Concept explainers

EXPANDED STATEMENT OF

Additional information:

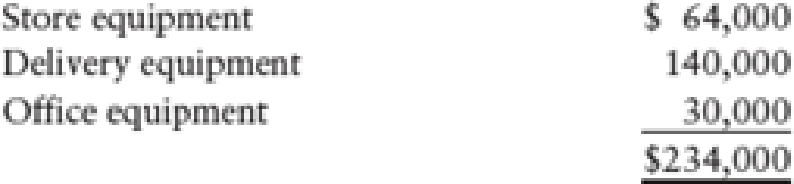

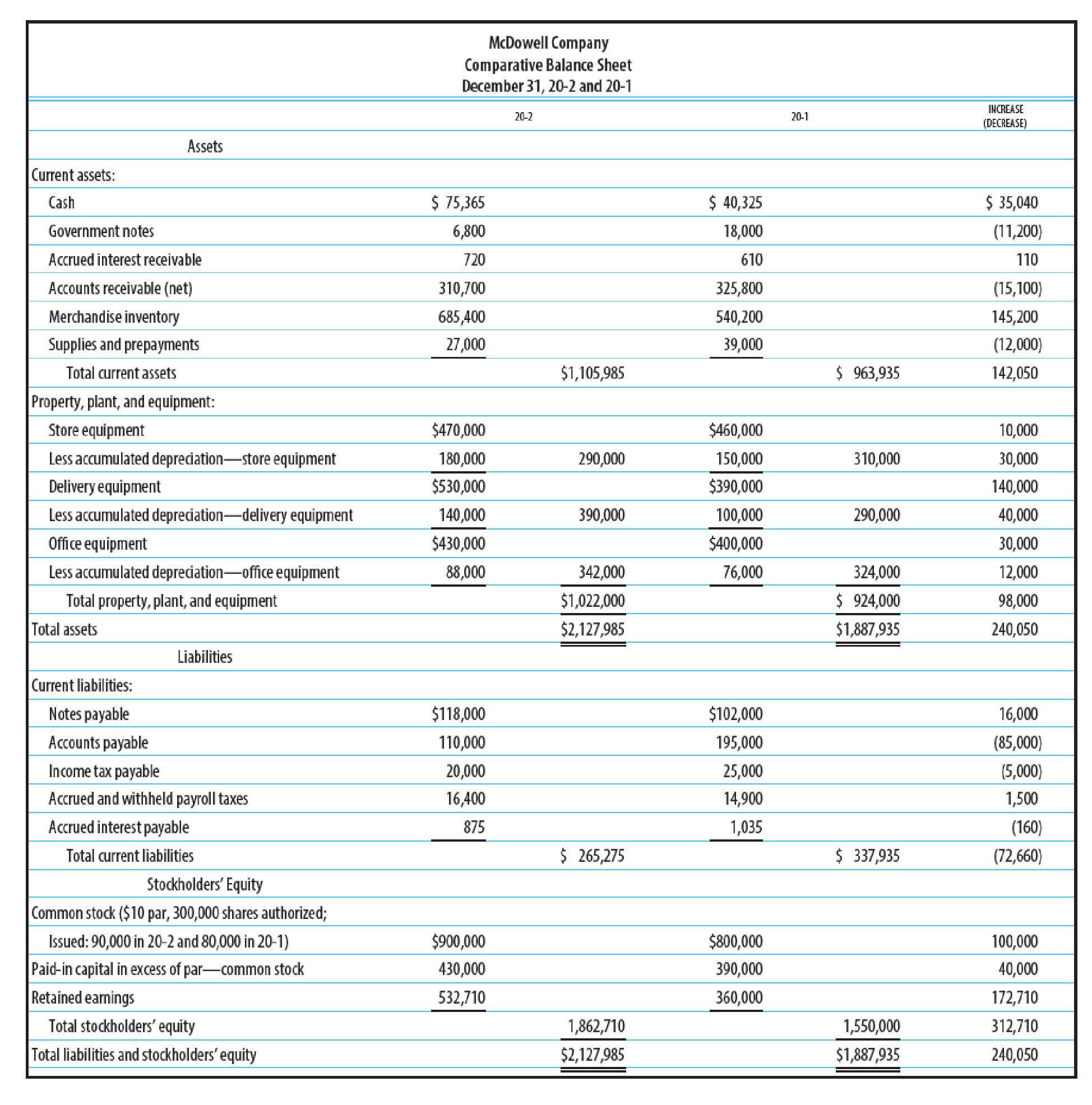

1. Store equipment was sold in 20-2 for $35,000. Additional information on the store equipment sold is provided below.

2.

3. The following purchases were made for cash:

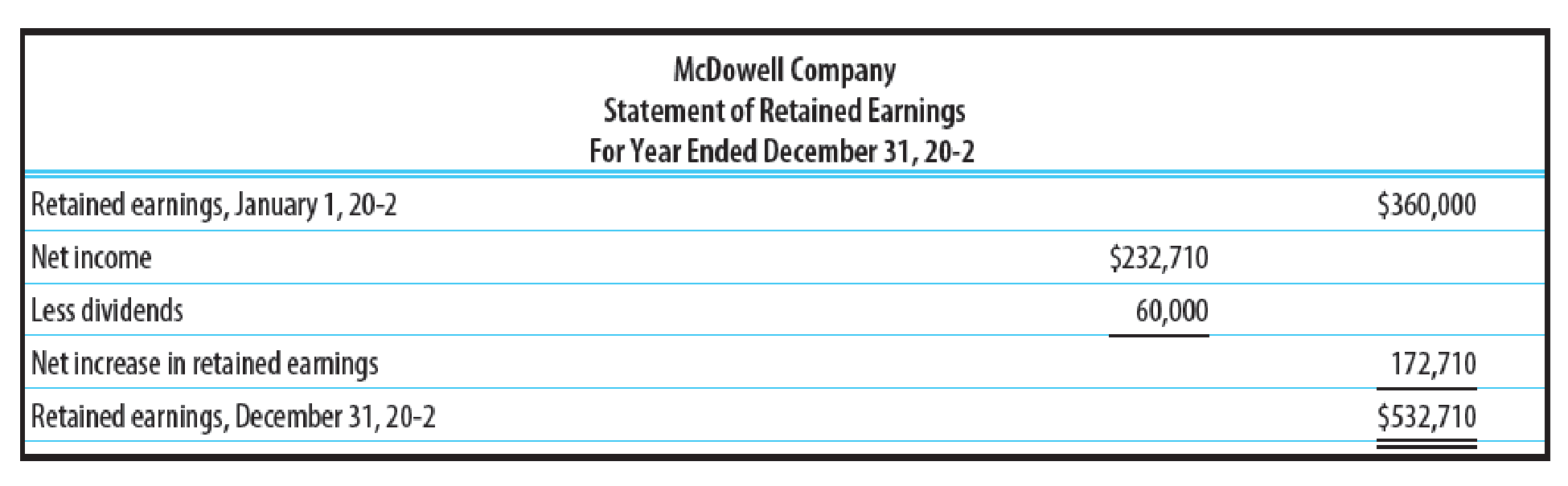

4. Declared and paid cash dividends of $60,000.

5. Issued 10,000 shares of $10 par common stock for $142 per share.

6. Acquired additional office equipment by issuing a note payable for $ 16,000.

REQUIRED

Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.

SCHEDULE FOR CALCULATION OF CASH GENERATED FROM OPERATING ACTIVITIES Using the information provided in Problem 23-12A for McDowell Company, prepare the following:

1. A schedule for the calculation of cash generated from operating activities for McDowellCompany for the year ended December 31, 20-2.

2. A partial statement of cash flows for McDowell Company reporting cash from operating activities under the direct method for the year ended December 31, 20-2.

1.

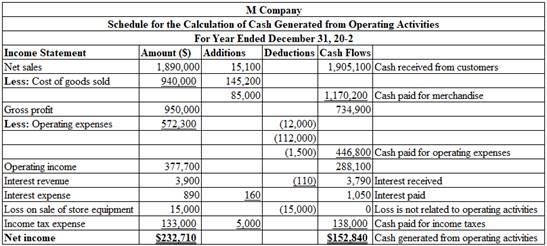

Prepare a schedule for the calculation of cash generated from operating activities for M Company for the year ended December 31, 20-2.

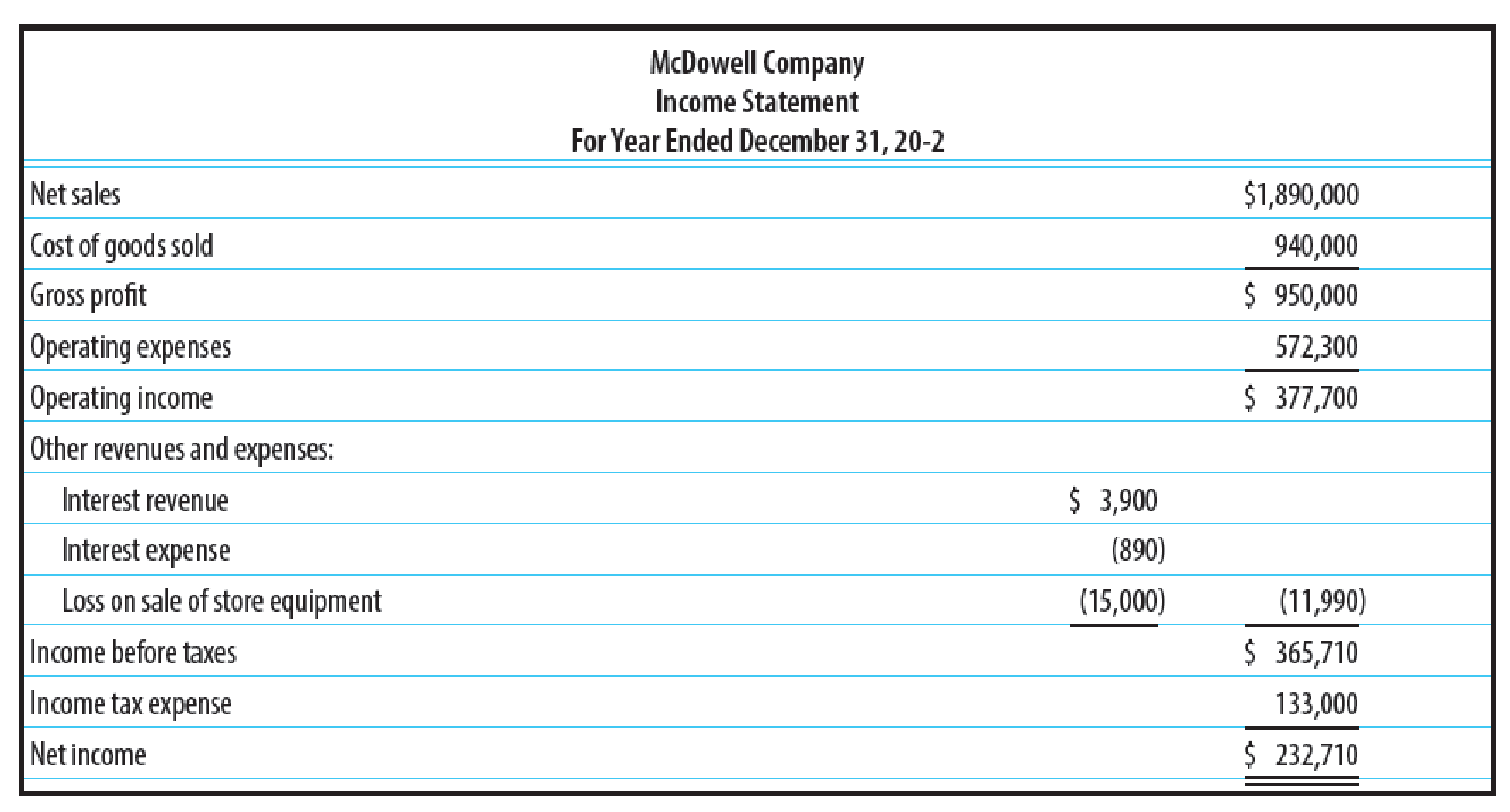

Explanation of Solution

Direct method: Under direct method, cash receipts from customers (cash inflows) and cash payments to suppliers (cash outflows) are reported under the operating activities.

Operating activities: Operating activities include cash inflows and outflows from business operations.

Prepare a schedule for the calculation of cash generated from operating activities for M Company for the year ended December 31, 20-2.

Table (1)

2.

Prepare a statement of cash flows for M Company under the direct method for the year ended December 31, 20-2.

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Direct method: Under direct method, cash receipts from customers (cash inflows) and cash payments to suppliers (cash outflows) are reported under the operating activities.

Operating activities: Operating activities include cash inflows and outflows from business operations.

The below table shows the way of calculation of cash flows from operating activities using direct method:

| Cash flows from operating activities (Direct method) |

| Add: Cash receipts. |

| Cash receipt from customer |

| Dividend received |

| Interest received |

| Less: Cash payments: |

| To supplier for acquisition of inventory |

| To employees |

| For interest on loans |

| Income tax expenses and other operating expenses |

| Net cash provided from or used by operating activities |

Table (2)

Cash flows from investing activities: Investing activities refer to the activities carried out by a company for acquisition of long term assets. It includes the purchase or sale of equipment or land, or marketable securities, which is used for business operations.

The below table shows the way of calculation of cash flows from investing activities:

| Cash flows from investing activities |

| Add: Proceeds from collection of loan made to borrowers |

| Sale of marketable securities / investments |

| Sale of property, plant and equipment |

| Proceeds from discounting notes receivables |

| Deduct: Purchase of fixed assets/long-lived assets |

| Loan made by the company to others |

| Purchase of marketable securities |

| Net cash provided from or used by investing activities |

Table (3)

Cash flows from financing activities: Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. It includes raising cash from long-term debt or payment of long-term debt, which is used for business operations.

The below table shows the way of calculation of cash flows from financing activities:

| Cash flows from financing activities |

| Add: Issuance of common stock |

| Proceeds from borrowings by signing of a mortgage |

| Proceeds from sale of treasury stock |

| Proceeds from issuance of debt |

| Deduct: Payment of dividend |

| Repayment of debt |

| Interest paid |

| Redemption of debt |

| Purchase of treasury stock |

| Net cash provided from or used by financing activities |

Table (4)

Prepare a statement of cash flows for M Company under the direct method for the year ended December 31, 20-2.

| M Company | ||

| Statement of Cash Flows Direct Method (Partial) | ||

| For the Year Ended December 20-2 | ||

| Details | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts: | ||

| Cash received from customers | 1,905,100 | |

| Interest received | 3,790 | |

| Total cash receipts | 1,908,890 | |

| Cash payments: | ||

| Cash paid for merchandise | (1,170,200) | |

| Cash paid for operating expenses | (446,800) | |

| Cash paid for interest | (1,050) | |

| Cash paid for income taxes | (138,000) | |

| Total cash payments | (1,756,050) | |

| Net cash provided by operating activities | $152,840 | |

| Cash flows from investing activities: | ||

| Sold store equipment | $25,000 | |

| Purchased store equipment | (64,000) | |

| Purchased delivery equipment | (140,000) | |

| Purchased office equipment | (30,000) | |

| Net cash used by investing activities | (209,000) | |

| Cash flows from financing activities: | ||

| Issued common stock | $140,000 | |

| Paid cash dividends | (60,000) | |

| Net cash provided by financing activities | 80,000 | |

| Net increase (decrease) in cash and cash equivalents | $23,840 | |

| Cash and cash equivalents, January 1, 20-2 | 58,325 | |

| Cash and cash equivalents, December 31, 20-2 | $82,165 | |

| Schedule of Noncash Investing and Financing Activities: | ||

| Acquired store equipment by issuing a note payable | $16,000 | |

Table (5)

Working notes:

Prepare the schedule in the changes of current assets and liabilities.

| Schedule in the Change of Assets and Liabilities | ||||

| Details | Amount ($) | Adjustment in Operating Activities | ||

| Accounts | 20-2 | 20-1 | Increase/ (Decrease) | |

| Accounts receivable | 310,700 | 325,800 | (15,100) | Add |

| Merchandised inventory | 685,400 | 540,200 | 145,200 | Less |

| Accounts payable | 110,000 | 195,000 | (85,000) | Less |

| Income tax payable | 20,000 | 25,000 | (5,000) | Less |

| Supplies and prepayments | 27,000 | 39,000 | (12,000) | Add |

| Accrued and withheld payroll taxes | 16,400 | 14,900 | 1,500 | Add |

| Accrued interest receivable | 720 | 610 | 110 | Less |

| Accrued interest payable | 875 | 1,035 | (160) | Less |

Table (4)

Calculate the amount of cash received from customers.

Calculate the amount of cash received for interest.

Calculate the amount of cash paid for merchandise in 20-2.

Compute the amount of cash received from customers in 20-2.

Compute the amount of cash paid for interest in 20-2.

Compute the amount of cash paid for income taxes in 20-2.

Want to see more full solutions like this?

Chapter 23A Solutions

Study Guide for Working Papers for Heintz/Parry's College Accounting, Chapters 16-27, 23rd

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardFresco Prints is producing 20 customized wedding invitations. The production costs include $42 in materials, $36 in hourly wages, and $22 in workstation rental space. What is the average cost per unit (invitation)?arrow_forwardShaan Manufacturing is planning to sell 320 electronic toys and to produce 300 electronic toys in November. Each electronic toy requires 85 grams of plastic and 1.25 hours of direct labor. The cost of the plastic used in each electronic toy is $4.50 per 85 grams. Employees of the company are paid at a rate of $22.50 per hour. Manufacturing overhead is applied at a rate of 125% of direct labor costs. Shaan Manufacturing has 75,000 grams of plastic in its beginning inventory and wants to have 65,000 grams in its ending inventory. What is the amount of budgeted direct labor cost for the month of November?arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardAccurate solution wanted. NO AI Please. IF you not sure please dont accept. UNHELPFULarrow_forward

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardOyama Manufacturing's performance report shows that its employees worked 120 hours, but their pay card report indicates that they worked 132 hours. What is the variance percentage?arrow_forwardI am searching for the most suitable approach to this financial accounting problem with valid standards.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning