EBK FUNDAMENTALS OF CORPORATE FINANCE

3rd Edition

ISBN: 9780133762808

Author: Harford

Publisher: PEARSON CUSTOM PUB.(CONSIGNMENT)

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 23, Problem 6DC

Summary Introduction

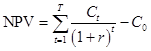

Net present value (NPV) can be defined as the difference between the present value of cash inflows and the present value of

Where,

is the net

is the net cash inflow during the period

is the initial investment cost.

is the initial investment cost. is the discount rate.

is the discount rate. is the total time period.

is the total time period.

To determine:

The net present value of the project in U.S. dollars.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following is not a financing activity?*

Repayment of long-term debt

Issuance of equity

Investments in businesses

Payment of dividends

The correct order of capital stack from the most to least secured is*

Equity > Subordinated debt > Senior debt

Suborindated debt > Senior debt > Equity

Senior debt > Subordinated debt > Equity

Senior debt > Equity > Subordinated debt

16. ____ underwriting commitment is when the underwriter agrees to buy the entire issue and assume full financial responsibility for any unsold shares.*

Best efforts

Firm commitment

All-or-none

Full-purchase

Chapter 23 Solutions

EBK FUNDAMENTALS OF CORPORATE FINANCE

Ch. 23 - Prob. 1CCCh. 23 - Prob. 2CCCh. 23 - Prob. 3CCCh. 23 - Prob. 4CCCh. 23 - Prob. 5CCCh. 23 - Prob. 6CCCh. 23 - Prob. 7CCCh. 23 - Prob. 8CCCh. 23 - Prob. 9CCCh. 23 - Prob. 10CC

Ch. 23 - Prob. 11CCCh. 23 - Prob. 12CCCh. 23 - Prob. 13CCCh. 23 - Prob. 14CCCh. 23 - Prob. 1CTCh. 23 - Prob. 2CTCh. 23 - Prob. 3CTCh. 23 - Prob. 4CTCh. 23 - Prob. 5CTCh. 23 - Prob. 6CTCh. 23 - Prob. 7CTCh. 23 - Prob. 8CTCh. 23 - Prob. 1DCCh. 23 - Prob. 2DCCh. 23 - Prob. 3DCCh. 23 - Prob. 4DCCh. 23 - Note that the free cash flows you calculated in...Ch. 23 - Prob. 6DCCh. 23 - Prob. 1PCh. 23 - Prob. 2PCh. 23 - Your start-up company has negotiated a contract to...Ch. 23 - You are a broker for frozen seafood products for...Ch. 23 - Prob. 5PCh. 23 - Prob. 6PCh. 23 - Prob. 7PCh. 23 - Prob. 8PCh. 23 - 9. You work for a U.S. firm, and your boss has...Ch. 23 - Prob. 10PCh. 23 - Prob. 11PCh. 23 - Prob. 12PCh. 23 - Prob. 13PCh. 23 - Prob. 14PCh. 23 - Prob. 15PCh. 23 - *16. Suppose the interest on Russian government...Ch. 23 - Prob. 17P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is not true about private equity funds?* Private equity funds are pools of capital invested in companies which represent an opportunity for high rate of return Exit strategies for private equity funds include Initial Public Offerings (IPOs) and leveraged buyout (LBO) Venture capital is an example of private equity funds Private equity funds are usually invested for unlimited time periodsarrow_forwardWhat is finance ? explain about its parts.arrow_forwardDividend problem . Solve plzarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License