentage |

| Grocery | $420,978 | ÷ | $2,104,890 | = | 20% |

| Meat | 198,150 | ÷ | 660,500 | = | 30% |

| Produce | 138,320 | ÷ | 345,800 | = | 40% |

Table (2)

Note: Refer to Table (1) for the value and computation of departmental gross profit for all the departments.

Ascertain the operating income percentage for both the departments.

| Departments | Operating Income | ÷ | Sales | = | Operating Income Percentage |

| Grocery | $92,478 | ÷ | $2,104,890 | = | 4.4% |

| Meat | 16,610 | ÷ | 660,500 | = | 2.5% |

| Produce | (14,630) | ÷ | 345,800 | = | (4.2)% |

Table (3)

Note: Refer to Table (1) for the value and computation of operating income for all the departments.

Thus, the departmental gross profit percentage of Departments Grocery, Meat, and Produce is 20%, 30%, and 40%, and the operating income percentage of Departments Grocery, Meat, and Produce is 4.4%, 2.5% and (4.2)%.

2-a

Prepare an income statement for A Supermarket for the year ended December 31, 20--, showing the departmental direct operating margin for all the departments and the total company.

Explanation of Solution

Departmental direct operating margin: The departmental income statement reports the departmental direct operating margin, which is the excess of departmental gross profit over the direct operating expenses incurred.

Formula for departmental direct operating margin:

Prepare an income statement for A Supermarket for the year ended December 31, 20--, showing the departmental direct operating margin for all the departments and the total company.

| A Supermarket | ||||

| Income Statement | ||||

| For the Year Ended December 31, 20-- | ||||

| Grocery | Meat | Produce | Total | |

| Sales | $2,104,890 | $660,500 | $345,800 | $3,111,190 |

| Cost of goods sold | 1,683,912 | 462,350 | 207,480 | 2,353,742 |

| Gross profit | $420,978 | $198,150 | $138,320 | $757,448 |

| Direct operating expenses: | ||||

| Store clerks’ wages expense | $125,000 | $58,000 | $38,500 | $221,500 |

| Advertising expense | 25,000 | 38,500 | 18,400 | 81,900 |

| Depreciation expense-Equipment | 10,800 | 15,000 | 12,000 | 37,800 |

| Other operating expenses | 28,200 | 28,540 | 35,600 | 92,340 |

| Total operating expenses | 189,000 | 140,040 | 104,500 | 433,540 |

| Direct operating margin | $231,978 | $58,110 | $33,820 | $323,908 |

| Indirect operating expenses: | ||||

| Store clerks’ wages expense | $21,000 | |||

| Advertising expense | 10,000 | |||

| Depreciation expense-Equipment | 50,000 | |||

| Store rent | 100,000 | |||

| Other operating expenses | 48,450 | |||

| Total operating expenses | 229,450 | |||

| Operating income | $94,458 | |||

Table (4)

Thus, the income statement of A Supermarket shows a departmental direct operating margin of $231,978 and $58,110, and $33,820 for grocery, meat, and produce departments respectively, and total operating income of $94,458.

b.

Compute the departmental direct operating margin percentage of all the departments.

Explanation of Solution

Direct operating margin percentage: This ratio gauges the operating profitability by quantifying the amount of direct operating income earned from business operations from the sales generated.

Formula of direct operating margin percentage:

Ascertain the direct operating margin percentage for all the departments.

| Departments | Direct Operating Margin | ÷ | Sales | = | Direct Operating Margin Percentage |

| Grocery | $231,978 | ÷ | $2,104,890 | = | 11.0% |

| Meat | 58,110 | ÷ | 660,500 | = | 8.8% |

| Produce | 33,820 | ÷ | 345,800 | = | 9.8% |

Table (5)

Note: Refer to Table (4) for the value and computation of direct operating margin for all the departments.

Thus, the departmental direct operating margin percentage of grocery, meat, and produce departments is 11.0%, 8.8%, and 9.8% respectively.

3.

Explain whether B should be concerned about the profitability of A Supermarket and whether to discontinue any of the departments.

Explanation of Solution

B should not concerned of the profitability of any of the departments of A Supermarket because the operating income of the department produce might not be effective, but the direct operating margin of the department is $33,820. So, produce department should not be discontinued because the operating income of the company would be reduced by $33,820, the direct operating margin of the produce department.

Thus, none of the departments should be discontinued.

Want to see more full solutions like this?

Chapter 25 Solutions

COLLEGE ACCOUNTING CH. 1-9 (LOW COST)

- Development costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardwhat are the Five List of Michael Porter's 5 Force Framework that describes the competitive dynamics of a firm and the industry they are in?arrow_forward

- Hello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwarddefine each item below: A competitive advantage. 2) Data incorporation. 3) Financial Statement Analysis. 4) Product Differentiation. 5) Strategic positioning for a business firmarrow_forwardHello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- Which of the following is true about contra revenue accounts like Sales Returns and Allowances?A. They increase total revenueB. They have a normal credit balanceC. They reduce gross salesD. They increase net income helparrow_forwardWhich of the following is true about contra revenue accounts like Sales Returns and Allowances?A. They increase total revenueB. They have a normal credit balanceC. They reduce gross salesD. They increase net incomearrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 9. In a bank reconciliation, a bank service charge would be:A. Deducted from the book balanceB. Added to the bank balanceC. Deducted from the bank balanceD. Ignoredarrow_forwardWhich statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statement need helparrow_forward10. Which statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statementhelp mearrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning