Analyze Pacific Airways

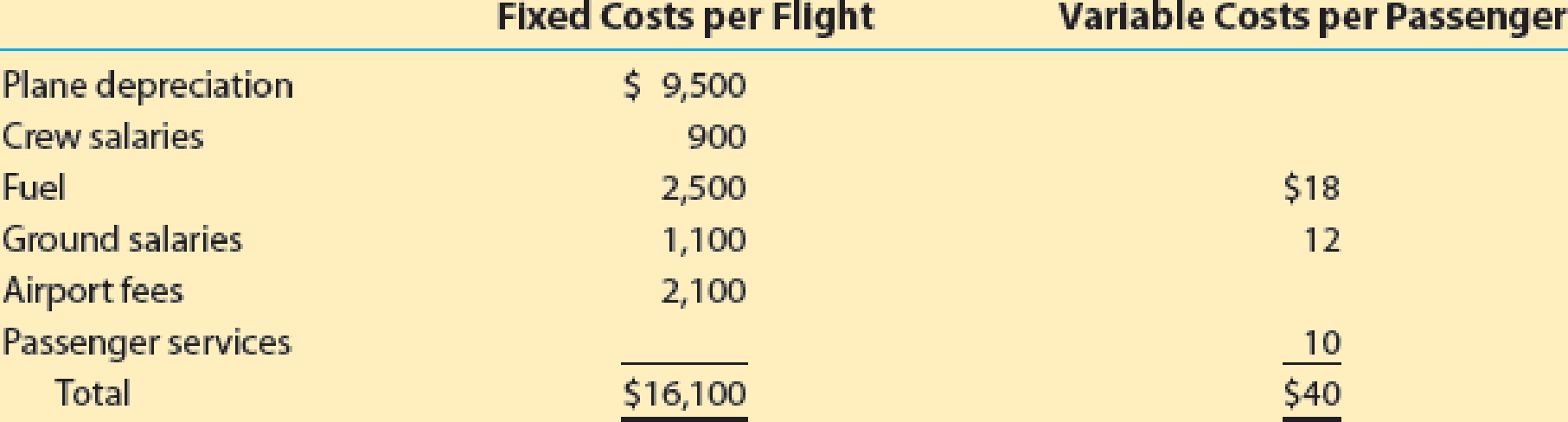

Pacific Airways provides air travel services between Los Angeles and Seattle. Cost information per flight is as follows:

Each flight has a capacity of 150 seats, with an average of 125 seats sold per flight at an average ticket price of $180. Assume Pacific Airways is considering a new service that would provide tickets at half price. Passengers would need to fly standby to receive the discount, but would be provided a flight for a given day of travel. An analysis revealed that an average of 8 existing passengers would use the new discounted tickets for travel. In addition, 15 new passengers would be attracted to the offer.

- a. Determine the contribution margin per passenger for the full-priced ticket.

- b. Determine the break-even number of seats sold per flight.

- c. Determine the contribution margin per passenger for discounted tickets.

- d. Should Pacific Airways offer the discounted ticket plan? Answer the question by computing the incremental contribution margin per flight for the plan.

a.

Compute the contribution margin per passenger for the full-priced ticket.

Explanation of Solution

Contribution Margin: The amount of sales revenue remained after the variable costs are incurred is called contribution margin. In other words, contribution margin is the surplus amount of revenue over variable costs.

The following is the formula to calculate the contribution margin:

Contribution Margin = Sales – Variable cost

Calculate the contribution margin per passenger.

The contribution margin per passenger at full fare is $140.

b.

Compute the break-even number of seats sold per flight.

Explanation of Solution

Break-even: Break even refers to the point where the production can yield all the costs involved and any further production contributes to the profit.

Calculate the break even seats per flight.

The break even seats per flight are 115 seats.

c.

Compute the contribution margin per passenger for the discounted tickets.

Explanation of Solution

Contribution Margin: The amount of sales revenue remained after the variable costs are incurred is called contribution margin. In other words, contribution margin is the surplus amount of revenue over variable costs.

Calculate the contribution margin per passenger.

The contribution margin per passenger at discounted fare is $50.

d.

Compute the incremental contribution margin per flight to decide on the proposal to allow discount.

Explanation of Solution

Contribution Margin: The amount of sales revenue remained after the variable costs are incurred is called contribution margin. In other words, contribution margin is the surplus amount of revenue over variable costs.

Calculate the incremental contribution margin per flight.

The incremental contribution margin per flight is $30.

Working Note (1):

Calculate the lost contribution margin from customers switching tickets.

Working Note (2):

Calculate the gained contribution margin from discount customers.

Differential Analysis: Differential analysis refers to the analysis of differential revenue which a company could gain or differential cost which a company could incur based on the available alternative options of business.

Prepare the differential analysis table to analyze the effect of the new plan:

| Differential Analysis of Company PA | |||

| Continue with No Change (Alt. 1) or Offer the Discount Plan (Alt. 2) | |||

| February 5 | |||

| Particulars | No Change (Alternative 1) | Discount Plan (Alternative 2) | Differential Effect (Alternative 2) |

| Revenues per flight | (3) $22,500 | (4) $23,130 | $630 |

| Costs per flight: | |||

| Plane depreciation | ($9,500) | ($9,500) | $0 |

| Crew salaries | ($900) | ($900) | $0 |

| Fuel | (5) ($4,750) | (6) ($5,020) | ($270) |

| Ground salaries | (7) ($2,600) | (8) ($2,780) | ($180) |

| Airport fees | ($2,100) | ($2,100) | $0 |

| Passenger services | (9) ($1,250) | (10) ($1,400) | ($150) |

| Income per flight | $1,400 | $1,430 | $30 |

Table (1)

The differential analysis of Company PA shows that the offer of Discount plan, has a greater differential income of $30.

Working Note (3):

Calculate the revenue per flight for existing plan.

Working Note (4):

Calculate the revenue per flight for new plan.

Working Note (5):

Calculate the fuel price for existing plan.

Working Note (6):

Calculate the fuel price for new plan.

Working Note (7):

Calculate the ground salaries for existing plan.

Working Note (8):

Calculate the ground salaries for new plan.

Working Note (9):

Calculate the passenger services cost for existing plan.

Working Note (10):

Calculate the passenger services cost for new plan.

Want to see more full solutions like this?

Chapter 25 Solutions

Financial and Managerial Accounting

- Can you solve this general accounting problem using accurate calculation methods?arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardGoodwill is an example of an indefinite-life intangible asset, meaning that public companies must test it for impairment rather than regularly amortizing to systematically reduce its value on the balance sheet of the public company. Can anyone recap the difference between limited-life versus indefinite-life intangible assets? Any specific examples of either category?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College