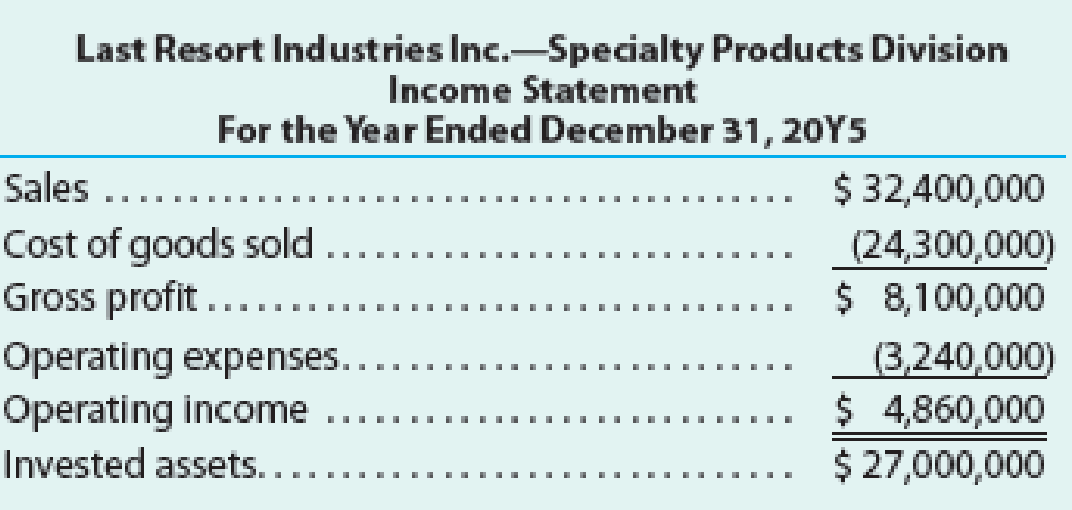

Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows:

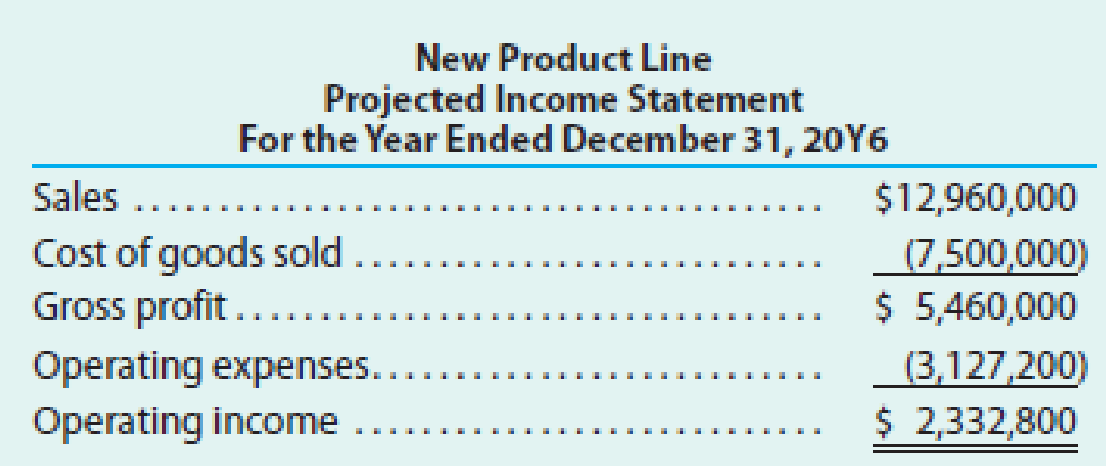

The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $14,400,000. A

The Specialty Products Division currently has $27,000,000 in invested assets, and Last Resort Industries Inc.’s overall

The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line.

- a. Determine the return on investment for the Specialty Products Division for the past year.

- b. Determine the Specialty Products Division manager’s bonus for the past year.

- c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places.

- d.

Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5.

Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. - e.

Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.

Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.

Trending nowThis is a popular solution!

Chapter 24 Solutions

Financial and Managerial Accounting - Workingpapers

- compared to the individual risks of constituting assets. Question 5 (6 marks) The common shares of Almond Beach Inc, have a beta of 0.75, offer a return of 9%, and have an historical standard deviation of return of 17%. Alternatively, the common shares of Palm Beach Inc. have a beta of 1.25, offer a return of 10%, and have an historical standard deviation of return of 13%. Both firms have a marginal tax rate of 37%. The risk-free rate of return is 3% and the expected rate of return on the market portfolio is 9½%. 1. Which company would a well-diversified investor prefer to invest in? Explain why and show all calculations. 2. Which company Would an investor who can invest in the shares of only one firm prefer to invest in? Explain why. RELEASED BY THE CI, MGMT2023, MARCH 2, 2025 5 Use the following template to organize and present your results: Theoretical CAPM Actual offered prediction for expected return (%) return (%) Standard deviation of return (%) Beta Almond Beach Inc. Palm Beach…arrow_forwardprovide correct answerarrow_forwardPlease solve. The screen print is kind of split. Please look carefully.arrow_forward

- Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardCoronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardThe completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College