Profit center responsibility reporting

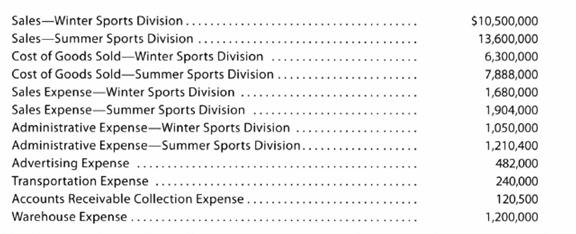

XSport Sporting Goods Co. operates two divisions-the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the

The bases to be used in allocating expenses, together with other essential information, are as follows:

a. Advertising expense-incurred at headquarters, charged back to divisions on the basis of usage: Winter Sports Division, $216,900; Summer Sports Division, $265,100.

b. Transportation expense-charged back to divisions at a charge rate of $8.00 per bill of lading: Winter Sports Division, 14,400 bills of lading; Summer Sports Division, 15,600 bills of lading.

c.

d. Warehouse expense-charged back to divisions on the basis of floor space used in storing division products: Winter Sports Division, 94,000 square feet; Summer Sports Division, 106,000 square feet.

Prepare a divisional income statement with two column headings: Winter Sports Division and Summer Sports Division. Provide supporting calculations for service department charges.

Want to see the full answer?

Check out a sample textbook solution

Chapter 24 Solutions

Bundle: Accounting, Loose-Leaf Version, 26th + CengageNOWv2, 2 term Printed Access Card

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardHow do milestone payments affect contract revenue recognition? a) Accrue when milestone achieved b) Recognize at contract completion c) Record when cash received d) Spread evenly over contract. MCQarrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning