Gen Combo Looseleaf Principles Of Corporate Finance With Connect Access Card

13th Edition

ISBN: 9781260695991

Author: Richard A Brealey

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 24, Problem 18PS

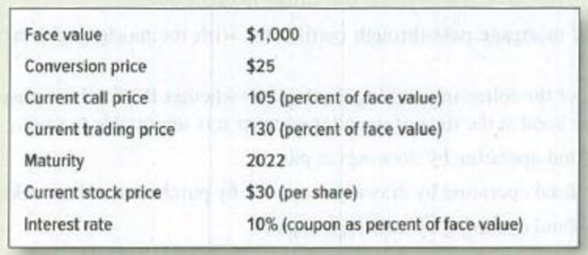

Convertible bonds The Surplus Value Company had $10 million (face value) of convertible bonds outstanding in 2015. Each bond has the following features.

- a. What is the bond’s conversion value?

- b. Can you explain why the bond is selling above conversion value?

- c. Should Surplus call? What will happen if it does so?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

file:///C:/Users/rafan/Downloads/Assignment%201%20Paving%20Company%20Case%20S2%202024%20to%202025.pdf

Using the link for the fraud case answer only this question below.

b) As discussed in units 1 to 4, all frauds involve key elements. Identify and describe usingexamples, the elements of Sharp’s fraud.

Option should be match

experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer.

i will give unhelpful if answer will not match in option.

dont use AI also

Option should be match.

please don't use ai

if option will not match means answer is incorrect .

Ai giving incorrect answer

Chapter 24 Solutions

Gen Combo Looseleaf Principles Of Corporate Finance With Connect Access Card

Ch. 24 - Bond terms Use Table 24.1 (but not the text) to...Ch. 24 - Bond terms Look at Table 24.1: a. The AMAT bond...Ch. 24 - Bond terms Select the most appropriate term from...Ch. 24 - Prob. 5PSCh. 24 - Bond terms Bond prices can fall either because of...Ch. 24 - Security and seniority a. As a senior bondholder,...Ch. 24 - Prob. 8PSCh. 24 - Prob. 9PSCh. 24 - Security and seniority a. Residential mortgages...Ch. 24 - Sinking funds For each of the following sinking...

Ch. 24 - Call provisions a. Look at Table 24.1. Suppose...Ch. 24 - Covenants Alpha Corp. is prohibited from issuing...Ch. 24 - Prob. 14PSCh. 24 - Private placements Explain the three principal...Ch. 24 - Convertible bonds True or false? a. Convertible...Ch. 24 - Convertible bonds Maple Aircraft has issued a 4%...Ch. 24 - Convertible bonds The Surplus Value Company had 10...Ch. 24 - Prob. 19PSCh. 24 - Convertible bonds Iota Microsystems 10%...Ch. 24 - Convertible bonds Zenco Inc. is financed by 3...Ch. 24 - Prob. 22PSCh. 24 - Prob. 23PSCh. 24 - Bank loans, commercial paper, and medium-term...Ch. 24 - Prob. 25PSCh. 24 - Tax benefits Dorlcote Milling has outstanding a 1...Ch. 24 - Convertible bonds This question illustrates that...Ch. 24 - Prob. 28PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Option should be match. please don't use ai if option will not match means answer is incorrect . Ai giving incorrect answerarrow_forwardall frauds involve key elements. Identify and describe usingexamples the elements of fraudarrow_forwardSolve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) Note: Do not round intermediate calculations. Round your final answers to the nearest cent. face value(principal) $50000rate interest:11%length of note: 95 days maturity value: ?date of note: june 10date note discounted: July 18discount period:?bank discount:?proceeds:?arrow_forward

- What are the different types of audits and different types of auditors? WHat is an example of each type of audit? What is the significance of each from the perspective of different stakeholders?arrow_forwardDrill Problem 11-5 (Static) [LU 11-2 (1, 2)]Solve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) Note: Do not round intermediate calculations. Round your final answers to the nearest cent. face value(principal) $50000rate interest =11% length of note= 95 days maturity value=?date of note=june 10date note discounted= July 18discount period=?bank discount=?proceeds=?arrow_forwardSolve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) Note: Do not round intermediate calculations. Round your final answers to the nearest cent.face value(principal) $50000rate interest =11%maturity value=?date of note =june 10date note discounted= July 18discount period=?bank discount=?proceeds=? i need an explanation I am having a lot of trouble to solve thisarrow_forward

- many experts giving wrong solAnswer should be match in options. Many experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer. i will give unhelpful if answer will not match in option. dont use AI alsoarrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information inits income statement:Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400;Depreciation expense = $79,000;Interest expense= $53,555;Taxes = $76,000;Dividends = $69,000.$136,700 worth of new shares were also issued during the year andlong-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capitalarrow_forwardQuestion 3 Footfall Manufacturing Ltd. reports the following financial information at the end of the current year: Net Sales $100,000 Debtor's turnover ratio (based on 2 net sales) Inventory turnover ratio 1.25 Fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% Gross profit margin 25% Return on investment 2% Use the given information to fill out the templates for income statement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year ending December 31, 20XX (in $) Sales 100,000 Cost of goods sold Gross profit Other expenses Earnings before tax Tax @50% Earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX (in $) Liabilities Amount Assets Amount Equity Net fixed assets Long term 50,000 Inventory debt Short term debt Debtors Cash TOTAL TOTALarrow_forward

- Toodles Inc. had sales of $1,840,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.) Arrange the financial information for Toodles Inc. in an income statement and compute its OCF? All computations must be done and shown manually. Kindly no spreadsheetcomputations. So that I am able to follow and understand clearly please.arrow_forwardJingle Ltd. and Bell Ltd. belong to the same industry. A snapshot of some of their financial information is given below: Jingle Ltd. Bell Ltd. Current ratio 3.2 1 2 1 Acid-test ratio 1.7 1 1.1 1 Debt Equity ratio 30% 40% Times interest earned 6 5 You are a loans officer and both companies have asked for an equal 2-year loan. i) ii) If you could facilitate only one loan, which company would you refuse? Explain your reasoning briefly If both companies could be facilitated, would you be willing to do so? Explain your argument briefly.arrow_forwardWaterfront Inc. wishes to borrow on a short-term basis withoutreducing its current ratio below 1.25. At present its current assetsand current liabilities are $1,600 and $1,000 respectively. How muchcan Waterfront Inc. borrow?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

What happens to my bond when interest rates rise?; Author: The Financial Pipeline;https://www.youtube.com/watch?v=6uaXlI4CLOs;License: Standard Youtube License