Concept explainers

EXPANDED STATEMENT OF

Additional information:

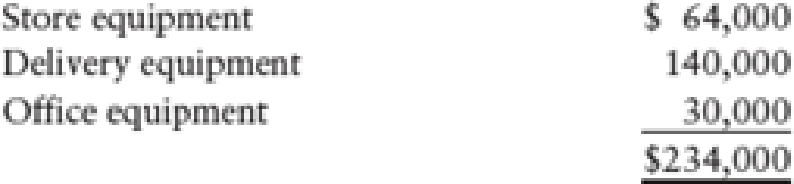

1. Store equipment was sold in 20-2 for $35,000. Additional information on the store equipment sold is provided below.

2.

3. The following purchases were made for cash:

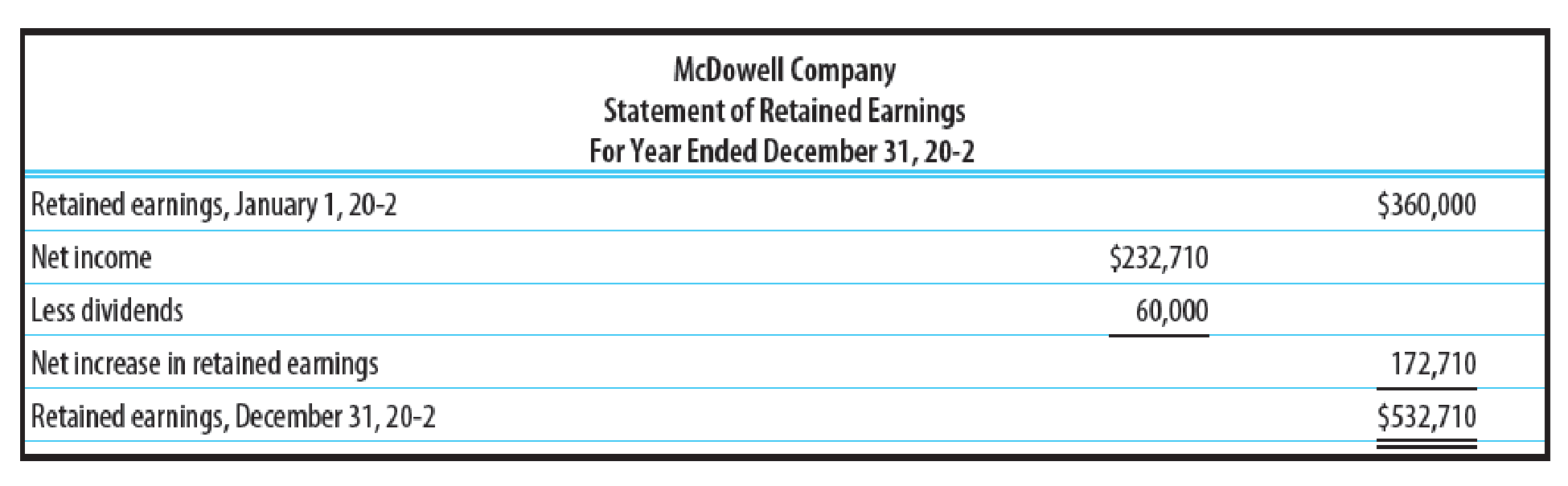

4. Declared and paid cash dividends of $60,000.

5. Issued 10,000 shares of $10 par common stock for $142 per share.

6. Acquired additional office equipment by issuing a note payable for $ 16,000.

REQUIRED

Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.

SCHEDULE FOR CALCULATION OF CASH GENERATED FROM OPERATING ACTIVITIES Using the information provided in Problem 23-12A for McDowell Company, prepare the following:

1. A schedule for the calculation of cash generated from operating activities for McDowellCompany for the year ended December 31, 20-2.

2. A partial statement of cash flows for McDowell Company reporting cash from operating activities under the direct method for the year ended December 31, 20-2.

1.

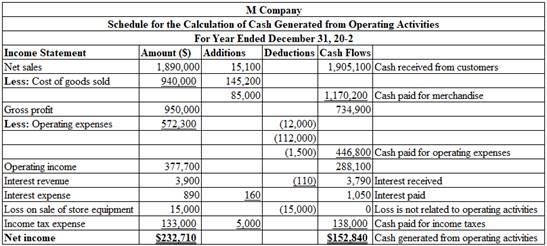

Prepare a schedule for the calculation of cash generated from operating activities for M Company for the year ended December 31, 20-2.

Explanation of Solution

Direct method: Under direct method, cash receipts from customers (cash inflows) and cash payments to suppliers (cash outflows) are reported under the operating activities.

Operating activities: Operating activities include cash inflows and outflows from business operations.

Prepare a schedule for the calculation of cash generated from operating activities for M Company for the year ended December 31, 20-2.

Table (1)

2.

Prepare a statement of cash flows for M Company under the direct method for the year ended December 31, 20-2.

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Direct method: Under direct method, cash receipts from customers (cash inflows) and cash payments to suppliers (cash outflows) are reported under the operating activities.

Operating activities: Operating activities include cash inflows and outflows from business operations.

The below table shows the way of calculation of cash flows from operating activities using direct method:

| Cash flows from operating activities (Direct method) |

| Add: Cash receipts. |

| Cash receipt from customer |

| Dividend received |

| Interest received |

| Less: Cash payments: |

| To supplier for acquisition of inventory |

| To employees |

| For interest on loans |

| Income tax expenses and other operating expenses |

| Net cash provided from or used by operating activities |

Table (2)

Cash flows from investing activities: Investing activities refer to the activities carried out by a company for acquisition of long term assets. It includes the purchase or sale of equipment or land, or marketable securities, which is used for business operations.

The below table shows the way of calculation of cash flows from investing activities:

| Cash flows from investing activities |

| Add: Proceeds from collection of loan made to borrowers |

| Sale of marketable securities / investments |

| Sale of property, plant and equipment |

| Proceeds from discounting notes receivables |

| Deduct: Purchase of fixed assets/long-lived assets |

| Loan made by the company to others |

| Purchase of marketable securities |

| Net cash provided from or used by investing activities |

Table (3)

Cash flows from financing activities: Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. It includes raising cash from long-term debt or payment of long-term debt, which is used for business operations.

The below table shows the way of calculation of cash flows from financing activities:

| Cash flows from financing activities |

| Add: Issuance of common stock |

| Proceeds from borrowings by signing of a mortgage |

| Proceeds from sale of treasury stock |

| Proceeds from issuance of debt |

| Deduct: Payment of dividend |

| Repayment of debt |

| Interest paid |

| Redemption of debt |

| Purchase of treasury stock |

| Net cash provided from or used by financing activities |

Table (4)

Prepare a statement of cash flows for M Company under the direct method for the year ended December 31, 20-2.

| M Company | ||

| Statement of Cash Flows Direct Method (Partial) | ||

| For the Year Ended December 20-2 | ||

| Details | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts: | ||

| Cash received from customers | 1,905,100 | |

| Interest received | 3,790 | |

| Total cash receipts | 1,908,890 | |

| Cash payments: | ||

| Cash paid for merchandise | (1,170,200) | |

| Cash paid for operating expenses | (446,800) | |

| Cash paid for interest | (1,050) | |

| Cash paid for income taxes | (138,000) | |

| Total cash payments | (1,756,050) | |

| Net cash provided by operating activities | $152,840 | |

| Cash flows from investing activities: | ||

| Sold store equipment | $25,000 | |

| Purchased store equipment | (64,000) | |

| Purchased delivery equipment | (140,000) | |

| Purchased office equipment | (30,000) | |

| Net cash used by investing activities | (209,000) | |

| Cash flows from financing activities: | ||

| Issued common stock | $140,000 | |

| Paid cash dividends | (60,000) | |

| Net cash provided by financing activities | 80,000 | |

| Net increase (decrease) in cash and cash equivalents | $23,840 | |

| Cash and cash equivalents, January 1, 20-2 | 58,325 | |

| Cash and cash equivalents, December 31, 20-2 | $82,165 | |

| Schedule of Noncash Investing and Financing Activities: | ||

| Acquired store equipment by issuing a note payable | $16,000 | |

Table (5)

Working notes:

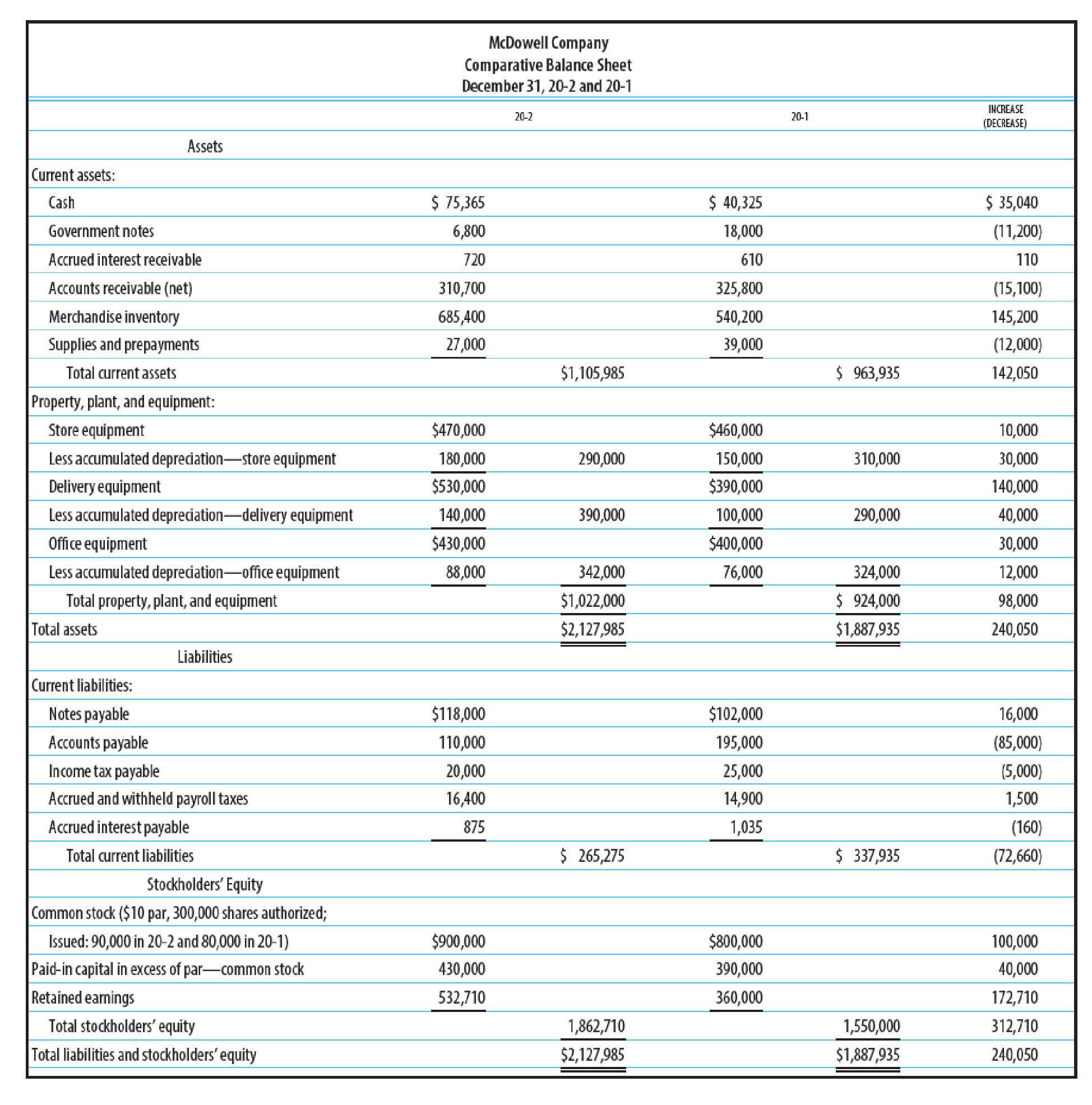

Prepare the schedule in the changes of current assets and liabilities.

| Schedule in the Change of Assets and Liabilities | ||||

| Details | Amount ($) | Adjustment in Operating Activities | ||

| Accounts | 20-2 | 20-1 | Increase/ (Decrease) | |

| Accounts receivable | 310,700 | 325,800 | (15,100) | Add |

| Merchandised inventory | 685,400 | 540,200 | 145,200 | Less |

| Accounts payable | 110,000 | 195,000 | (85,000) | Less |

| Income tax payable | 20,000 | 25,000 | (5,000) | Less |

| Supplies and prepayments | 27,000 | 39,000 | (12,000) | Add |

| Accrued and withheld payroll taxes | 16,400 | 14,900 | 1,500 | Add |

| Accrued interest receivable | 720 | 610 | 110 | Less |

| Accrued interest payable | 875 | 1,035 | (160) | Less |

Table (4)

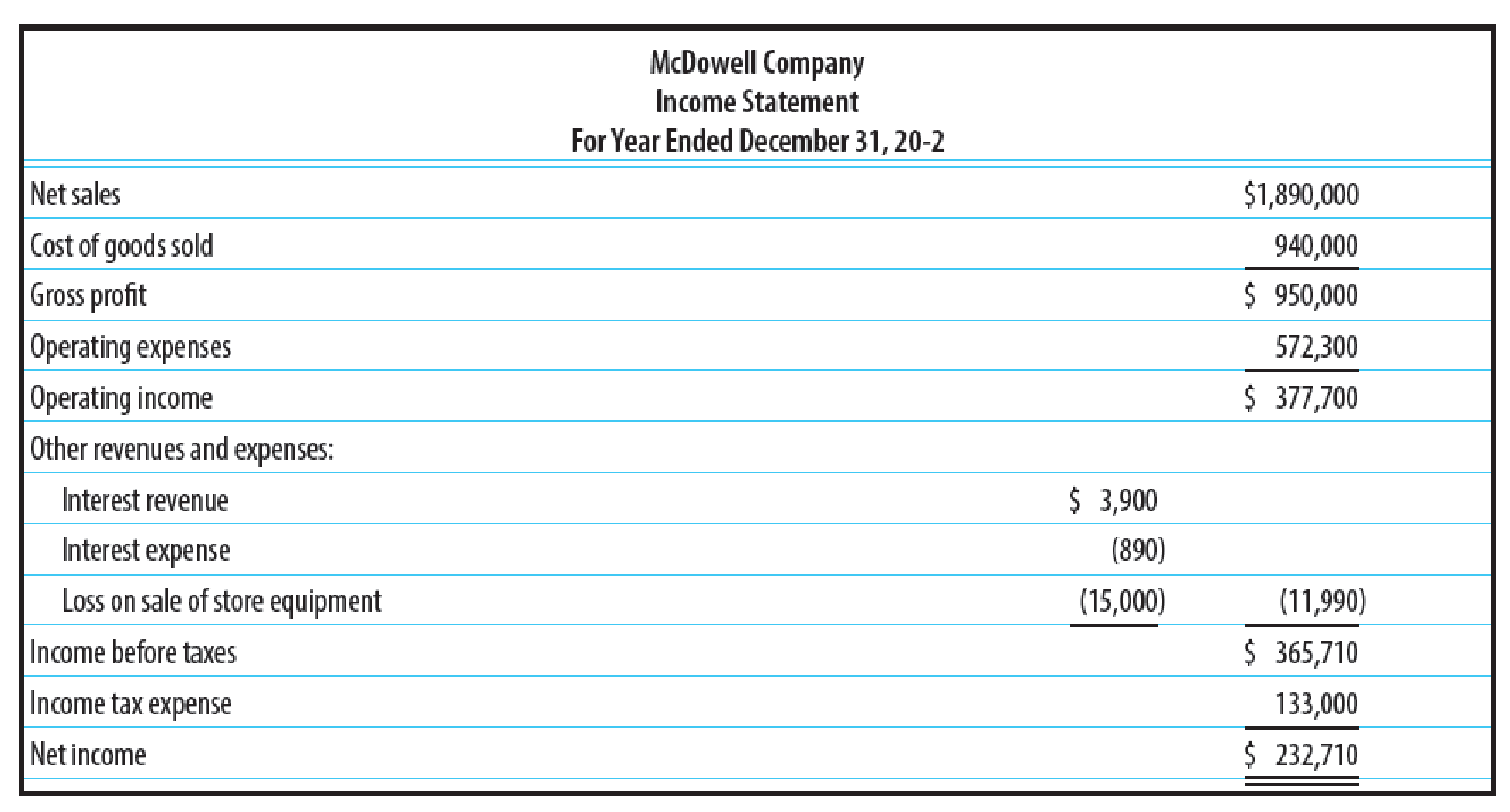

Calculate the amount of cash received from customers.

(Cash receipts from customers)=[Net sales (+Decrease in accounts receivable OR − Increase in accounts receivable)]=(Net sales + Decrease in accounts receivable)=($1,890,000+$15,100)=$1,905,100

Calculate the amount of cash received for interest.

Cash received for interest}=[Interst revenue (+Decrease in accrued interest receivable OR − Increase in accrued interest receivable)]=(Interst revenue −Increase in accrued interest receivable)=($3,900−110)=$3,790

Calculate the amount of cash paid for merchandise in 20-2.

Cash paid for merchandise}=Cost of Goods Sold (+ Decrease in Accounts Payable/ Increase in Inventory OR − Increase in Accounts Payable / Decrease in Inventory)=(Cost of goods sold + Decrease in accounts payable +Increase in inventory)=$940,000+$85,000+$145,200=$1,170,200

Compute the amount of cash received from customers in 20-2.

Cash paid for operating expenses}=[Operating expenses other than depreciation (+Decrease in accrued expense payable+Increase in supplies and prepayments OR − Increase in accrued expense tax payable−Decrease in supplies and prepayments)]=(Operating expenses −Depreciation expense − Increase in accrued and withheld payroll taxes−Decrease in supplies and prepayments)=($572,300−$112,000 − $1,500 −$12,000)=$446,800

Compute the amount of cash paid for interest in 20-2.

(Cash paid for interest expenses)=Interest expenses(+Decrease in accrued liabilities OR−Increase in accrued liabilities)=(Interest expenses +Decrease in accrued interest payable)=$890+$160=$1,050

Compute the amount of cash paid for income taxes in 20-2.

(Cash paid for income taxes)=Income tax expense(+Decrease in income taxes payable OR−Increase in income taxes payable)=(Income tax expense +Decrease in interest payable)=$133,000+$5,000=$138,000

Want to see more full solutions like this?

Chapter 23A Solutions

Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

- I need help with this problem and accounting questionarrow_forwardJackson's Automotive has total assets of $300,000, a debt-equity ratio of 0.50, and net income of $24,000. What is the return on equity? A) 8.70 percent B) 9.50 percent C) 12.80 percent D) 11.30 percent E) 10.20 percentarrow_forwardProvide correct solution and accountingarrow_forward

- I want the correct answer with accounting questionarrow_forwardDo fast answer of this accounting questionsarrow_forwardWhich of the following is the most appropriate way to display liabilities on the balance sheet? a. alphabetically by payee b. relative likelihood of payment c. nearness to maturity d. All of these answer choices are correct.arrow_forward

- Can you help me with accounting questionsarrow_forwardFor which of the following would year-end accrual of a current liability be optional? a. Current portion of a long-term lease obligation that comes due next year b. A declared property dividend c. Sick pay benefits that accumulate but do not vest d. Short-term debt that is being refinanced on a long-term basisarrow_forwardQuick answer of this accounting questionsarrow_forward

- Swifty Supply Co. has the following transactions related to notes receivable during the last 2 months of 2027. The company does not make entries to accrue interest except at December 31. Nov. 1 Loaned $30,000 cash to Manny Lopez on a 12 month, 10% note. Dec. 11 Sold goods to Ralph Kremer, Inc., receiving a $85,500, 90-day, 8% note. 16 Received a $87,840, 180 day. 10% note to settle an open account from Joe Fernetti. 31 Accrued interest revenue on all notes receivable. (a) Journalize the transactions for Swifty Supply Co. (Ignore entries for cost of goods sold.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Use 360 days for cal in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardHi expert please give me answer general accounting questionarrow_forwardHoward James started a business in 2011 in Jamaica and has been operating in the wholesale/retail industries, where he buys and sells household items to the local market. In 2012, he expanded his business operations and opened two other businesses in Trinidad and Tobago and Antigua and Barbuda, respectively. The annual sales of the respective businesses in 2015 are: Jamaica: J$3,000.00 Trinidad and Tobago: TT$251,000.00 Antigua and Barbuda: $299.00 Mr. James failed to register his business for VAT/GCT as specified by the respective Sales Tax Acts and Regulations. He stated that there is no need for his businesses to be registered because their sales are under the VAT thresholds and thus not required to be registered. a) You are to advise Mr. James if his decision not to register his businesses is justifiable. b) Search the respective VAT Acts for the 3 countries and advise Mr. James of the benefits of being a registered taxpayer; also the penalties for not registering for VAT/GCT.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning